In the ever-changing landscape of business, financial resilience is not just a luxury, but a necessity for small businesses aiming to thrive. It’s about creating a robust foundation that can weather any storm, whether it’s a global economic downturn or a sudden shift in market trends. Here are seven financial resilience strategies that can help small businesses not only survive but flourish.

Diversifying Revenue Streams

Imagine a business that relies solely on one revenue stream. It’s like putting all your eggs in one basket – a single crack can be disastrous. Diversifying revenue streams is a proactive way to mitigate this risk. For instance, a boutique clothing store could expand its product line to include accessories, or introduce an online shopping platform to reach a broader audience.

“As we look ahead into the next century, leaders will be those who empower others.” - Bill Gates. Empowering your business through diverse revenue streams can be a game-changer. Consider introducing new products or services, targeting different customer segments, or even venturing into alternative markets. This not only reduces dependency on a single income source but also provides a buffer against market fluctuations.

Building and Maintaining Cash Reserves

Having a financial safety net is akin to having a lifeline during turbulent times. It’s essential to save at least three to six months of operating expenses in a liquid account. This might sound daunting, but starting small and making it a habit can be incredibly beneficial. Think of it as an investment in your business’s stability.

“What lies within us is greater than what lies before us.” - Steven Haffenden. What lies within your business’s financial reserves can be the difference between survival and shutdown. This cushion gives you the flexibility to take strategic risks when opportunities arise and helps you navigate through crises without breaking a sweat.

Implementing Effective Inventory Management

Inventory management is often overlooked but is crucial for maintaining financial health. Overstocking can lead to wasted resources, while understocking can result in lost sales. Implementing a just-in-time inventory system or using inventory management software can help you strike the perfect balance.

“How you manage your inventory can make or break your business,” a wise entrepreneur once said. Effective inventory management involves regular audits, optimizing storage, and using data analytics to predict demand. This approach ensures that you’re always stocked with what you need, without tying up too much capital in inventory.

Developing Flexible Supplier Relationships

Supply chain disruptions can be catastrophic for any business. Developing flexible supplier relationships can help mitigate this risk. Securing multiple suppliers for critical components or materials ensures that your operations remain uninterrupted even if one supplier faces issues.

“Alone we can do so little; together we can do so much.” - Helen Keller. Building strong, flexible relationships with your suppliers is about collaboration and mutual benefit. It involves open communication, negotiating favorable terms, and having contingency plans in place. This way, you’re not left high and dry if a key supplier goes out of business.

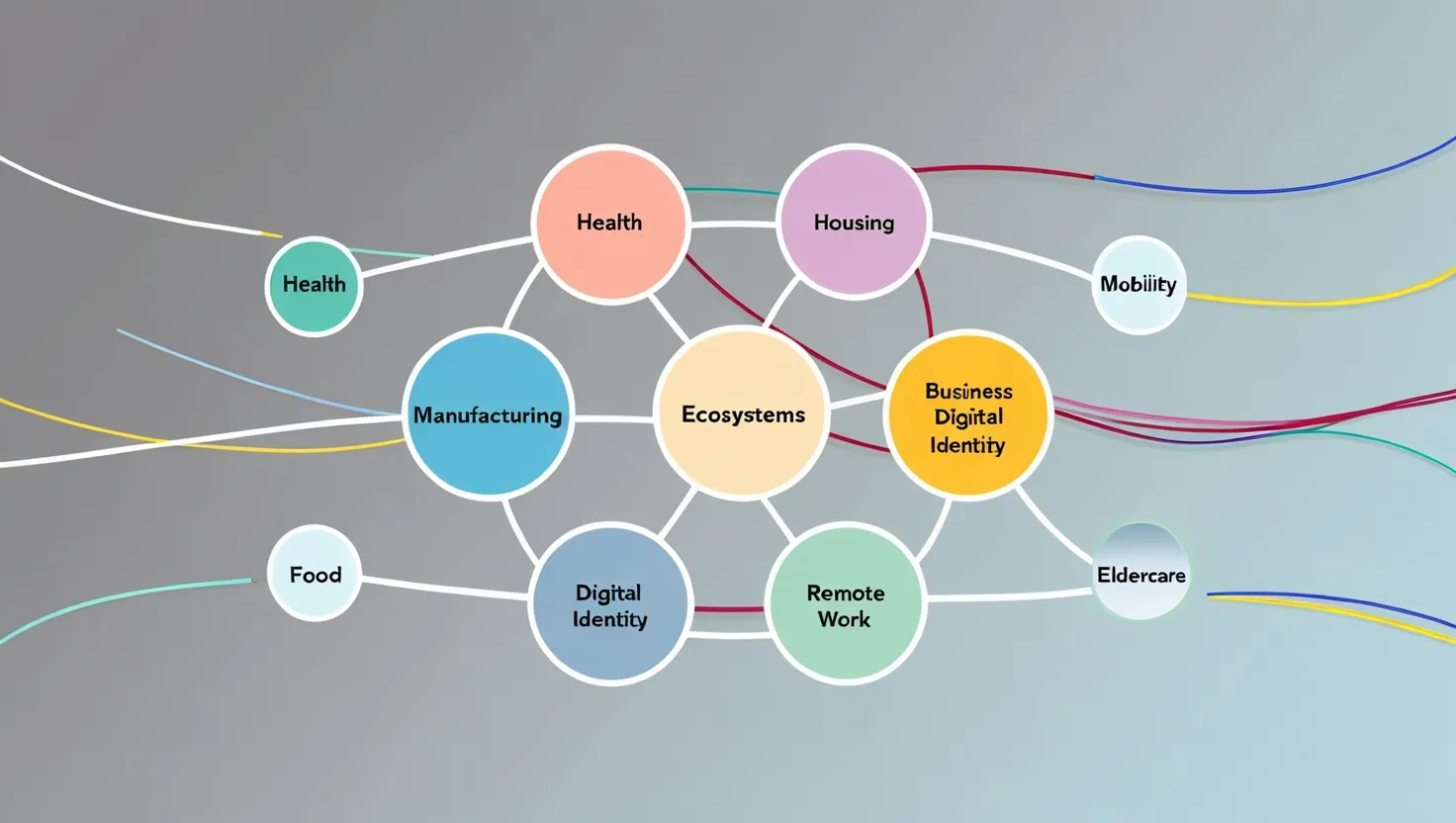

Adopting Scalable Technology Solutions

Technology can be a double-edged sword – it can either streamline your operations or complicate them. Adopting scalable technology solutions, such as cloud-based accounting software or project management tools, can help you stay agile and efficient.

“The future belongs to those who see possibilities before they become obvious.” - John Sculley. Investing in the right technology can future-proof your business. It allows you to scale up or down as needed, automate repetitive tasks, and gain valuable insights through data analytics. This not only saves time but also reduces costs in the long run.

Creating Crisis Management and Continuity Plans

No business is immune to crises, whether it’s a natural disaster, economic downturn, or cyberattack. Having a crisis management and continuity plan in place can help you respond swiftly and effectively.

“Preparedness is the key to success and survival.” - Alan Axelrod. A well-thought-out plan involves identifying potential risks, creating contingency strategies, and regularly updating your plans to reflect changing circumstances. This ensures that your business can continue to operate even in the face of adversity.

Prioritizing Customer Retention and Loyalty Programs

Customer retention is often more cost-effective than customer acquisition. Prioritizing customer retention and loyalty programs can help you build a loyal customer base that will stick with you through thick and thin.

“Loyal customers, they don’t just come back, they don’t simply recommend you, they insist that their friends do business with you.” - Chip Bell. Implementing subscription models, offering loyalty rewards, and providing exceptional customer service can foster long-term relationships with your customers. This not only generates recurring revenue but also acts as a powerful marketing tool through word-of-mouth.

Real-World Examples

Consider a small bakery that diversified its revenue streams by introducing an online ordering system and partnering with local cafes to supply pastries. This not only increased their customer base but also provided a steady stream of income.

Or think about a tech startup that adopted scalable technology solutions, allowing them to quickly scale up their operations when demand surged. This flexibility helped them capitalize on new opportunities without breaking the bank.

Tailoring Strategies to Different Industries and Business Sizes

Each industry and business size has its unique challenges and opportunities. For instance, a retail business might focus more on inventory management and customer retention, while a service-based business might prioritize developing flexible supplier relationships and adopting scalable technology solutions.

“Success is not final, failure is not fatal: It is the courage to continue that counts.” - Winston Churchill. The key is to understand your business’s specific needs and tailor these strategies accordingly. Whether you’re a small boutique or a growing startup, these financial resilience strategies can be adapted to fit your unique situation.

Interactive Questions

- How does your business currently manage risk? Are there any areas where you could improve?

- What are some potential revenue streams you could explore to diversify your income?

- How do you ensure customer loyalty and retention in your business?

Conclusion

Building financial resilience is not a one-time task; it’s an ongoing process that requires continuous effort and adaptation. By diversifying revenue streams, maintaining cash reserves, implementing effective inventory management, developing flexible supplier relationships, adopting scalable technology solutions, creating crisis management and continuity plans, and prioritizing customer retention and loyalty programs, small businesses can enhance their financial stability and adaptability.

As the famous saying goes, “The best way to predict the future is to invent it.” By proactively implementing these strategies, you’re not just preparing for the future; you’re shaping it. So, take the first step today and build a financially resilient business that can thrive in any environment.