Currency Manipulation: How Nations Game the Global Trade System

Learn how currency manipulation impacts global trade, economic opportunities, and consumer prices. Discover the tactics nations use to gain competitive advantages, from devaluation to market intervention, and understand the economic ripple effects on international markets. Read more now.

Sovereign Wealth Funds: The New Architects of Global Food Security

Discover how sovereign wealth funds are reshaping global food security through strategic investments in land, technology, and supply chains. Learn the diverse approaches of UAE, China, Norway, and Singapore in securing food resources for their nations. #FoodSecurity #Investment

5 Critical Post-2008 Financial Reforms That Reshaped Global Banking

Discover how Basel III, Volcker Rule, FSB, EMIR and stress testing frameworks reshaped global banking after 2008. Learn the impact of these regulatory reforms on financial stability and what they mean for today's economy. Read more now.

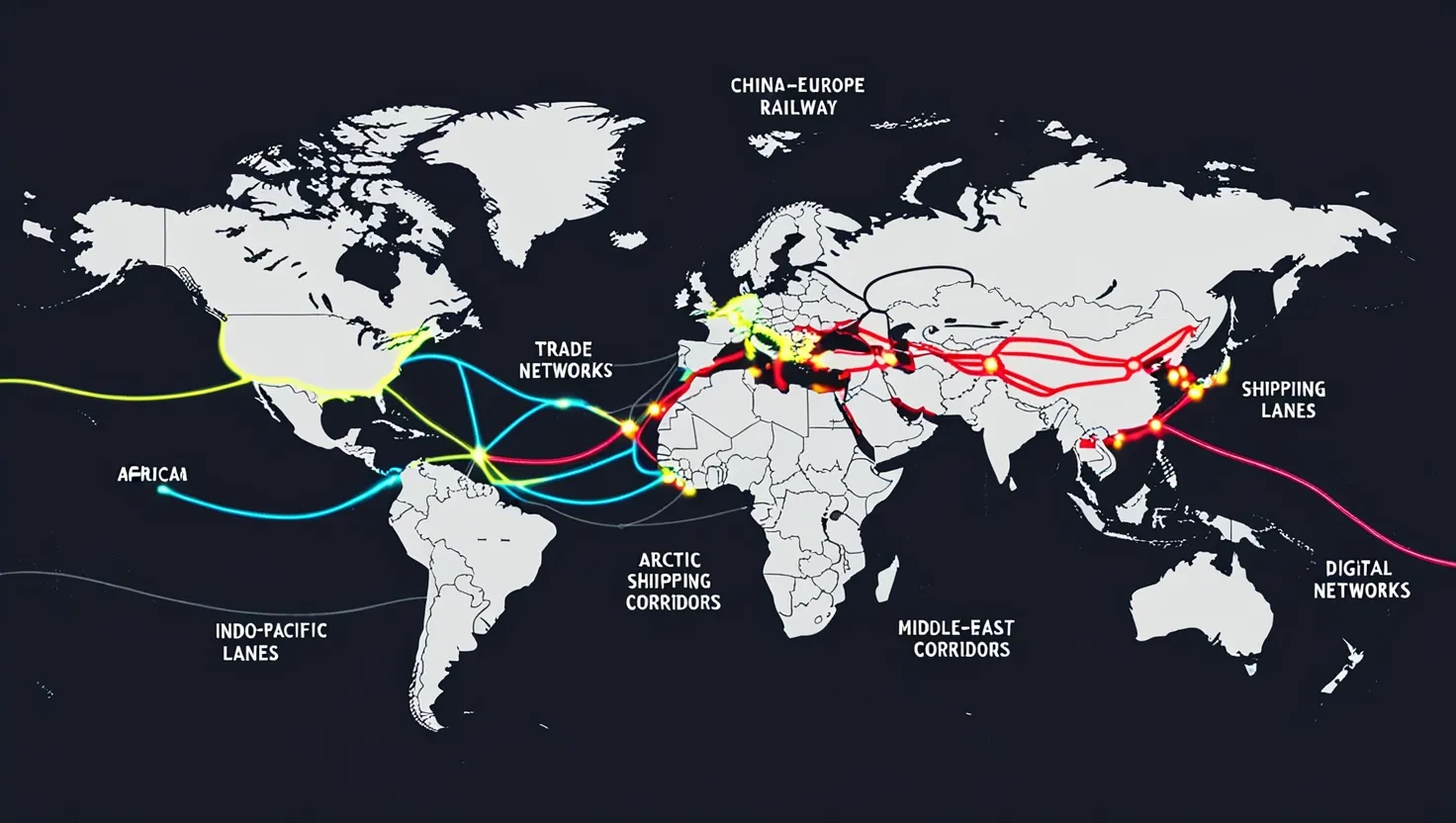

Emerging Trade Corridors: How New Routes Are Reshaping Global Power Dynamics

Discover how six emerging trade corridors are reshaping global power dynamics and economic relationships. From China's railway network to Africa's free trade area, explore the future of international commerce and what it means for businesses worldwide. Learn more now.

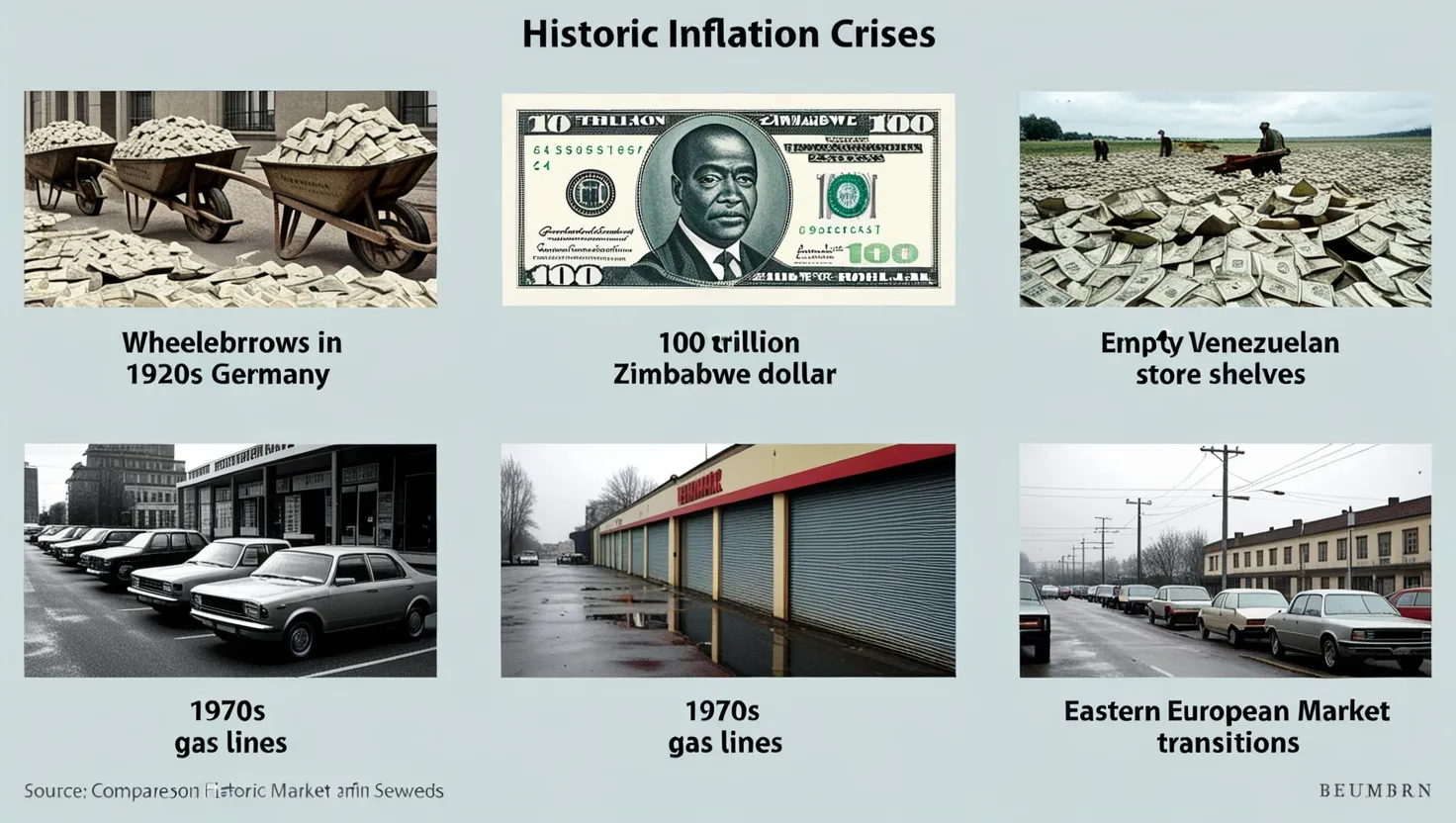

5 Devastating Inflation Crises That Transformed Global Economics

Discover how 5 historic inflation crises from Weimar Germany to Venezuela reshaped global economics. Learn crucial lessons from these financial disasters and what they mean for today's economy. Read now for insights on financial stability.

7 Critical Maritime Chokepoints Controlling Global Trade and Energy Flow

Discover how seven crucial maritime chokepoints control global trade and energy flows. Learn why these strategic waterways shape economics, geopolitics, and security in our interconnected world. Navigate the future of international commerce.

5 Major Sovereign Defaults That Changed Global Finance (1998-2020)

Explore 5 major sovereign defaults that shaped global finance, from Argentina's 2001 crisis to Lebanon's 2020 default. Learn key lessons for debt management and financial stability. Read the full analysis.

6 Space Economy Trends Reshaping Global Markets in 2024: Expert Analysis

Discover how six emerging trends in the global space economy are transforming industries & creating new opportunities. Learn about satellite technology, space tourism & lunar mining. Read more for insights.

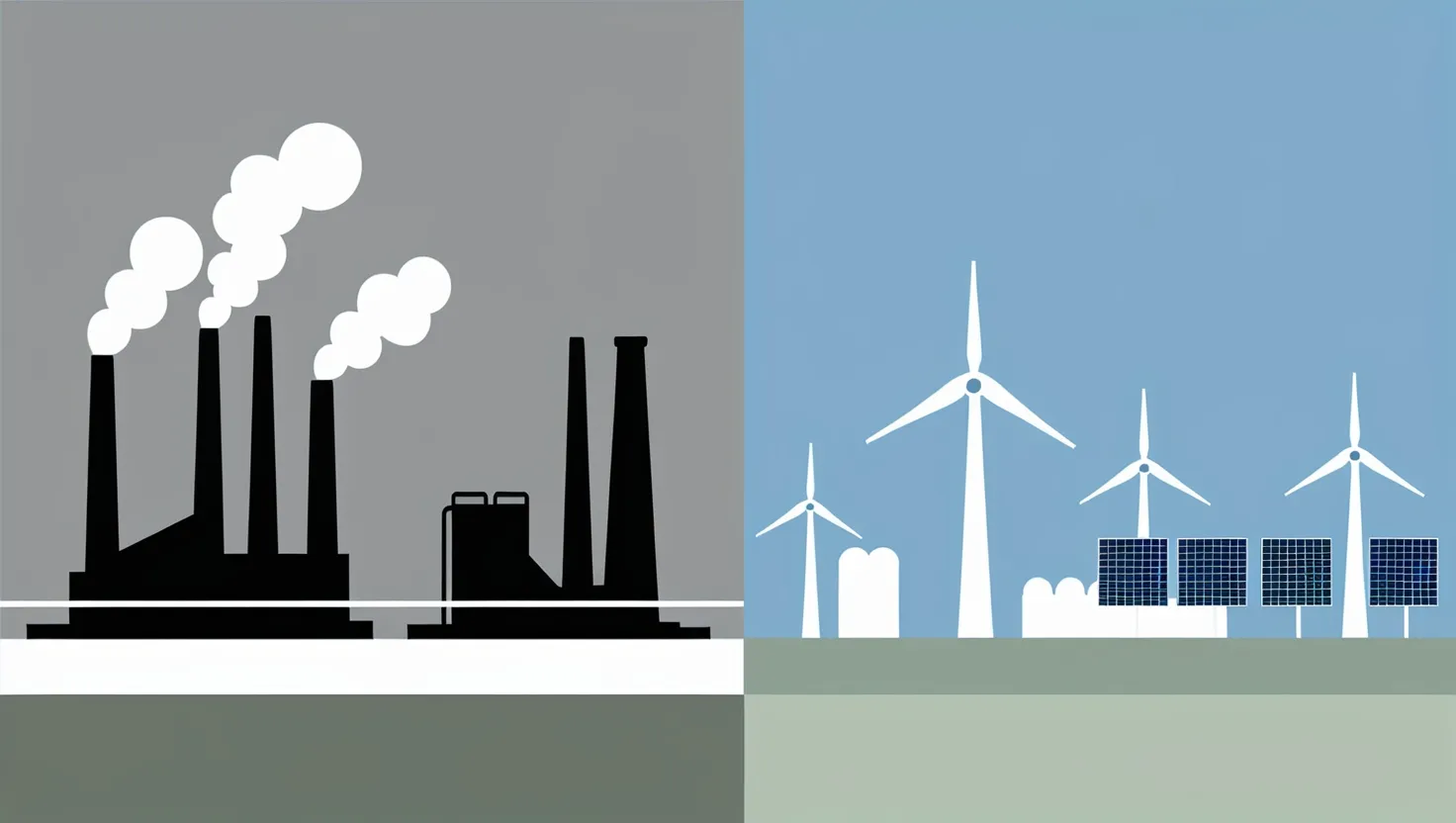

Top 5 Carbon Markets Driving Global Climate Action 2024: A Complete Guide

Explore the impact of global carbon markets in fighting climate change. Learn about key trading systems, market mechanisms, and their role in reducing emissions. Discover how these markets shape climate economics today.

Global Banking Policies: 5 Key Strategies Shaping Modern Finance in 2024

Discover how 5 key international monetary policies shape global banking. Learn about forward guidance, RTGS systems, reserve currencies, capital buffers & emergency lending. Essential insights for finance professionals. #Banking #Finance

2025 Green Infrastructure Trends: 6 Global Investments Reshaping Our Future

Discover 6 transformative green infrastructure trends shaping 2025. From massive renewable energy projects to smart cities, explore how sustainable development is revolutionizing our future. Learn more now.

5 Groundbreaking Global Infrastructure Projects Reshaping International Trade and Connectivity in 2024

Discover how 5 major infrastructure projects are transforming global connectivity. From Africa's highway network to China's Belt & Road, explore the impacts on trade, development & international cooperation. Learn more.

The Future of Global Trade: Inside 5 Port Cities Transforming Maritime Commerce

Discover how 5 global ports are revolutionizing maritime trade through automation, sustainability & smart tech. From Rotterdam's robotic cranes to Dubai's logistics hub, explore the future of shipping. Learn what drives port success today.