7 Essential Value Investing Metrics for Finding Undervalued Stocks in Today's Market

Learn to spot undervalued stocks with 7 essential value investing metrics. Discover how P/E ratio, P/B ratio, and cash flow analysis can help identify hidden gems in any market. Master these practical tools to make smarter investment decisions today.

Market Corrections: 6 Key Lessons for Investors During Financial Volatility

Discover 6 timeless lessons from market corrections that can transform your investment strategy. Learn how quality assets, cash reserves, and emotional discipline create opportunity in downturns. #InvestingWisdom ChatGPT: Learn how market corrections offer valuable investment lessons. Discover strategies for managing emotions, maintaining quality assets, and leveraging downturns for opportunities. Act smarter during volatility.

15 Proven Strategies to Build a Recession-Proof Investment Portfolio

Fortify your investments against economic uncertainty with proven strategies for a recession-resistant portfolio. Learn diversification tactics, defensive sector allocation, and psychological preparation to protect your wealth during market downturns. Start building resilience today.

5 Advanced Financial Ratios for Smarter Company Analysis

Discover 5 advanced financial ratios beyond P/E that reveal a company's true performance and competitive position. Learn how to analyze profitability, debt, efficiency, and cash flow like professional investors.

6 Essential Wealth Transfer Strategies to Preserve Your Family's Financial Legacy

Discover 6 tax-efficient strategies for preserving your wealth across generations. Learn how to leverage gift exclusions, trusts, and timing to maximize your legacy while minimizing tax impact. Start planning today for tomorrow's financial security.

7 Unconventional Assets to Diversify Your Investment Portfolio Beyond Stocks and Bonds

Discover 7 unconventional investments beyond stocks and bonds. From music royalties to water rights, learn how these alternative assets can diversify your portfolio and create unique growth opportunities. Start small and think big.

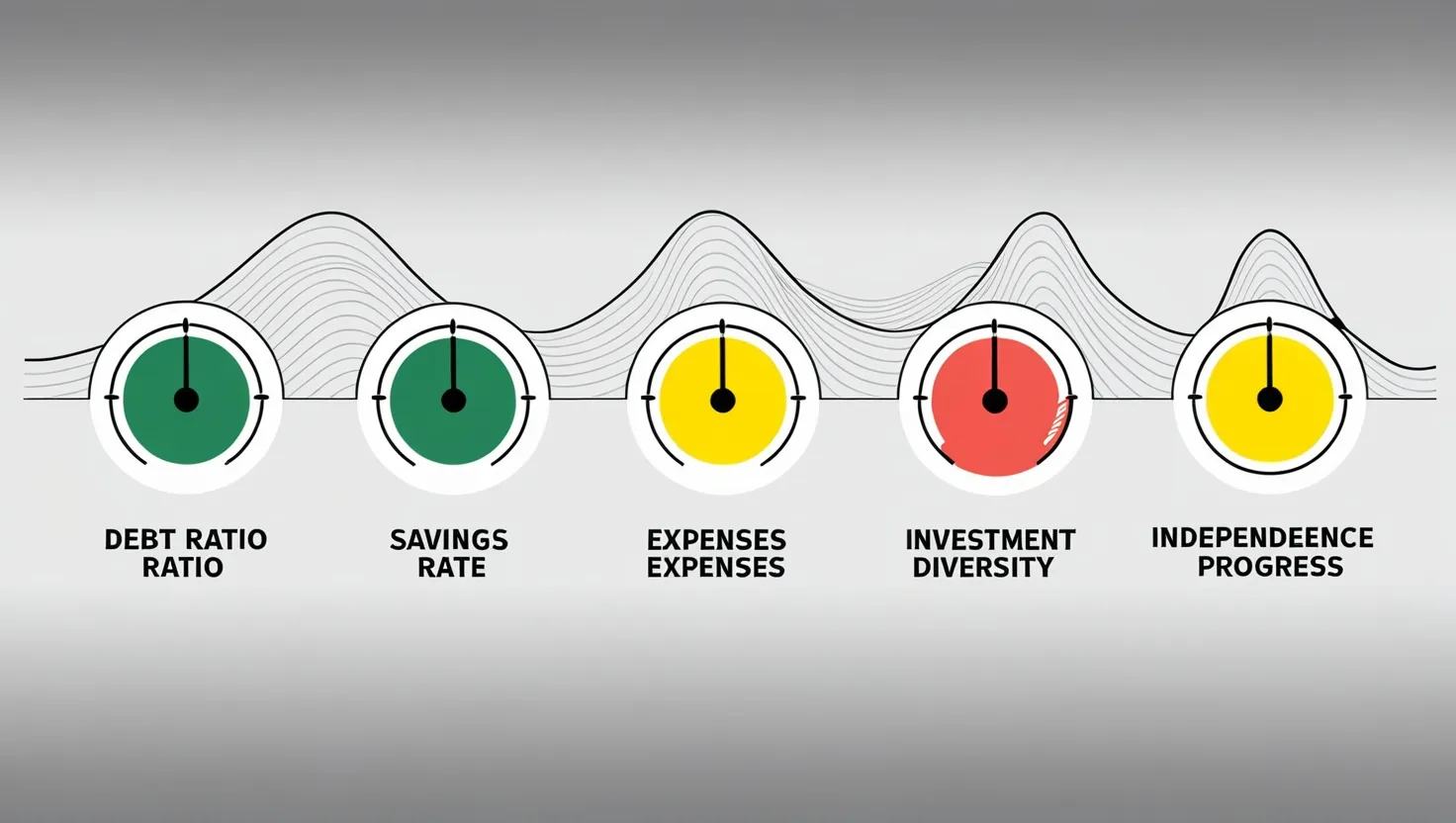

5 Critical Financial Metrics to Track During Economic Changes

Discover 5 essential financial metrics that provide a comprehensive view of your financial health during any economic cycle. Learn how to calculate and optimize each metric for greater stability and freedom. #PersonalFinance

Essential Estate Planning for Under 40: Protect Your Future Now

Learn why estate planning before 40 is essential, not just for the wealthy. Discover the 6 key documents every young adult needs to protect loved ones and assets. Start planning today for peace of mind tomorrow. #EstatePlanning

7 Cost-Effective Ways to Reduce Debt Using Interest Rate Arbitrage

Discover 7 cost-effective ways to reduce debt through interest rate arbitrage. Learn how balance transfers, consolidation loans, and repayment strategies can help you save money and regain financial freedom. Start your debt-free journey today!

8 Overlooked Market Sentiment Indicators for Contrarian Investors: Your Edge in Financial Markets

Discover 8 overlooked market sentiment indicators that give contrarian investors an edge. Learn how to read fund flows, short interest ratios, and insider buying patterns to spot opportunities others miss. Start investing smarter today.

5 Bear Market Investment Strategies That Generate Stable Returns in 2024

Master bear market investing with 5 proven strategies. Learn defensive allocation, dividend stocks, and smart cash management to protect and grow your portfolio. Get expert insights now.

6 Critical Business Metrics to Survive an Economic Downturn in 2024

Learn how to track 6 crucial business metrics during economic uncertainty. Master quick ratio, burn rate, retention costs & more to protect your company in a recession. Get actionable insights.

How to Start Index Fund Investing: A Complete Guide for Beginners in 2024

Learn to start index fund investing with minimal costs. Discover practical strategies for building wealth through low-cost brokers, smart asset allocation, and automated investing plans. Start your investment journey today.