7 Unconventional Assets to Diversify Your Investment Portfolio Beyond Stocks and Bonds

Discover 7 unconventional investments beyond stocks and bonds. From music royalties to water rights, learn how these alternative assets can diversify your portfolio and create unique growth opportunities. Start small and think big.

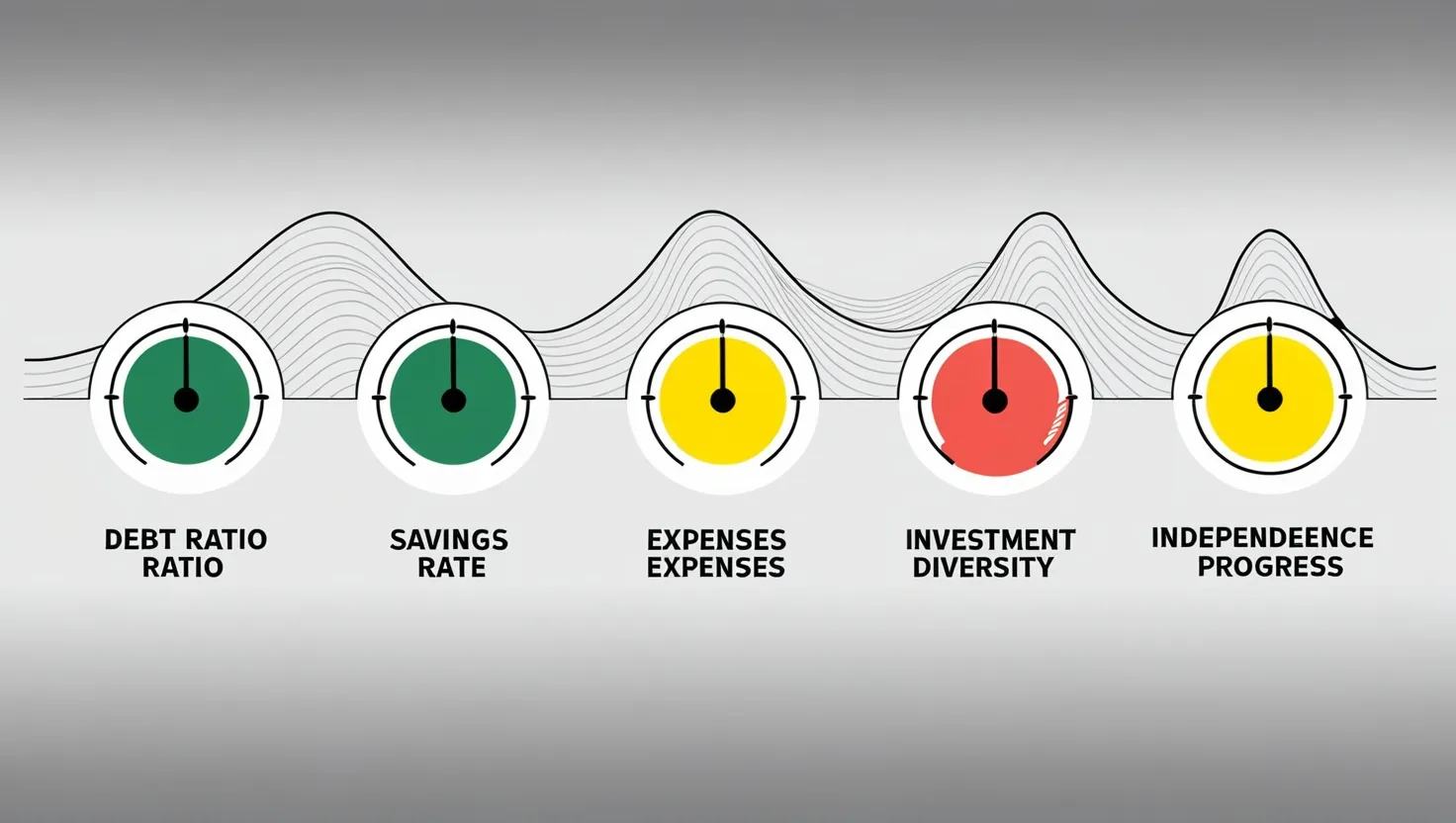

5 Critical Financial Metrics to Track During Economic Changes

Discover 5 essential financial metrics that provide a comprehensive view of your financial health during any economic cycle. Learn how to calculate and optimize each metric for greater stability and freedom. #PersonalFinance

Essential Estate Planning for Under 40: Protect Your Future Now

Learn why estate planning before 40 is essential, not just for the wealthy. Discover the 6 key documents every young adult needs to protect loved ones and assets. Start planning today for peace of mind tomorrow. #EstatePlanning

7 Cost-Effective Ways to Reduce Debt Using Interest Rate Arbitrage

Discover 7 cost-effective ways to reduce debt through interest rate arbitrage. Learn how balance transfers, consolidation loans, and repayment strategies can help you save money and regain financial freedom. Start your debt-free journey today!

8 Overlooked Market Sentiment Indicators for Contrarian Investors: Your Edge in Financial Markets

Discover 8 overlooked market sentiment indicators that give contrarian investors an edge. Learn how to read fund flows, short interest ratios, and insider buying patterns to spot opportunities others miss. Start investing smarter today.

5 Bear Market Investment Strategies That Generate Stable Returns in 2024

Master bear market investing with 5 proven strategies. Learn defensive allocation, dividend stocks, and smart cash management to protect and grow your portfolio. Get expert insights now.

6 Critical Business Metrics to Survive an Economic Downturn in 2024

Learn how to track 6 crucial business metrics during economic uncertainty. Master quick ratio, burn rate, retention costs & more to protect your company in a recession. Get actionable insights.

How to Start Index Fund Investing: A Complete Guide for Beginners in 2024

Learn to start index fund investing with minimal costs. Discover practical strategies for building wealth through low-cost brokers, smart asset allocation, and automated investing plans. Start your investment journey today.

5 Essential Portfolio Health Checks Every Investor Should Master in 2024

Discover 5 essential portfolio health checks for uncertain markets. Learn proven strategies for risk assessment, performance tracking, and cost optimization. Expert tips for smarter investing. Read more.

5 Smart Ways to Protect Your Emergency Fund from High Inflation in 2024

Learn proven strategies to protect your emergency fund from inflation while maintaining quick access to cash. Discover smart ways to balance safety and growth with high-yield accounts, I-Bonds, and CD ladders. Start saving smarter today.

5 Essential Real Estate Investment Ratios: A Complete Guide [2024]

Learn how essential real estate investment ratios can guide your property decisions. Discover 5 key metrics - Price to Rent, Cap Rate, Cash on Cash Return, Operating Expense & Debt Service Coverage - for smarter investing. Read now.

8 Essential Financial Metrics Every Small Business Owner Must Track in 2024

Discover 8 essential financial metrics for small business success. Learn how to track cash flow, profit margins, and key indicators to make data-driven decisions. Master your business numbers today.

5 Market-Based Income Strategies That Beat Traditional Investments [2024 Guide]

Learn 5 Market-Based Income Strategies: From covered calls to crypto market making, discover proven methods to generate alternative income streams. Expert tips for diversifying your portfolio. 🎯 #investing