Imagine you are Arjun, a young professional with a promising career, but there’s one aspect of your life where you consistently struggle: making financial decisions. Whether it’s planning for retirement, paying off debt, or simply creating a budget, you find yourself putting these tasks off until the last minute. This habit of financial procrastination is more common than you think, and it has significant, often hidden, costs.

The Psychological Triggers

Financial procrastination is not just about laziness or lack of motivation; it is deeply rooted in psychological triggers. One of the primary reasons is the fear of failure. The thought of making a wrong financial decision can be paralyzing, leading you to delay any decision altogether. This fear is compounded by the feeling of being overwhelmed by the complexity of financial planning. With so many options and so much information available, it’s easy to feel like you’re drowning in a sea of uncertainty.

Another critical factor is present bias, a concept from behavioral economics that explains why we tend to prefer immediate rewards over future benefits. This bias makes it difficult to prioritize long-term financial goals, such as saving for retirement, when there are immediate needs or wants that seem more pressing. For instance, the temptation to spend money on a vacation or a new gadget often outweighs the less tangible benefit of saving for a distant future.

The Cost of Delay

These small delays might seem insignificant at first, but they snowball into significant financial setbacks over time. Let’s consider an example: if Arjun starts saving for retirement just five years later than he should, he could end up with tens of thousands of dollars less in his retirement account. This is because compound interest, which is the interest earned on both the principal amount and any accrued interest, works in favor of early starters.

Hyperbolic discounting is another behavioral economics concept that plays a crucial role here. It suggests that people tend to value immediate rewards more highly than future rewards. For Arjun, the immediate gratification of buying something he wants now is more appealing than the long-term benefit of saving for the future. This preference for immediate rewards can lead to a pattern of financial decisions that prioritize short-term pleasure over long-term financial well-being.

The Invisible Tax

Financial procrastination acts as an invisible tax on our financial health. Every delay in making a financial decision costs us in terms of lost opportunities and increased financial stress. For example, procrastinating on debt repayment can lead to higher interest payments over time, while delaying investment decisions can result in missed investment gains.

Moreover, financial procrastination can have a ripple effect on other areas of life. It can lead to increased stress levels, strained relationships, and a general sense of financial insecurity. This stress can further exacerbate the problem, creating a vicious cycle where the fear of making financial decisions leads to more procrastination, which in turn increases financial stress.

Overcoming Procrastination

So, how can Arjun, and others like him, overcome this costly habit? The key lies in understanding and leveraging the principles of behavioral economics.

One effective strategy is to use commitment devices. These are tools or mechanisms that help you stick to your financial plans by making it more difficult to procrastinate. For instance, setting up automatic transfers to a savings or investment account ensures that you save a portion of your income regularly, without having to think about it each time. Another example is enrolling in a retirement plan that requires active decisions, such as opting in or out within a specific timeframe, rather than simply providing a toll-free number to call whenever you decide to enroll.

Social accountability is another powerful tool. Sharing your financial goals with a trusted friend or family member can provide an added motivation to stay on track. This can be as simple as having a monthly check-in to discuss progress or as structured as joining a financial support group.

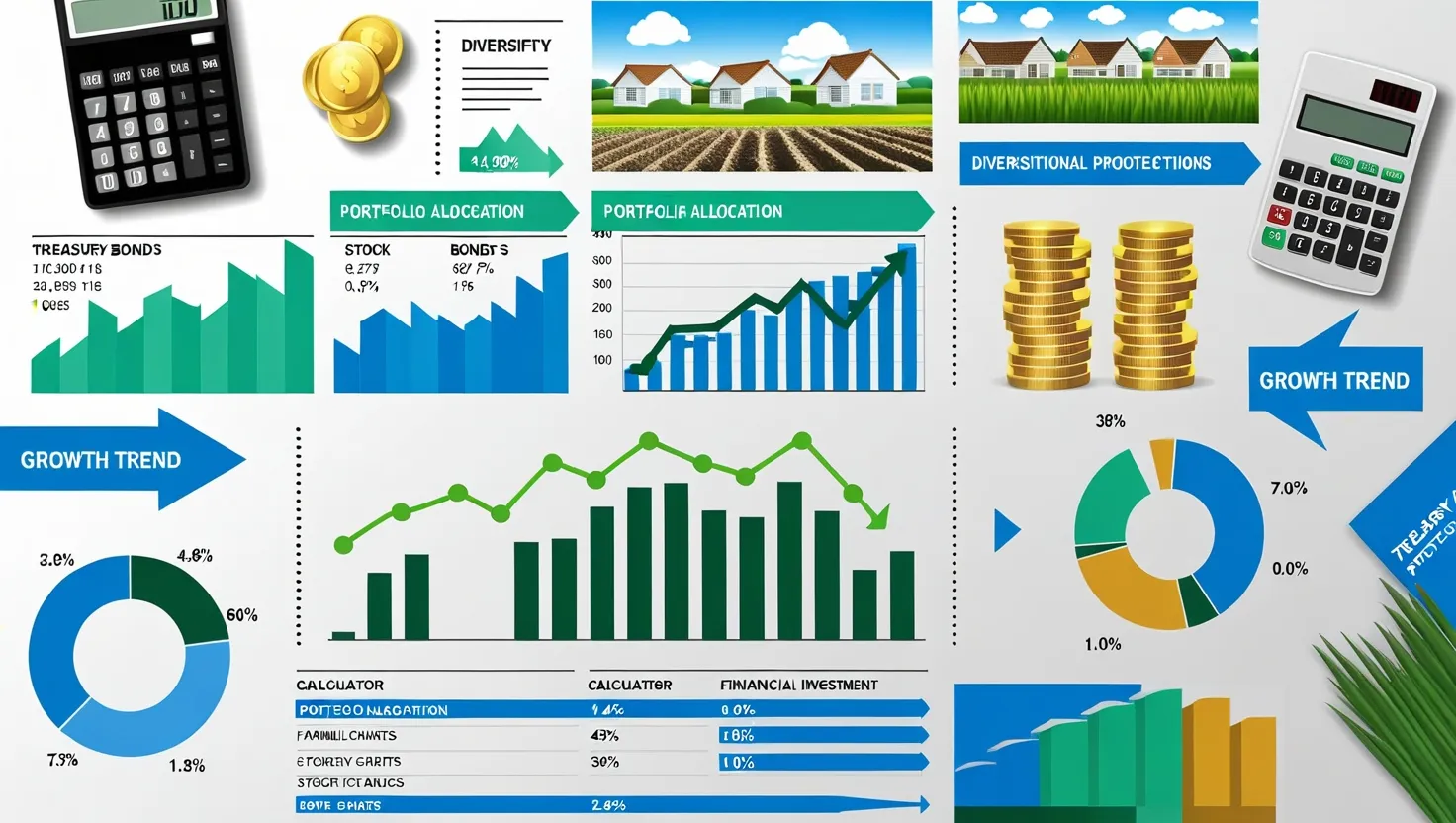

Simplifying Decisions

Decision paralysis, which occurs when faced with too many choices, is a common obstacle to making financial decisions. To overcome this, simplifying the decision-making process can be incredibly effective. For example, instead of being overwhelmed by the numerous investment options available, you can opt for a simple, diversified portfolio that requires minimal maintenance.

Automating good habits is also a strategy rooted in behavioral economics. By setting up automatic processes for savings, investments, and bill payments, you can ensure that these tasks are completed without requiring constant decision-making. This not only saves time but also reduces the likelihood of procrastination.

Reframing Financial Information

How information is presented can significantly impact decision-making. This is known as the framing effect. For instance, instead of thinking about saving $500 each month, reframing it as saving $17 per day can make the task seem less daunting. Similarly, presenting financial goals in terms of what you will gain rather than what you will give up can make them more appealing.

Leveraging Loss Aversion

Loss aversion, the fear of losing money, is a powerful psychological bias. By leveraging this bias, you can create strategies that make financial decisions more appealing. For example, framing savings goals in terms of what you might lose if you don’t save (e.g., missing out on retirement funds) rather than what you gain (e.g., having a comfortable retirement) can be a strong motivator.

Conclusion

Financial procrastination is a common but often overlooked financial behavior that can have significant long-term costs. By understanding the psychological triggers behind this habit and leveraging the principles of behavioral economics, you can develop practical strategies to overcome it.

For Arjun, and for anyone struggling with financial procrastination, the journey to better financial health starts with small, manageable steps. It involves recognizing the biases that drive our financial decisions, simplifying the decision-making process, and using tools like commitment devices and social accountability to stay on track.

As you navigate the complex landscape of personal finance, remember that every small decision today can have a profound impact on your financial future. By making informed, mindful choices and overcoming the costly habit of financial procrastination, you can build a stronger, more secure financial foundation for yourself.