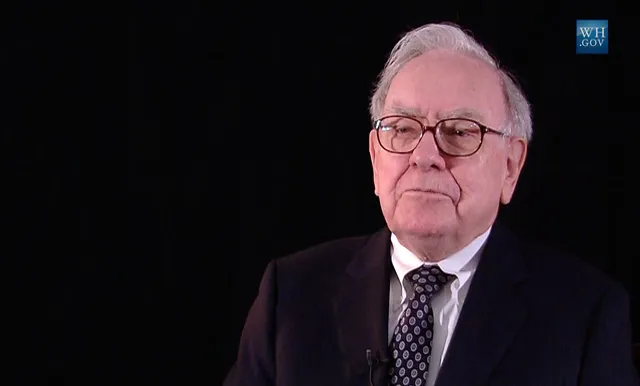

Warren Buffett is a name that resonates in the hallways of investment circles worldwide. Known affectionately as the "Oracle of Omaha," Buffett's journey from a precocious investor to one of the richest men alive is nothing short of legendary. Unlike many of his contemporaries who amassed fortunes through technological innovations or inheritance, Buffett built his vast empire through astute stock market investments.

His approach to investing, characterized by patience, meticulous analysis, and a keen understanding of market dynamics, has turned him into a figure of reverence for anyone interested in finance. Buffett's success is not just a tale of wealth accumulation but also a beacon of inspiration for investors aiming for consistent market success over a prolonged period. His life’s work demonstrates that with the right strategy and a steadfast commitment to value investing, remarkable financial achievements are within reach.

Early Years

Warren Buffett's story begins in Omaha, Nebraska, during the depths of the Great Depression. Born in 1930, Buffett’s formative years were marked by economic turmoil, but he was shielded from the worst of it by his family’s relative stability. His father, Howard Buffett, was a stockbroker who provided a modest but secure upbringing amidst the economic chaos. This early exposure to the financial world planted the seeds of interest in investing within young Buffett.

Despite the widespread economic hardship, Buffett showed early signs of business acumen. He was always looking for ways to earn money, from selling cola to his classmates to delivering newspapers. His childhood activities were not merely ways to make money; they were the beginning of a lifelong passion for growth and investment.

Buffett’s relentless drive to succeed was evident even during his school days. He famously promised his friends that he would be a millionaire by the age of thirty or he'd jump off the tallest building he could find—a bold statement that reflects both his ambition and confidence. These early experiences set the stage for what would become a monumental career in investing, underpinned by a deep understanding of and respect for the market’s potential.

Early Business Ventures

Warren Buffett's entrepreneurial spirit was evident from a young age. His foray into the business world began long before he entered the stock market. As a child, Buffett was always on the lookout for opportunities to make money, showing a keen sense for profitable ventures. One of his first business operations involved purchasing six-packs of Coca-Cola from his grandfather's grocery store and selling them at a profit to his thirsty classmates.

This early lesson in buy low and sell high principles was just the beginning. In his teenage years, Buffett ventured into more complex business operations. He bought used pinball machines and placed them in local barber shops, splitting the profits with the shop owners. This venture was particularly successful and provided him with more capital to reinvest into other projects.

At just 14 years old, Warren took his earnings from the pinball business and made his first significant investment, purchasing 40 acres of farmland in Nebraska. He managed this property wisely, hiring a farmer to work the land and using the profits to fund his future education.

These early ventures were critical in shaping Buffett's understanding of business and investment. They instilled a foundational sense of responsibility, management, and most importantly, the value of reinvesting profits into new opportunities. This mindset would become a cornerstone of his investment philosophy and a key to his future success.

Education and Influence of Benjamin Graham

Warren Buffett's formative years as an investor were heavily influenced by his academic experiences and the mentors he encountered. After being rejected by Harvard Business School, Buffett enrolled at Columbia Business School, a decision that would prove pivotal. It was here that he met Benjamin Graham, a professor and the author of "The Intelligent Investor," a book that has become a bible in the investment world.

Graham's philosophy of "value investing" resonated deeply with Buffett. This approach emphasizes buying stocks that appear underpriced by some form of fundamental analysis, thus providing a margin of safety while ensuring long-term growth. Graham taught that investment success did not depend on timing the market, but on recognizing undervalued companies and understanding their true worth.

Under Graham's tutelage, Buffett flourished, absorbing every lesson and applying these principles rigorously as he began his investing career. Graham’s impact on Buffett extended beyond the classroom; he also offered him a job at his partnership, further allowing Buffett to hone his skills in practical settings.

This period was crucial for Buffett as it shaped his investment style and philosophy, blending rigorous financial analysis with a focus on long-term value creation. His time with Graham not only equipped him with invaluable tools but also instilled a disciplined approach to investing that would underpin his future successes.

Early Investment Career

Warren Buffett's early investment career began soon after his mentorship under Benjamin Graham ended when Graham decided to retire. This pivotal moment led Buffett to return to Omaha, where he founded the Buffett Partnership Ltd. in 1956. With an initial capital sourced from family and friends, Buffett set out to apply the value investing principles he had mastered under Graham.

Buffett's strategy during these early years was simple yet profoundly effective. He sought out companies that were undervalued by the market—businesses that resembled, as Graham would say, "cigarette butts" with one last puff left in them. These were often companies that were mundane or in declining industries but had assets that were worth more than their market price.

One of the hallmark investments during this period was his purchase of shares in a troubled company, the Sanborn Map Company. This company had a market price that was significantly less than the investments it held. Buffett realized that by buying enough stock, he could control the company and unlock this hidden value, which he successfully did.

Through the Buffett Partnership, his investments consistently outperformed the market, building both his reputation and his wealth. His ability to scrutinize a company's books and understand its true worth—even when obscured by temporary circumstances or poor management—was unmatched. This meticulous approach not only solidified his investment philosophy but also prepared him for the significant ventures that lay ahead, including his eventual takeover of Berkshire Hathaway.

Berkshire Hathaway

Warren Buffett's interaction with Berkshire Hathaway began as another investment opportunity but eventually transformed into the cornerstone of his financial empire. Initially, Berkshire was a struggling textile company based in New England, a region where the textile industry had been declining for decades. The company had closed most of its mills and its stock was trading below the value of its assets, attracting Buffett's attention for its potential as an undervalued investment.

In the early 1960s, Buffett started buying shares in Berkshire Hathaway, viewing it as a typical 'cigarette butt'—a company with a little left to give at a cheap price. However, a turning point came when he felt slighted by the then CEO, who tried to buy back Buffett’s shares at a price lower than agreed upon. Motivated by what he perceived as a personal slight, Buffett ended up buying enough shares to control the company and eventually ousted the CEO.

This move marked the beginning of a pivotal shift in Buffett’s career. Rather than dismantling the company for its assets, he chose to transform it into a massive holding company. Over the following decades, Berkshire Hathaway shifted away from its textile roots and became a vehicle for Buffett to make substantial investments in insurance, energy, transportation, and other industries, thereby leveraging the capital generated from these ventures to fund further investments.

The acquisition of Berkshire Hathaway highlights a significant evolution in Buffett's investment strategy—from finding undervalued companies to acquiring businesses that could generate long-term value. This transition was not just about capitalizing on market inefficiencies but also about creating and sustaining growth through strategic investments.

Investment Philosophy

As Warren Buffett's experience and success grew, so did his investment philosophy, which underwent a significant transformation during his tenure at Berkshire Hathaway. Initially, Buffett's approach was heavily influenced by Benjamin Graham's concept of value investing, focusing primarily on undervalued companies with a safety margin reflected in their discounted asset prices. This strategy involved buying stocks that were priced less than their intrinsic value, often in companies that were mediocre but had undervalued assets.

However, Buffett's strategy evolved after his experiences with Berkshire Hathaway. He began shifting his focus towards buying high-quality companies at fair prices rather than mediocre companies at bargain prices. This was a marked shift from seeking short-term gains from undervalued assets to pursuing long-term growth through investments in companies with strong fundamentals, excellent management, and durable competitive advantages.

This change was partly inspired by his partnership with Charlie Munger, who emphasized the importance of investing in 'wonderful companies at fair prices' rather than 'fair companies at wonderful prices.' One of the first examples of this new approach was Buffett's investment in American Express during the 1960s. The company was experiencing temporary difficulties due to a scandal, but Buffett recognized its enduring value and strong brand, leading to a highly profitable long-term investment.

This refined approach not only reduced the risk inherent in investing in struggling companies but also aligned more with Buffett's growing focus on sustainable business practices and ethical leadership. It reflected a deeper understanding of the market's potential for growth and a more nuanced appreciation of how businesses can create value over time. This shift has defined the investment strategy that has led to Berkshire Hathaway's phenomenal success and has been a crucial element of Buffett's legacy in the financial world.

Insurance Business

In the mid-1960s, Warren Buffett recognized an opportunity that would profoundly shape the future of Berkshire Hathaway and his investment strategy: the insurance industry. This sector intrigued him not just for its business model but for the unique financial advantages it offered, particularly the concept of "float." Float is the money insurance companies hold during the time between receiving premiums and paying claims. It's essentially free capital that can be invested elsewhere.

Buffett's first major foray into insurance was in 1967 when he acquired National Indemnity Company. This purchase wasn't just about entering a new industry; it was about gaining access to substantial amounts of float that could be used to fund investments across various sectors. This strategic move allowed Buffett to leverage the cash from insurance premiums to invest in other companies, significantly enhancing Berkshire Hathaway’s ability to generate wealth.

The acquisition of other insurance companies, including GEICO in 1996, further cemented Berkshire Hathaway's position in the insurance market. GEICO, in particular, provided a massive influx of float, which Buffett used to pursue larger and more significant investments. This approach transformed Berkshire Hathaway into a powerhouse, using the steady stream of capital from insurance operations to invest in diverse sectors such as energy, transportation, and consumer goods.

Buffett’s strategic entry into the insurance business exemplified his genius for recognizing and capitalizing on unique financial structures. It not only diversified Berkshire Hathaway’s portfolio but also provided a consistent and relatively risk-free source of capital to fuel its growth. This expansion into insurance has been a critical component of Berkshire Hathaway's success, demonstrating Buffett’s ability to innovate within traditional investment frameworks.

Philosophy and Success

Warren Buffett's success as an investor can largely be attributed to his unique investment philosophy, which has consistently emphasized patience, discipline, and a thorough understanding of a company's intrinsic value. His approach is rooted in the principles of value investing, but with a distinct focus on long-term sustainability rather than short-term gains.

One key aspect of Buffett's philosophy is his focus on companies with durable competitive advantages, often referred to as "moats." These moats could be strong brand identities, proprietary technology, or significant market dominance. This approach ensures that investments are not only safe but also capable of yielding significant returns over time.

Buffett also stresses the importance of management quality when considering investments. He believes in leaders who are not only skilled and experienced but also imbued with integrity and a shareholder-oriented approach. This focus on strong leadership has been instrumental in maintaining high standards of governance and performance across Berkshire Hathaway’s diverse holdings.

Furthermore, Buffett advocates for a disciplined approach to investing, which involves strict adherence to the criteria of buying undervalued stocks that show potential for long-term growth. This discipline helps avoid the pitfalls of market speculation and ensures that each investment decision is backed by solid financial reasoning and thorough analysis.

Another cornerstone of Buffett's success is his ability to stay grounded and avoid the herd mentality that often leads to market bubbles and crashes. His philosophy of being "fearful when others are greedy, and greedy when others are fearful" has guided his investment decisions during times of economic turbulence, allowing him to capitalize on market downturns where others see despair.

Overall, Warren Buffett's investment philosophy combines a deep understanding of economic fundamentals with a principled approach to business and management. This philosophy has not only made him one of the most successful investors in history but has also inspired countless others in the field of finance and beyond.

Conclusion

Today, Warren Buffett remains a towering figure in the world of finance, not just for his investment acumen but also for his commitment to sharing his knowledge and philosophy with others. His annual letters to Berkshire Hathaway shareholders are widely read for insights into his thinking and strategies, serving as valuable lessons in finance and economics.

Buffett's educational initiatives extend beyond these letters. He has actively participated in various educational platforms to teach the principles of investing to a broader audience. One significant partnership has been with Skillshare, where he has created a series of educational videos on stock market investing. These videos aim to demystify the complexities of the stock market and make investing more accessible to the public.

This educational outreach is part of Buffett’s broader legacy of philanthropy and knowledge-sharing. He believes in empowering individuals by providing them with the tools and knowledge to make informed financial decisions. Through these efforts, Buffett is not only helping shape the next generation of investors but also promoting a more financially literate society.

Moreover, Buffett's commitment to education reflects his belief in the power of informed investing to improve individual lives and, by extension, the broader economy. His teachings encourage a rational, value-based approach to investing, emphasizing that sound investment decisions are within reach of anyone willing to learn the fundamentals.

In conclusion, Warren Buffett's influence stretches far beyond his investment successes. Through his educational and philanthropic efforts, he continues to inspire and equip individuals with the knowledge needed to succeed in the financial world, cementing his legacy as one of the most impactful figures in modern finance.