As I sit down to write about the potential impact of China’s economic slowdown on global stock markets, I am reminded of the intricate web of global economics and how one major player can send ripples across the world. China, with its vast economy and significant influence on global trade, is no small player. So, what happens when this economic giant starts to slow down?

The China Effect

To understand the impact, let's start with some numbers. China's GDP growth has been on a decline, hitting its lowest level since 1990, excluding the pandemic years. This slowdown is not just a domestic issue; it has far-reaching implications. For instance, companies listed on the S&P 500 Index derive about 4% of their total revenue from China. While this might seem modest, it has quadrupled since 2004, indicating a growing dependence on the Chinese market.

The technology sector is particularly exposed, with about 13.4% of its revenues coming from China. This is significantly higher than any other sector, making tech companies highly sensitive to China's economic health. When China's economy slows down, these companies feel the pinch, and this can be reflected in their stock performance.

Global Macroeconomic Implications

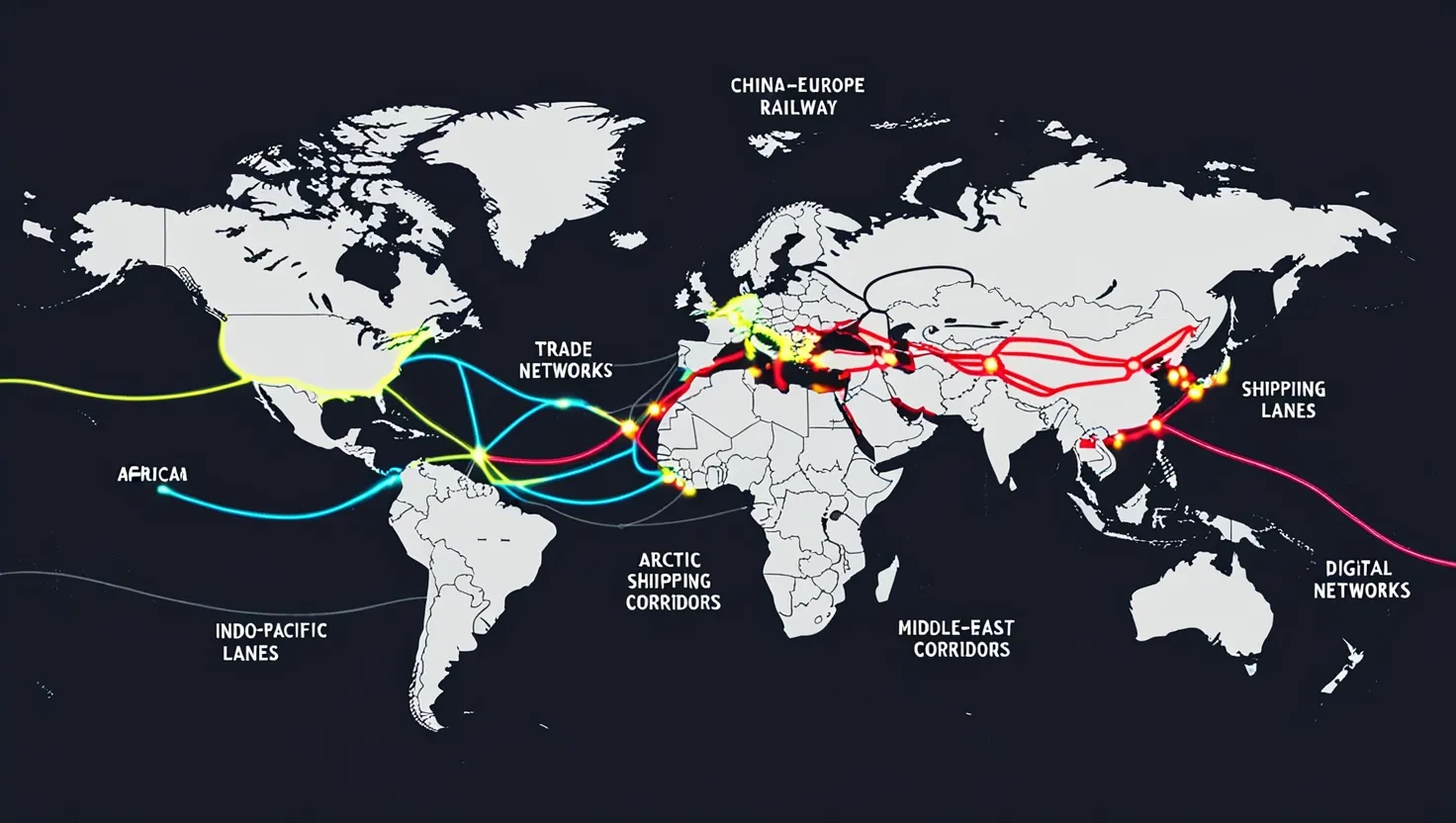

A slowdown in China's economy is not just a local issue; it has global macroeconomic implications. According to some studies, a 1% permanent negative GDP shock in China could reduce global growth by 0.23 percentage points in the short run. This might not seem like a lot, but it can have significant effects on commodity prices, oil prices, and even global equity markets.

For example, a decline in China's growth can lead to lower demand for commodities, which in turn can affect countries that are major commodity exporters. This was evident during the 2015-2016 period when China's slowdown led to a surge in global financial market volatility, resulting in a fall in oil prices and global equity prices.

Stock Market Performance

Historically, companies with revenue exposure to China have outperformed those without. However, during periods of economic downturn in China, this trend can reverse. When China's economy slows, companies that rely heavily on the Chinese market tend to underperform. This is because investors become cautious about the future prospects of these companies, leading to a decline in their stock prices.

For instance, in recent months, Chinese stocks have experienced significant declines due to disappointing economic stimulus announcements. The Shanghai Composite Index and the CSI 300 Index have plummeted, reflecting investor disappointment and concerns over China's growth prospects. This sentiment can spill over into global markets, affecting stocks of companies with significant exposure to China.

Regional Impacts

The impact of China's slowdown is not uniform across all regions. Countries in the Asia-Pacific region, particularly those that are part of ASEAN (Association of Southeast Asian Nations), are more vulnerable. These countries have strong trade ties with China and are heavily dependent on Chinese demand for their exports.

For example, during the 2015-2016 slowdown, countries like Indonesia, Malaysia, and Thailand experienced significant economic repercussions due to their exposure to China. Similarly, in the current scenario, these countries are likely to feel the effects of China's economic deceleration more intensely.

Market Volatility and Investor Sentiment

Market volatility is another key aspect to consider. When China's economy slows down, it can lead to increased volatility in global financial markets. This volatility can be driven by investor sentiment, which often reacts negatively to any signs of economic weakness in China.

Recently, the absence of new stimulus measures from Beijing led to a sharp decline in Chinese stocks, with the Shenzhen Composite Index experiencing its largest drop since 1997. This kind of volatility can spread to other markets, making investors cautious and leading to a broader market downturn.

Real-World Examples

Let's look at some real-world examples to put this into perspective. In September 2024, when China announced its economic stimulus measures, the market initially reacted positively. However, when the specifics of these measures did not meet investor expectations, the market sentiment quickly turned negative. This led to a significant decline in Chinese stocks and had a ripple effect on other Asian markets.

Similarly, in the U.S., companies with significant revenue exposure to China saw their stock prices fluctuate in response to China's economic news. For instance, tech companies that derive a substantial portion of their revenue from China experienced volatility in their stock prices as investors adjusted their expectations based on China's economic performance.

Geopolitical and Structural Issues

China's economic slowdown is also intertwined with geopolitical and structural issues. The country is grappling with a faltering real estate sector, high urban youth unemployment, and a tit-for-tat trade conflict with the EU. These factors add layers of complexity to the economic situation and can exacerbate the impact of any slowdown.

For example, the trade conflict with the EU has led to tariffs on European imports, which can further dampen economic growth. Additionally, the real estate sector's struggles can have a cascading effect on other sectors, given its significant contribution to China's GDP.

Investor Expectations and Policy Responses

Investors are keenly watching for policy responses from the Chinese government. The anticipation of stimulus measures can drive market sentiment, and any disappointment can lead to sharp declines. For instance, investors were expecting significant stimulus measures in October 2024, but when these were not announced, the market reacted negatively.

The Chinese government's ability to implement effective policies to stimulate growth will be crucial in mitigating the impact of the slowdown. However, the complexity of China's economic challenges means that any policy response will need to be multifaceted and robust.

Conclusion

In conclusion, China's economic slowdown is a significant event with far-reaching implications for global stock markets. The interdependence of economies means that what happens in China does not stay in China; it affects companies, investors, and economies around the world.

As an investor, it's important to stay informed about these developments and understand the nuances of how China's economy impacts global markets. While the current slowdown is a cause for concern, it also presents opportunities for those who can navigate these complex economic waters.

So, can China’s economic slowdown crash global stock markets? The answer is not a simple yes or no. It's a complex web of factors, including the extent of the slowdown, the response of policymakers, and the interconnectedness of global economies. As we move forward, keeping a close eye on these dynamics will be crucial for making informed investment decisions.