China, the world's second-largest economy, is facing a series of significant challenges that threaten its future stability and growth. From a declining population and surging youth unemployment to a faltering real estate market and economic slowdown, these issues are reshaping the country's economic landscape. This article delves into the key crises China is grappling with, exploring their causes, implications, and potential solutions, while also considering the broader impact on the global economy.

Population Decline

For the first time in decades, China's population has decreased. This decline marks the end of an era of rapid growth and cheap labor, which has been a cornerstone of China's economic success. With fewer people, especially in the working-age group, labor costs are expected to rise, potentially leading to higher prices for manufacturing goods globally. This could impact the cost of products like iPhones and cars.

The population decline is closely linked to the one-child policy that was implemented from 1980 to 2015. This policy led to a significant gender imbalance, as many families preferred to have sons. Now, the country faces an aging population, with fewer young people to support the elderly. The gender imbalance has also resulted in a large number of surplus bachelors, further complicating the issue of population growth.

The shrinking population presents a long-term economic challenge for China. As the labor force contracts, maintaining economic growth becomes more difficult. This demographic shift underscores the urgent need for China to adapt its economic policies and consider strategies to mitigate the impacts of an aging and declining population.

Ghost Cities and Real Estate Woes

China's ghost cities, filled with unfinished or unoccupied buildings, have become stark symbols of the country's real estate crisis. These empty developments highlight the severe lack of demand and the deep mistrust among homebuyers. Many people fear that developers won't complete their projects, leading to a significant decline in property prices and sales.

Major developers, like Evergrande, have defaulted on their debts, causing a ripple effect across the economy. Evergrande's financial troubles have shaken consumer confidence and led to broader concerns about the stability of China's real estate market. The crisis has also impacted local governments that relied heavily on land sales for revenue.

Real estate once played a crucial role in China's GDP, contributing to rapid economic growth. However, the sector's decline now poses a major threat to the overall economy. The Chinese government has implemented various measures to stabilize the market, such as lowering down payment requirements and reducing mortgage rates. Despite these efforts, recovery has been slow, and the real estate sector continues to struggle.

The ongoing issues in real estate are a clear indication that China's economic model, heavily reliant on construction and property development, needs significant adjustments. As the country grapples with these challenges, the broader implications for the global economy remain uncertain.

Youth Unemployment Crisis

China is grappling with a significant youth unemployment crisis. Since late 2022, the unemployment rate for urban youth, ages 16 to 24, has surged to 21%. This translates to about 6 million young people actively seeking jobs. This rate is comparable to those in G7 countries that also face challenges with youth employment.

Several factors contribute to this issue. The overall economic slowdown, worsened by stringent zero-COVID policies, has led businesses to be cautious about hiring. Companies, especially in sectors like technology and education, have slowed down recruitment due to regulatory crackdowns and economic uncertainties. Many young graduates find themselves without job prospects, prompting them to pursue further education as a way to delay entering a tough job market.

The high youth unemployment rate is particularly troubling for a country that prides itself on its large, well-educated workforce. The lack of job opportunities for young people not only affects their immediate financial stability but also has long-term implications for economic growth and social stability.

To address this crisis, the Chinese government needs to create more job opportunities and ensure that the education system aligns better with the job market's needs. This involves encouraging industries that can provide sustainable employment and adapting policies to support young entrepreneurs and small businesses. Only through such comprehensive efforts can China hope to mitigate the impact of this growing youth unemployment crisis.

Economic Slowdown

China's economic slowdown has been a significant concern, exacerbated by the stringent zero-COVID policy that stifled business activities and consumer spending. The economic deceleration has affected various sectors, with real estate and services taking the hardest hit. Investment in real estate plummeted, leading to unfinished projects and a lack of new developments.

Consumer confidence has been steadily declining since the beginning of the year. Many people hoped for a strong post-COVID recovery, but the reality has been disappointing. The service sector, in particular, has seen a drop in investment, and imports and exports have also decreased significantly. For instance, exports to the United States and the European Union dropped by 23% and 21% respectively in July compared to the previous year.

In response to these challenges, the Chinese government has cut interest rates in an effort to stimulate the economy. This move is in contrast to other major economies that have been raising rates to combat inflation. The goal is to boost consumer spending and investment, but so far, the recovery has been slow and uneven.

The economic slowdown has broad implications not just for China but for the global economy as well. As one of the world's largest economies, China's economic health significantly influences global trade and investment patterns. The country's struggles underscore the need for structural reforms and more effective economic policies to restore growth and rebuild consumer confidence.

Deflation Problem

China is grappling with deflation, where prices for goods and services steadily fall. This issue adds to the country’s economic woes and poses significant risks. The primary causes of deflation in China include the economic slowdown, exacerbated by stringent zero-COVID policies, and a real estate crisis that has eroded consumer wealth and confidence. Additionally, surplus capacity in various industries leads to fierce competition and falling prices. Regulatory crackdowns on key sectors like technology and real estate have also created uncertainty, dampening investment and spending.

The consequences of deflation are far-reaching. Reduced consumer spending occurs as people delay purchases, expecting even lower prices in the future. This behavior further slows economic growth. Businesses face lower profit margins, leading to cost-cutting measures such as layoffs and reduced investments. Moreover, deflation increases the real value of debt, making it harder for borrowers to repay loans, potentially leading to higher default rates and financial instability.

In response, the Chinese government has cut interest rates to encourage borrowing and spending. They have also implemented fiscal stimulus measures, including increased infrastructure spending, to boost economic activity. Despite these efforts, deflation remains a significant challenge, requiring ongoing policy adjustments to foster sustainable growth.

Technology Sector Impact

China's technology sector, once a booming industry, is now facing significant challenges due to regulatory changes. Major tech companies like Alibaba and Tencent have slowed their hiring, directly affecting the job market. These companies were known for their rapid growth and significant demand for young talent, but recent government crackdowns have curbed their expansion.

In 2020, regulators suspended the highly anticipated IPO of Alibaba's Ant Group, citing changes in the financial technology regulatory environment. This move signaled a shift in the government's approach to regulating tech giants. The crackdown has led to increased scrutiny and tighter controls over the industry, impacting planned IPOs and overall economic growth.

These regulatory changes have contributed to an unstable job market for young graduates, many of whom previously aimed for careers in tech. With fewer opportunities in this once-thriving sector, the pressure on the job market has intensified. The tech sector's slowdown is part of a broader pattern of economic deceleration and regulatory tightening across various industries.

The government's intent behind these regulations is to address systemic risks and ensure long-term economic stability. However, the immediate impact has been a cooling of the tech sector, which has had a ripple effect on the broader economy. Balancing regulation with growth remains a critical challenge for China as it navigates these complex economic dynamics.

Demographic Challenges and Policy Adjustments

China's aging population and declining birth rates present long-term economic challenges. Despite relaxing the one-child policy to allow for two or even three children, birth rates have not significantly improved. The high cost of living and economic uncertainties discourage many young couples from having more children.

This demographic shift means fewer young people entering the workforce, increasing the burden on the economy to support an aging population. The shrinking labor force complicates efforts to maintain economic growth and stability. As the population ages, the government faces rising costs for healthcare, social security, and other welfare programs.

To address these challenges, China is exploring several policy adjustments. Pension reforms and initiatives to boost productivity are critical components of this strategy. The government is also looking at ways to reform the education system to better align with the job market's needs, ensuring that the workforce is well-equipped for the future.

One controversial suggestion has been the potential import of labor from other countries to offset the domestic labor shortage. While this could alleviate some immediate pressures, it also presents cultural and social integration challenges. Ultimately, China's ability to navigate these demographic challenges will significantly impact its economic future and social stability.

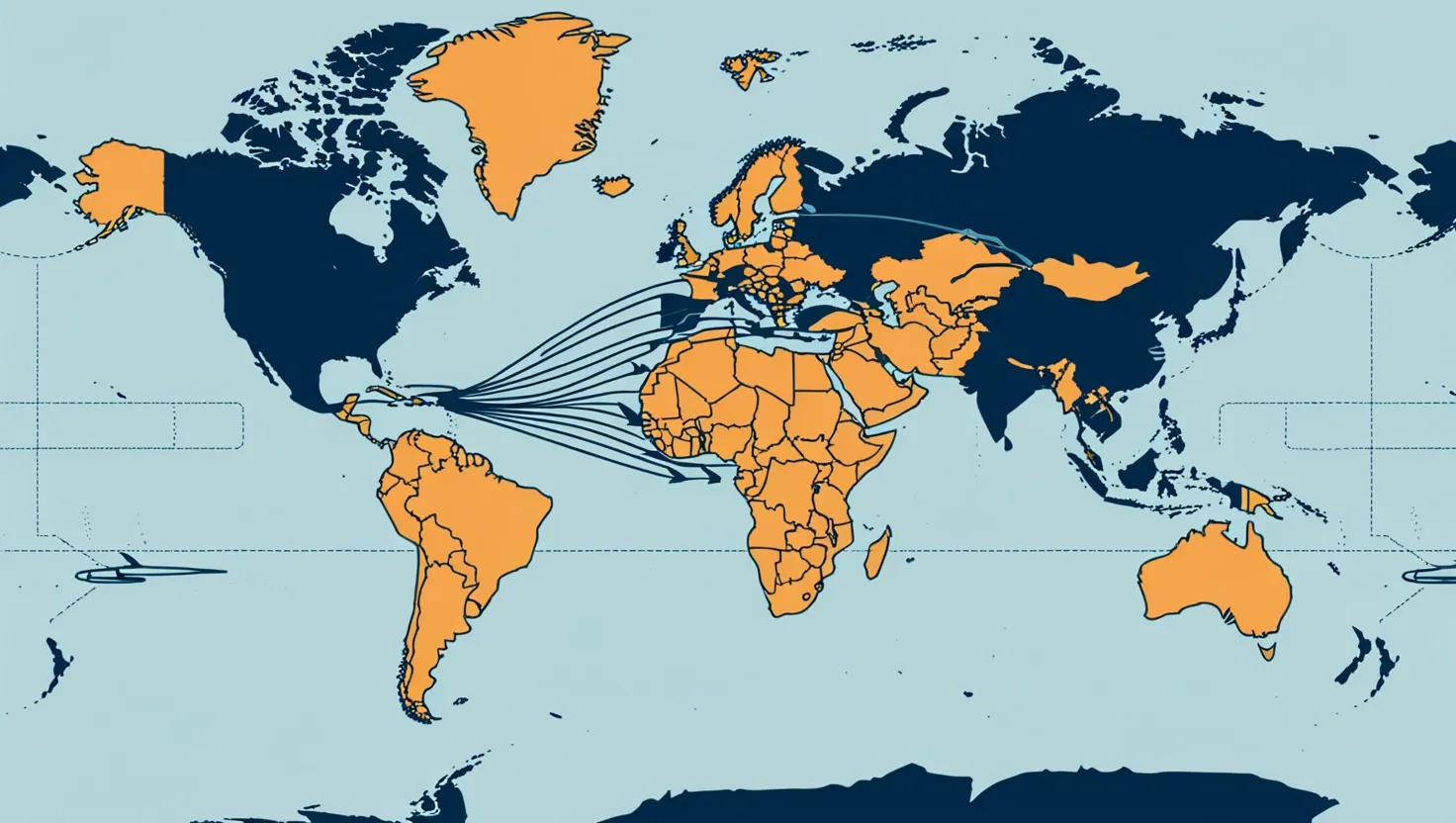

Global Supply Chain and Manufacturing Shifts

China's status as the world's manufacturing hub is under threat due to demographic and economic changes. The country has long benefited from an abundant supply of cheap labor, which attracted global manufacturers. However, the declining population and rising labor costs are eroding this advantage.

As China's labor force shrinks, production costs are expected to increase, prompting many companies to reconsider their supply chain strategies. Some businesses are already shifting their manufacturing operations to countries with younger, cheaper labor forces, such as India and Vietnam. India's growing workforce, in particular, positions it as a potential new leader in global manufacturing.

This shift has significant implications for global supply chains. Higher production costs in China could lead to increased prices for consumer goods worldwide. Additionally, the transition to new manufacturing hubs will require substantial investments in infrastructure and logistics. Countries like India will need to develop their industrial base and improve their supply chain capabilities to meet global demand effectively.

For China, the challenge is to transition from a manufacturing-based economy to one driven by innovation and high-tech industries. This shift will require significant investments in education, technology, and infrastructure to maintain its competitive edge. How China adapts to these changes will play a crucial role in shaping the future of global trade and economic dynamics.

Impact on Investors

China's economic challenges and strategic shifts have significant implications for investors worldwide. As the world's second-largest economy grapples with issues like population decline, a real estate crisis, and regulatory changes, investors need to reassess their strategies and exposure to Chinese markets.

Given the volatility in China's real estate market and regulatory environment, diversification is more important than ever. Investors should consider spreading their investments across different sectors and regions to mitigate risks. Emerging markets like India and Vietnam, which are becoming new manufacturing hubs, may offer attractive opportunities for growth and diversification.

China's heavy investment in technology and innovation, particularly in areas like artificial intelligence and renewable energy, presents both opportunities and risks. While these sectors are poised for growth, they also come with regulatory uncertainties. Investors should keep an eye on government policies and regulations that could impact the tech landscape.

China's emphasis on long-term economic security and technological advancement suggests that investors with a long-term horizon might find promising opportunities. However, short-term volatility and economic pressures require a cautious approach. Balancing short-term risk with long-term potential is crucial for a sound investment strategy.

The shift in global supply chains away from China to other countries like India presents new investment prospects. As these emerging markets develop their industrial and logistical capabilities, they offer potential for significant returns. Investors should consider the growth trajectories and infrastructural developments in these regions.

Staying informed about China's economic policies and political climate is essential. Changes in regulations, trade policies, and diplomatic relations can have substantial impacts on markets. Regularly monitoring these developments can help investors make informed decisions and adjust their portfolios accordingly.

Future Outlook and Global Impact

The ongoing crises in China, from real estate to unemployment, are causing significant global economic concerns. The International Monetary Fund (IMF) has highlighted China's issues as major risks for the global economy. The slowdown in China has led to reduced demand for commodities, lower global trade volumes, and disruptions in supply chains.

China's economic health is closely tied to global markets. A slowdown in China can lead to reduced demand for raw materials and intermediate goods from other countries, impacting global trade. Countries that heavily export to China, such as Australia, Brazil, and Germany, may face economic slowdowns due to decreased demand.

As companies and investors reconsider their strategies in China, there may be a shift towards other emerging markets. Countries like India, Vietnam, and Indonesia could benefit from increased investment as businesses seek to diversify their supply chains and reduce dependency on China. This shift could lead to the growth of new economic hubs and altered global trade patterns.

Financial markets are sensitive to changes in China's economic outlook. Reduced consumer confidence and economic instability can lead to market volatility, affecting global stock markets and investment portfolios. Investors need to be aware of these potential fluctuations and plan accordingly.

China's economic challenges may prompt greater international cooperation and policy responses. Countries may work together to address global economic risks and stabilize markets. Additionally, China's willingness to engage in diplomatic exchanges, particularly with the United States, could lead to new trade agreements and economic collaborations.

The structural changes in China's economy, such as the shift from manufacturing to high-tech industries, will have long-term implications. These changes will require adjustments in global supply chains and investment strategies. Countries and companies that can adapt to these shifts will be better positioned to thrive in the evolving economic landscape.