As I reflect on the global pandemic that swept the world, it’s clear that the economic responses were as unprecedented as the crisis itself. The COVID-19 pandemic forced economists, policymakers, and governments to think outside the box, leading to some of the most significant changes in economic policies in recent history.

The Fiscal Stimulus: A Double-Edged Sword

One of the most immediate and widespread responses was the implementation of massive fiscal stimulus packages. Governments around the world poured trillions of dollars into their economies to keep businesses afloat and people employed. This was a bold move, one that echoed the words of John Maynard Keynes: “The important thing for government is to keep the ball rolling, and it does not matter whether the ball is made of gold or of rubber.”

However, this largesse came with a price. National debts skyrocketed, raising concerns about long-term sustainability. In high-income countries, the fiscal response was substantial, but in low-income countries, the ability to mobilize such resources was severely limited. This disparity highlighted the existing inequalities within and across nations, making the recovery process uneven and challenging.

Central Banks: The New Guardians of Stability

Central banks played a pivotal role in stabilizing the economy through unconventional monetary policies. They implemented asset purchase programs, cut interest rates to historic lows, and even ventured into uncharted territory with negative interest rates. As former Federal Reserve Chairman Ben Bernanke once said, “The problem with quantitative easing is that it works in practice, but it doesn’t work in theory.”

These interventions helped prevent a complete economic collapse but also introduced new risks. The rapid expansion of central bank balance sheets and the subsequent need to shrink them quickly created volatility in financial markets. The slow response to rising inflation forced central banks to hike interest rates aggressively, catching many households and businesses off guard.

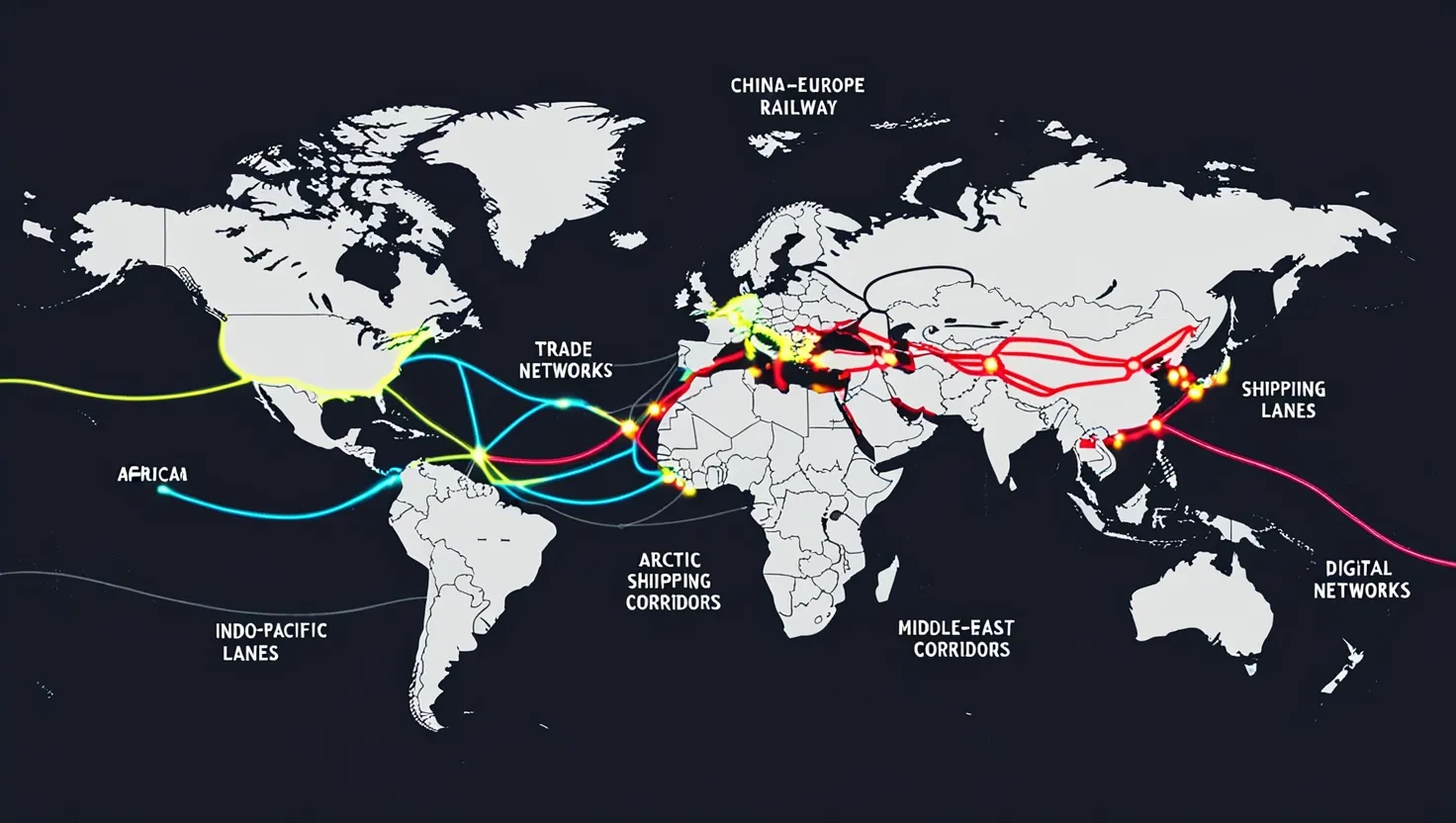

Supply Chains: From Global to Local

The pandemic exposed the vulnerabilities of global supply chains, prompting a shift towards diversification and reshoring initiatives. Companies began to reassess their reliance on international suppliers, opting instead for local or regional alternatives. This move was driven by the realization that just-in-time supply chains, while efficient, were also fragile.

As companies reshored their operations, it raised questions about the future of global trade. Would this trend continue, or was it a temporary response to an extraordinary situation? The answer lies in the balance between efficiency and resilience. As the world becomes increasingly interconnected, the need for robust and adaptable supply chains will only grow.

Digital Transformation: The Pandemic’s Silver Lining

One of the most profound impacts of the pandemic was the accelerated digital transformation across industries. Remote work became the new norm, and businesses that had previously resisted digital change were forced to adapt. This transformation was not just about technology; it was about culture and mindset.

As Microsoft CEO Satya Nadella noted, “The future is not something we enter, but something we create.” The pandemic created an environment where innovation thrived, and companies that embraced this change were better positioned to survive and thrive.

Universal Basic Income and Social Safety Nets

The pandemic also saw a renewed interest in universal basic income (UBI) experiments and the expansion of social safety nets. Governments recognized that traditional welfare systems were inadequate in the face of such widespread disruption. UBI, though still a controversial concept, offered a lifeline to many who found themselves suddenly without income.

As economist Milton Friedman once argued, “The government should not be in the business of providing goods and services that can be better provided by the private sector.” However, the pandemic challenged this view, highlighting the need for a robust social safety net in times of crisis.

Long-Term Implications

The long-term implications of these responses are multifaceted. On the one hand, the fiscal stimulus and central bank interventions helped mitigate the immediate economic damage. On the other hand, they have contributed to rising inflation and labor market imbalances. The question now is how to manage these challenges without stifling economic growth.

Inflation, in particular, has become a pressing concern. Central banks are walking a tightrope, trying to control inflation without choking off the recovery. The labor market is also undergoing significant changes, with many industries facing shortages and others experiencing structural shifts.

Lessons for the Future

So, what have we learned from this crisis? First and foremost, the importance of preparedness and flexibility cannot be overstated. Economic policies must be adaptable to unexpected shocks, and policymakers must be willing to think outside the box.

As former IMF Managing Director Christine Lagarde said, “The future is not what it used to be.” This crisis has shown us that traditional policy approaches may not be sufficient in the face of global challenges. We need new tools, new frameworks, and a willingness to collaborate across borders.

International Cooperation: A New Era

The pandemic has underscored the need for international cooperation. Economic policies are no longer isolated within national borders; they have global implications. The response to the pandemic showed that when countries work together, they can achieve far more than when they act alone.

However, this cooperation is not without its challenges. Different countries have different economic systems, political structures, and social norms. Finding common ground and coordinating policies is a complex task, but it is one that is essential for global economic resilience.

Conclusion

As we look back on the pandemic, it’s clear that it has changed the economic landscape forever. The responses to this crisis have altered economic thinking, challenged traditional policy approaches, and reshaped global trade patterns. The lessons learned are invaluable, and they will shape how we prepare for and respond to future crises.

In the words of economist Joseph Schumpeter, “The process of creative destruction is the essential fact about capitalism.” The pandemic has been a destructive force, but it has also been a catalyst for creative change. As we move forward, it’s up to us to harness this creativity to build a more resilient, more equitable, and more sustainable global economy.

So, what does the future hold? Only time will tell, but one thing is certain: the world will never be the same again. The pandemic has left an indelible mark on our economic policies, and it is up to us to ensure that this mark is one of progress and innovation.