Cash Flow Investing: The Key to Financial Freedom

Ever wondered how some people seem to have money flowing in without breaking a sweat? Well, they've probably cracked the code of cash flow investing. It's not rocket science, but it does require some smart thinking and a bit of patience.

Let's dive into the world of cash flow investing and see how it can transform your financial future. Trust me, it's not as boring as it sounds!

First off, what exactly is cash flow investing? Think of it as setting up little money streams that keep flowing into your bank account. These could be rental income from properties, dividends from stocks, or even interest from savings accounts. The idea is to create multiple sources of income that don't require you to clock in 9-to-5 every day.

Real estate is often the poster child for cash flow investing, and for good reason. Imagine owning a cozy apartment that you rent out. Every month, like clockwork, that rent money hits your account. Sure, you might have to deal with the occasional leaky faucet or temperamental tenant, but overall, it's a pretty sweet deal. And the best part? While you're collecting rent, the property itself might be going up in value. Double win!

But let's be real, not everyone has the cash to buy a whole building. That's where REITs (Real Estate Investment Trusts) come in. Think of them as mutual funds, but for real estate. You get to invest in property without actually having to unclog any toilets. It's like being a landlord without the 3 AM emergency calls.

Now, if you're more of a stock market person, dividend stocks might be your jam. These are like the generous aunts and uncles of the stock world – they regularly share their profits with you. Some companies even increase their dividends over time, which means your passive income grows without you lifting a finger. How cool is that?

For those who break out in a cold sweat at the mere thought of risk, high-yield savings accounts and CDs (Certificates of Deposit) are worth considering. Sure, the returns might not be as flashy as other investments, but they're stable and predictable. It's like the trusty old Toyota of the investment world – not exciting, but it gets the job done.

Bonds and bond funds are another option for the risk-averse. When you buy a bond, you're essentially lending money to a company or government. They promise to pay you back with interest. It's like being a mini-bank, minus the free lollipops.

For the more adventurous souls, peer-to-peer lending and private equity investments offer higher potential returns, but also come with higher risks. It's like the rollercoaster of the investment world – thrilling, but not for the faint of heart.

Now, let's talk about the digital age. If you've got skills, why not turn them into passive income? Creating and selling online courses, ebooks, or digital designs can be a goldmine. Sure, it takes some effort upfront, but once it's done, you could be making money while you sleep. Literally.

Got a spare room? A parking space you're not using? Even a power tool gathering dust in your garage? Why not rent them out? Platforms like Airbnb and Turo make it easy to turn your unused assets into cash cows.

For the creatives out there, building a blog or YouTube channel can be a fantastic way to generate passive income. It might take a while to build an audience, but once you do, the possibilities are endless. Ad revenue, sponsorships, merchandise – the sky's the limit.

Ever fancied yourself as a music mogul? Investing in royalties could be your ticket. You buy the rights to a song or book, and every time it's played or sold, cha-ching! Money in your pocket.

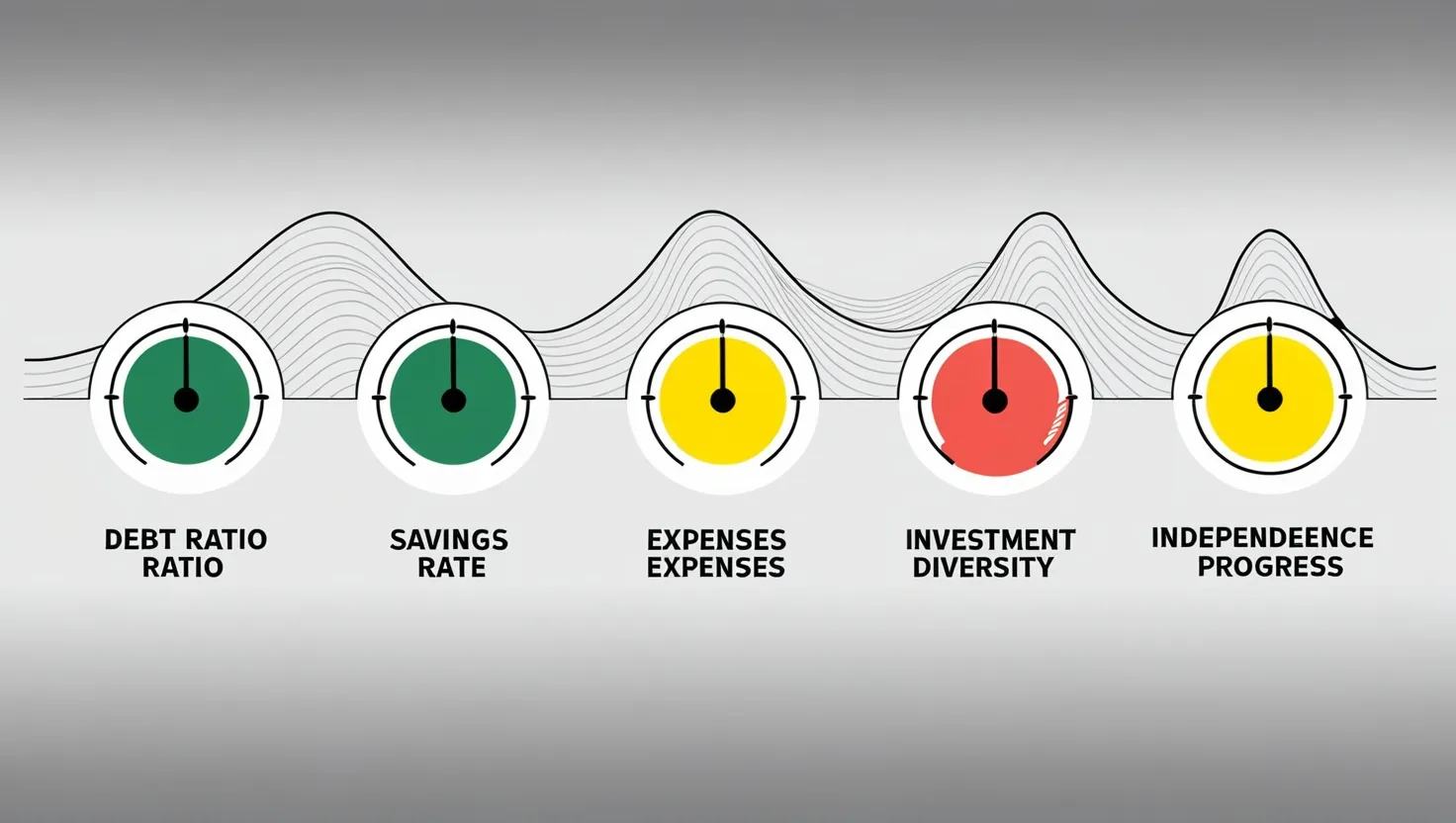

Now, here's the kicker – diversification. Don't put all your eggs in one basket. Spread your investments across different types of assets. This way, if one investment tanks, you're not left high and dry.

But let's be real for a second. Passive income isn't some magic money tree. It often requires a significant upfront investment, whether that's time or money. Building a rental property portfolio or creating an online course takes effort. But once it's set up, the rewards can be sweet.

And remember, even "passive" income requires some management. You'll need to keep an eye on your investments, make adjustments, and sometimes put in a bit of work to keep things running smoothly. But hey, it's a lot less work than a 9-to-5 job, right?

The real beauty of cash flow investing lies in its long-term benefits. Imagine reaching a point where your passive income covers all your living expenses. Suddenly, work becomes a choice rather than a necessity. You're free to pursue your passions, travel the world, or simply enjoy more time with your loved ones.

So, how do you get started? Start small. Maybe it's investing in a dividend-paying stock or creating a small online course. The key is to start building those income streams, no matter how tiny they might be at first.

As you go along, keep learning. The world of investing is always changing, and staying informed is crucial. Read books, follow financial blogs, or even take some courses. The more you know, the better decisions you'll make.

And don't forget to be patient. Building significant passive income takes time. It's not a get-rich-quick scheme, but rather a get-rich-slowly-but-surely plan.

In conclusion, cash flow investing isn't just about making money – it's about buying your freedom. It's about creating a life where money works for you, instead of you working for money. So why not give it a shot? Your future self might just thank you for it.

Remember, the best time to plant a tree was 20 years ago. The second best time is now. The same goes for cash flow investing. So what are you waiting for? Start planting those money trees!