In a world where managing finances often feels like a tedious task, a revolutionary approach is transforming the way we think about money. Imagine a scenario where a teenager can use an app that makes learning about finances as engaging as playing their favorite video game. This is the future of financial literacy, where gamification is not just a trend, but a powerful tool in shaping how we understand and manage our money.

The Power of Gamification

Gamification, the application of game mechanics in non-gaming contexts, is changing the landscape of financial education. It's no longer about dry lectures or complex financial jargon; it's about turning financial management into an interactive and enjoyable experience. By incorporating elements like points, badges, leaderboards, and challenges, financial apps are making learning fun and memorable.

For instance, when you use a gamified financial app, you might earn points for saving money or completing quizzes on investment strategies. These points can be redeemed for rewards, such as discount vouchers for financial services or even real money. This approach not only makes learning engaging but also provides immediate feedback, helping you track your progress and stay motivated.

Enhancing Engagement and Retention

One of the most significant benefits of gamification in financial literacy is its ability to enhance engagement and retention. Traditional financial education methods often result in high dropout rates due to the complexity and boredom associated with the subject. However, gamified programs have shown remarkable success in keeping learners engaged.

Studies have demonstrated that participants in gamified financial programs retain up to 20% more information than those using traditional methods. This is because gamification creates an immersive learning environment that encourages regular participation. For example, an app might offer daily challenges or weekly quizzes that keep you coming back, not just to play, but to learn.

Catering to Diverse Demographics

Gamified financial education is not a one-size-fits-all solution. It needs to cater to diverse demographics, each requiring a tailored approach based on their existing financial knowledge and goals. This means creating relevant challenges for different age groups, financial backgrounds, and preferences.

For younger generations, apps like Kit Money Quests offer a vibrant, game-like environment where kids can embark on quests that teach financial concepts in a fun and interactive way. These quests are designed to foster positive financial behaviors, such as setting and achieving savings goals or understanding the value of money through real-world simulations.

For adults, apps can offer more sophisticated challenges that mimic real-world financial scenarios, such as budgeting, investing, or managing debt. These challenges are often personalized using data analytics to understand user behavior and provide tailored feedback and rewards.

The Psychology Behind Gamification

The effectiveness of gamification in financial literacy is rooted in psychology. Our brains are wired to enjoy games, and when we engage in activities that are enjoyable, we are more likely to stick with them. Gamification leverages this by introducing elements of play into financial education.

Motivation plays a critical role in game-based learning environments. By satisfying users' needs for competence and autonomy, gamified apps increase autonomous motivation to use personal financial management tools. This means that instead of viewing budgeting or investing as tedious chores, you see them as exciting challenges to overcome.

Real-World Applications

Gamified financial education is not just about accumulating points or badges; it's about building a foundation of financial literacy that can be applied in real-world scenarios. Apps that simulate real-world financial decisions help users understand complex financial concepts in an enjoyable and relaxed environment.

For example, an app might offer a simulation where you have to manage a virtual budget, make investment decisions, or deal with unexpected expenses. These simulations provide a practical, hands-on approach to learning, making financial education less intimidating and more accessible.

Ensuring Data Security and Privacy

While gamification offers numerous benefits, it's crucial to ensure that these apps comply with strict data security and privacy standards. Protecting user information is essential to build trust and maintain the integrity of the learning experience.

Institutions must clearly communicate data use policies, encrypt user data, and ensure that only essential information is collected. This not only safeguards users' privacy but also enhances the overall credibility of the gamified financial education programs.

Overcoming Challenges

Despite the many advantages, there are potential drawbacks to consider. One significant risk is the oversimplification of complex financial decisions. By reducing intricate financial concepts to simple games or challenges, there's a risk that users might not fully grasp the complexity and risks involved.

For instance, investing in the stock market or cryptocurrency trading involves significant risks that cannot be fully captured in a game. Therefore, it's essential to strike a balance between engaging gameplay and educational value, ensuring that the core educational message is not overshadowed by game mechanics.

Another challenge is the potential for overconfidence. Reward mechanisms in gamified finance apps can sometimes encourage users to develop a false sense of expertise or invulnerability, leading to riskier financial behaviors without adequate understanding or preparation.

The Future of Financial Literacy

As technology continues to evolve, the role of gamification in financial literacy is set to become even more prominent. For younger generations, apps like Banqer and Kit Money Quests are already making a significant impact by providing a hands-on environment to learn about money.

Banqer, for example, offers a simulated online banking program for schools, allowing over 300,000 students to take charge of their financial future. This approach not only enhances financial literacy but also builds financial capability, providing students with the skills and attitudes needed to manage personal finances in a practical sense.

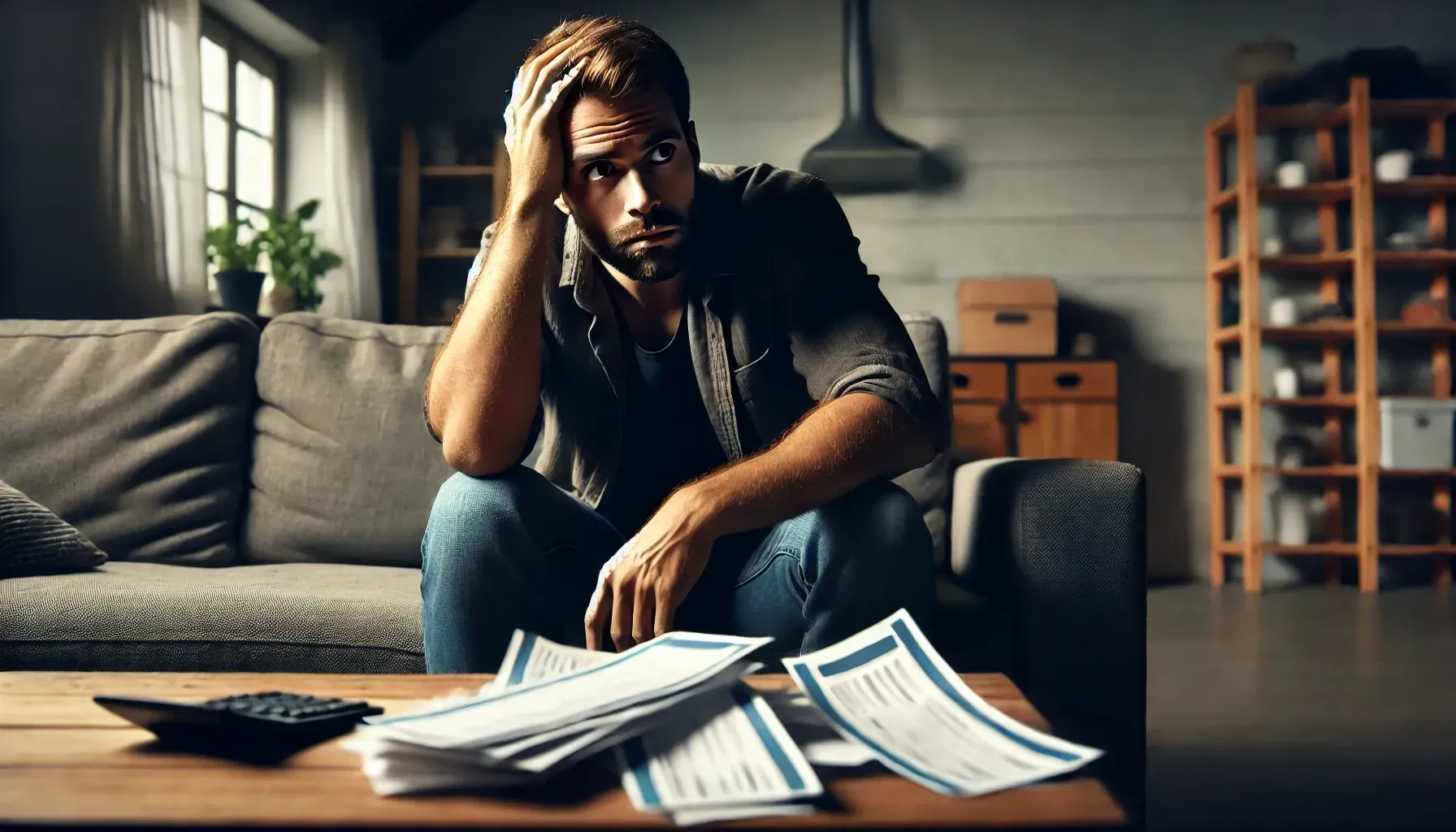

Personal Touches and Real-Life Examples

Personally, I've seen the impact of gamification in financial literacy through friends who have used these apps. One friend, who was initially hesitant about managing her finances, found an app that made budgeting and saving money a fun challenge. She would earn points for every dollar she saved and could redeem these points for rewards like coffee vouchers or movie tickets.

This approach not only helped her stay motivated but also taught her valuable financial skills that she now applies in her daily life. She's more confident in her ability to manage her finances and has even started investing in stocks, something she never thought she'd be interested in.

Conclusion

The future of financial literacy is indeed gamified. By turning financial education into an interactive and enjoyable experience, we can cultivate sound financial habits from a young age. This approach is not just about making learning fun; it's about creating a deeper engagement with managing money, making it a quest everyone wants to take on.

As we move forward, it's crucial to balance the engaging aspects of gamification with the core educational message, ensuring that users gain a comprehensive understanding of financial concepts. With the right approach, gamification can revolutionize the way we handle finances, making financial literacy accessible, engaging, and a lifelong skill.