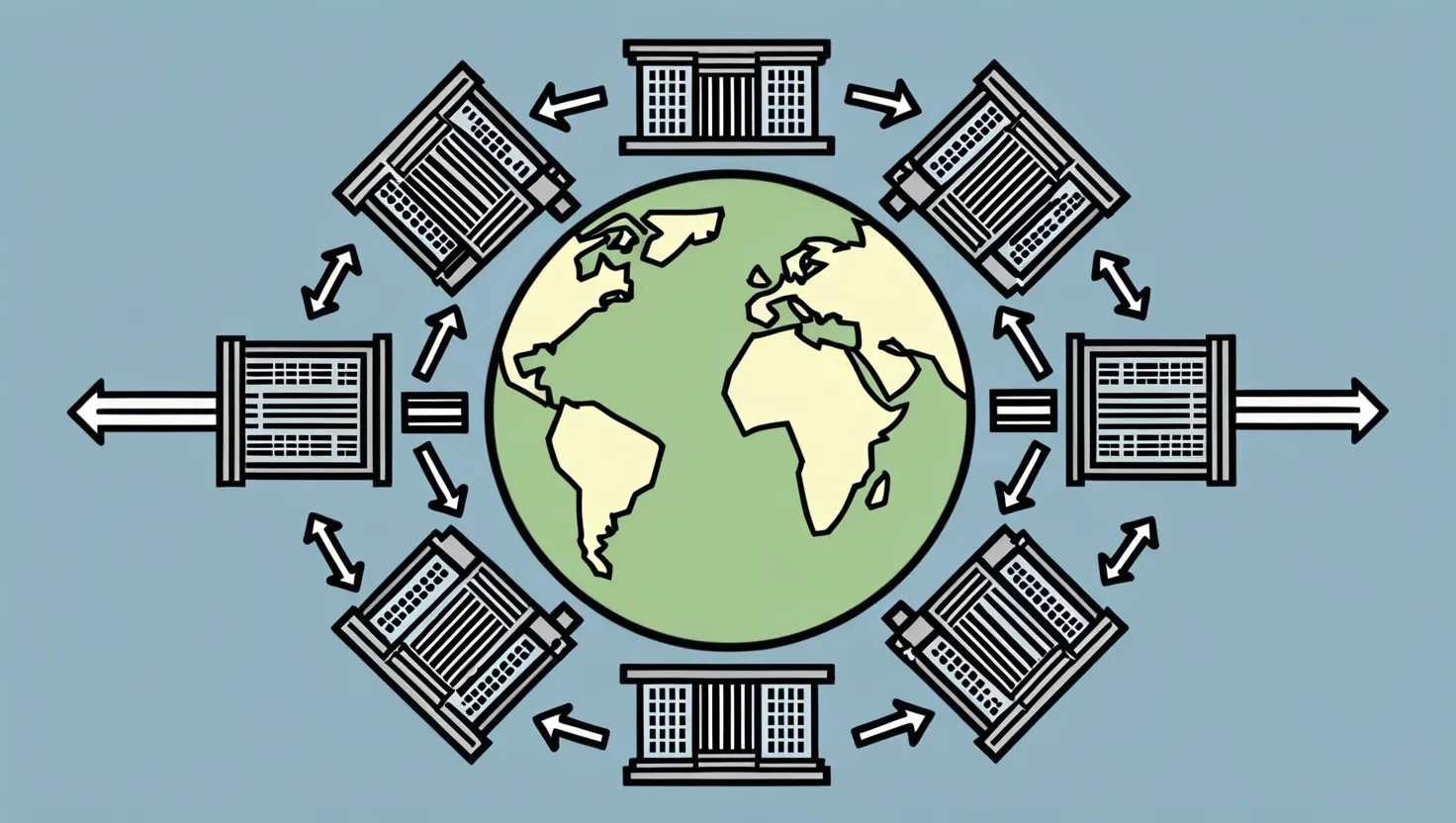

In the intricate web of global development, international financial institutions play a pivotal role, often working behind the scenes to shape economic policies, fund critical projects, and address some of the world’s most pressing challenges. Let’s delve into the unique contributions and evolving roles of seven key players in this arena.

The World Bank: A Pillar of Poverty Reduction and Infrastructure

The World Bank is perhaps one of the most recognizable names in the realm of international finance. Its mission to reduce poverty and promote sustainable development is multifaceted. One of the Bank’s most significant contributions is in community-driven development (CLD) programs. These initiatives empower local communities to identify and address their own development needs, whether it’s constructing schools, health clinics, or rural roads. By providing clear rules, access to information, and the necessary technical and financial support, the World Bank enables communities to take charge of their own development.

For instance, during crises like natural disasters or the COVID-19 pandemic, CLD programs have proven invaluable. They allow for the quick and flexible distribution of funds, often through community-level grants that are tailored to the specific needs of each area. This approach not only ensures that aid reaches the most vulnerable populations but also fosters a sense of community ownership and legitimacy.

Asian Development Bank: The Architect of Regional Integration

Across the Asia-Pacific region, the Asian Development Bank (ADB) is a driving force behind economic integration and cooperation. The ADB’s work goes beyond mere financial assistance; it involves building the very infrastructure that connects nations. From roads and power lines to bridges and ports, ADB projects have transformed the region into a manufacturing powerhouse.

The bank’s commitment to regional cooperation has been instrumental in creating sophisticated supply chains and production networks. This has led to the creation of millions of jobs and significant economic growth. Moreover, the ADB is at the forefront of addressing transnational challenges such as pollution, climate change, and pandemics. By fostering collective regional action, the ADB ensures that no country is left to face these challenges alone.

African Development Bank: Championing Sustainable Growth

In Africa, the African Development Bank (AfDB) is a beacon of hope for sustainable growth and development. The AfDB’s strategy is built around several key pillars, including infrastructure development, regional integration, and private sector development. By investing in these areas, the bank aims to create a more resilient and prosperous Africa.

One of the AfDB’s unique strengths is its ability to adapt to the diverse needs of African countries. Whether it’s supporting agricultural development, improving access to clean water, or enhancing energy infrastructure, the AfDB’s projects are designed to have a lasting impact. The bank also places a strong emphasis on environmental sustainability, recognizing that economic growth must be balanced with the need to protect Africa’s rich natural resources.

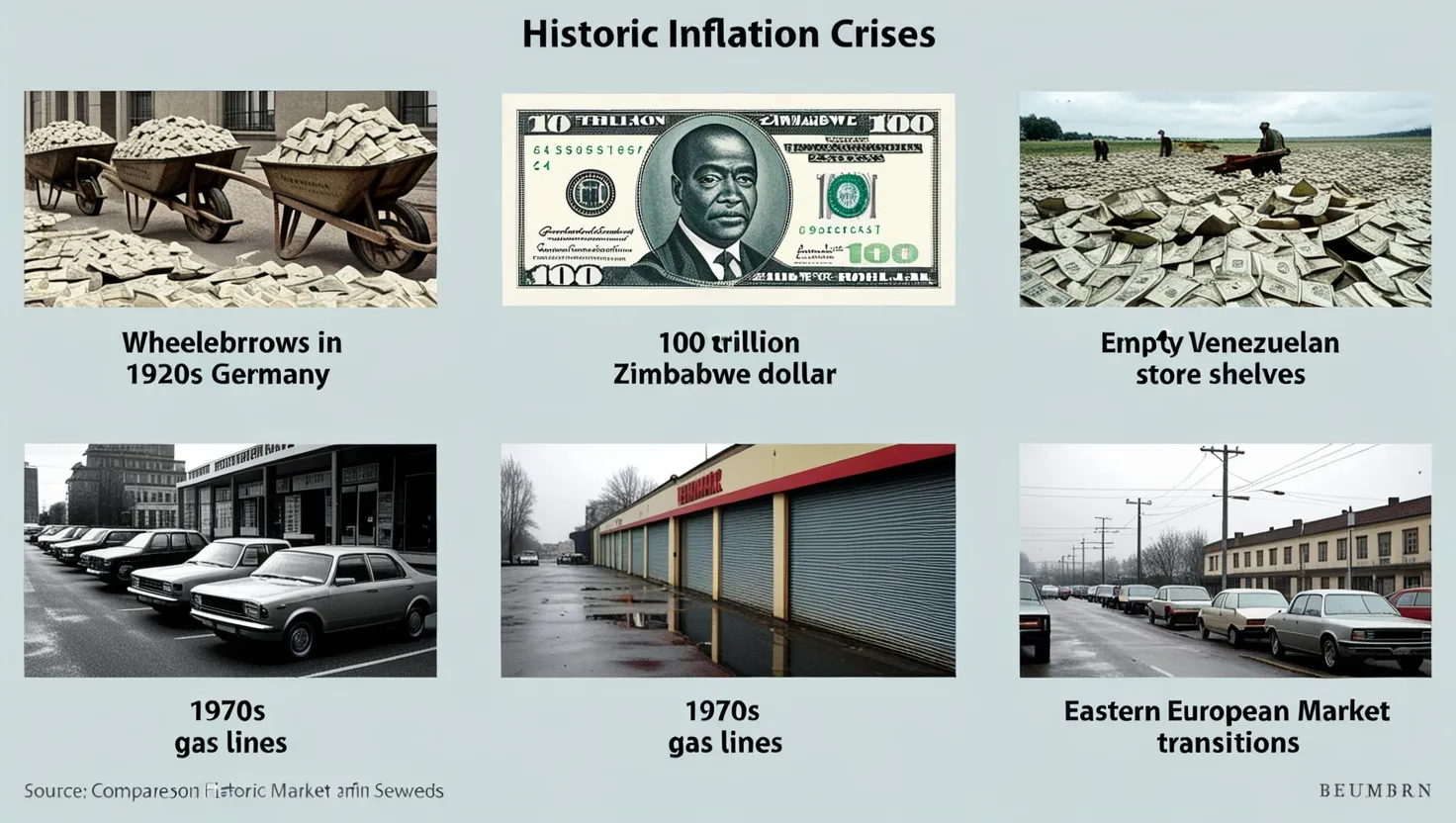

European Bank for Reconstruction and Development: Supporting Market Economies

The European Bank for Reconstruction and Development (EBRD) has a distinct mandate: to support the development of market economies in countries transitioning from central planning to free market systems. Since its inception, the EBRD has been instrumental in fostering economic growth and stability in regions that were once economically isolated.

The EBRD’s approach is holistic, involving not just financial investments but also policy advice and technical assistance. By promoting private sector development and encouraging foreign investment, the EBRD helps create the conditions necessary for sustainable economic growth. The bank’s work extends to sectors such as energy, transportation, and manufacturing, and it has played a crucial role in integrating these economies into the global market.

Inter-American Development Bank: Fostering Social Equity and Productivity

In the Americas, the Inter-American Development Bank (IDB) is dedicated to improving lives through social equity and increased productivity. The IDB’s focus on social equity is reflected in its programs aimed at reducing inequality and promoting inclusive growth. This includes initiatives in education, healthcare, and social protection, all designed to ensure that the benefits of economic growth are shared by all.

The IDB also places a strong emphasis on innovation and technological advancement. By supporting research and development, the bank helps countries in the region to stay competitive in a rapidly changing global economy. Additionally, the IDB’s work on infrastructure development, such as transportation and energy projects, is critical for enhancing productivity and facilitating trade.

Islamic Development Bank: The Pioneer of Interest-Free Financing

The Islamic Development Bank (IsDB) stands out for its unique approach to financing, which is based on Islamic principles that prohibit the collection and payment of interest. This model, known as Islamic finance, offers an alternative to conventional banking and has been particularly appealing in Muslim-majority countries.

The IsDB’s approach is not just about financing; it’s about promoting economic development that is ethical and sustainable. The bank supports projects in various sectors, including agriculture, energy, and infrastructure, all while adhering to the principles of Islamic finance. This includes the use of instruments like sukuk (Islamic bonds) and mudarabah (profit-sharing agreements), which provide financing without violating Islamic law.

New Development Bank: The Voice of Emerging Economies

The New Development Bank (NDB), established by the BRICS countries (Brazil, Russia, India, China, and South Africa), represents a new era in global development finance. The NDB’s mission is to support the development of its member countries and other emerging economies through sustainable infrastructure projects.

Unlike traditional development banks, the NDB is driven by the needs and perspectives of its member countries. This gives it a unique advantage in understanding and addressing the specific challenges faced by emerging economies. The NDB’s focus on sustainable infrastructure, including renewable energy and transportation projects, is crucial for supporting the rapid growth of these countries while ensuring environmental sustainability.

Evolving Roles in Climate Change Mitigation

As the world grapples with the challenges of climate change, international financial institutions are evolving to play a more critical role in mitigation efforts. The World Bank, for example, has been at the forefront of promoting climate-resilient development. This includes enhancing the quality and quantity of dedicated climate finance, ensuring that investment portfolios align with global climate goals, and protecting vulnerable populations and ecosystems.

Similarly, the ADB has made significant strides in addressing climate change through its regional cooperation initiatives. By promoting cross-border infrastructure and trade integration, the ADB helps reduce carbon footprints and enhance the resilience of regional economies to climate-related shocks.

Post-Pandemic Recovery and Technological Innovation

The COVID-19 pandemic has underscored the importance of international financial institutions in supporting global recovery efforts. The IMF, for instance, has provided critical financial assistance to countries facing balance of payments problems, helping them stabilize their economies and implement necessary reforms.

In addition to immediate financial support, these institutions are also driving technological innovation. The IDB’s focus on digital transformation is a prime example. By supporting the development of digital infrastructure and promoting the use of technology in various sectors, the IDB helps countries in the Americas stay competitive and resilient in the face of future challenges.

Lending Practices and Criticisms

While international financial institutions have made significant contributions to global development, their lending practices have not been without criticism. One of the main concerns is the debt burden that these loans can impose on recipient countries. There have been instances where countries have struggled to repay these loans, leading to economic instability and social unrest.

Moreover, there are criticisms about the conditionalities attached to these loans, which can sometimes undermine the sovereignty of recipient countries. For instance, structural adjustment programs imposed by the IMF have been criticized for their harsh economic reforms that can have adverse social impacts.

Success Stories and Future Directions

Despite these criticisms, there are numerous success stories that highlight the positive impact of international financial institutions. For example, the World Bank’s community-driven development programs have improved the lives of millions of people around the world by providing them with access to basic services like clean water, education, and healthcare.

As we look to the future, it is clear that these institutions will continue to play a vital role in shaping global development. Their evolving roles in addressing climate change, supporting post-pandemic recovery, and driving technological innovation are just a few examples of how they are adapting to the changing needs of the world.

In conclusion, international financial institutions are more than just lenders; they are architects of global development. Their work is complex, multifaceted, and often unseen, but it has a profound impact on the lives of people around the world. As we navigate the challenges of the 21st century, the role of these institutions will only become more critical, and their success will be measured by the sustainable, equitable, and resilient development they help achieve.