When it comes to the intricate dance between currency wars and stock markets, the landscape can be as volatile as it is complex. As someone who follows financial markets closely, I've seen how the subtle shifts in currency values can send ripples through the global stock market, affecting investors in ways both immediate and long-term.

The Basics of Currency Wars

To start, let's define what a currency war is. Essentially, it's a situation where countries deliberately devalue their currencies to gain a competitive edge in international trade. This can lead to a chain reaction, as other countries feel compelled to follow suit to protect their own export industries. The recent concerns about the Chinese yuan weakening to boost export growth are a prime example of this scenario.

Impact on Stock Markets

When a currency war unfolds, it can have far-reaching consequences for stock markets. For instance, if the Chinese yuan weakens significantly, it can trigger a wave of competitive devaluations among other export-oriented countries like South Korea, Taiwan, and Malaysia. This creates an adverse feedback loop where each country tries to outdo the others in weakening their currency, leading to instability in global markets.

The US Dollar's Role

The US dollar often plays a pivotal role in these scenarios. A strong US dollar, which can result from a weaker yuan or other currencies, can be a double-edged sword. On one hand, it makes US exports more expensive and less competitive, which can negatively impact sectors like technology that derive a significant portion of their revenue from international markets. For example, the Information Technology sector of the S&P 500, which has a high revenue exposure to international markets, can see its total revenue flows dragged down when the US dollar appreciates.

Historical Context

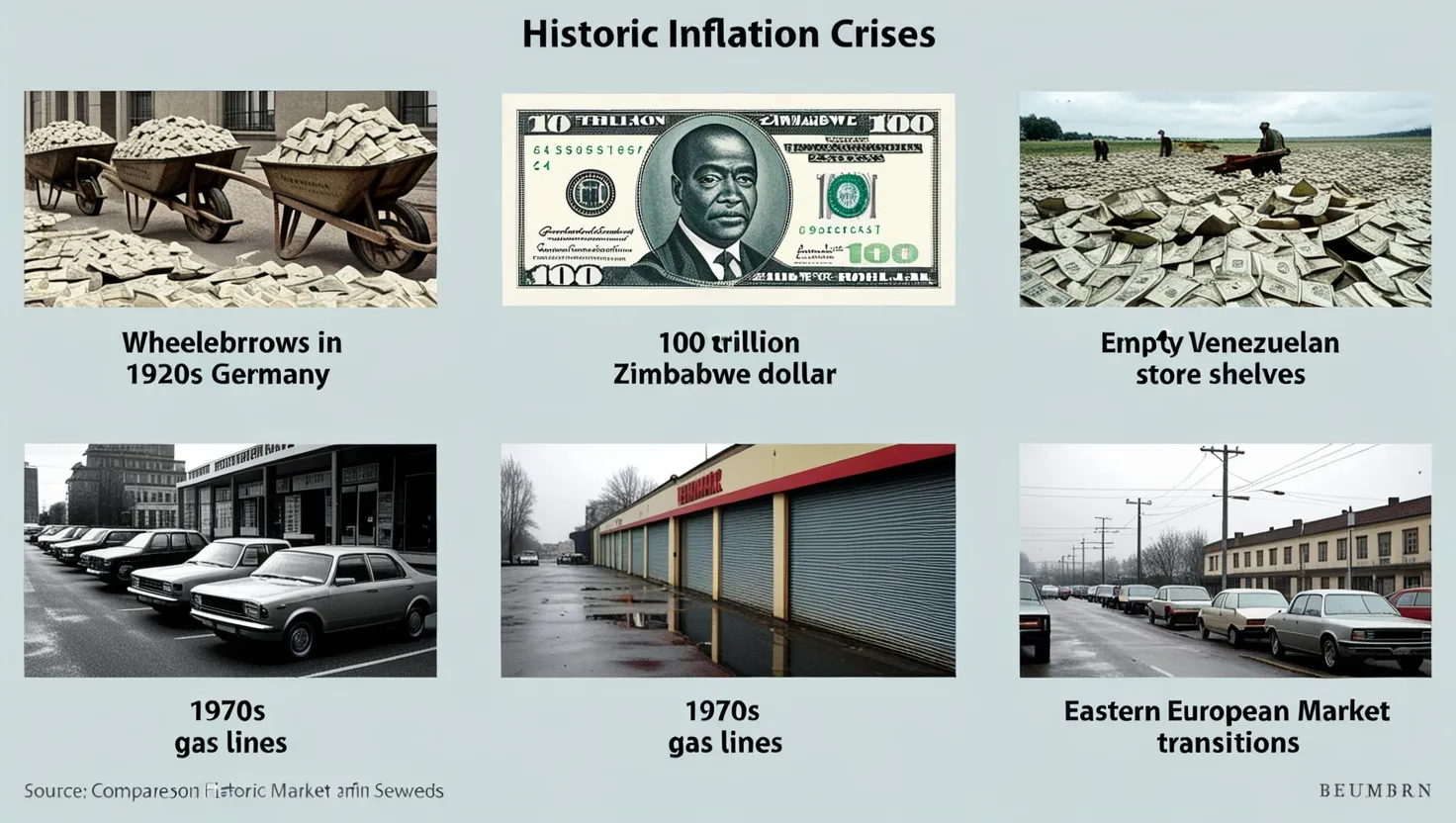

Historically, currency wars have not been kind to stock markets. During the 1930s, the Great Depression saw a series of competitive devaluations that exacerbated economic conditions. More recently, the periods of US dollar strength from January 2022 to October 2022 and again from July 2023 to October 2023 corresponded with significant corrections in the S&P 500, highlighting the potential for a strong dollar to dampen global stock market performance.

Sector-Specific Impacts

The impact of currency wars is not uniform across all sectors. Some sectors, like defense and energy, can actually benefit from the uncertainty and instability that comes with geopolitical tensions. For example, during the anticipation of war with Iraq, the gold and energy sectors saw a boost as investors sought safer havens. However, sectors like consumer discretionary, airlines, and IT tend to suffer as consumer confidence wanes and global trade becomes more uncertain.

Regional Impacts

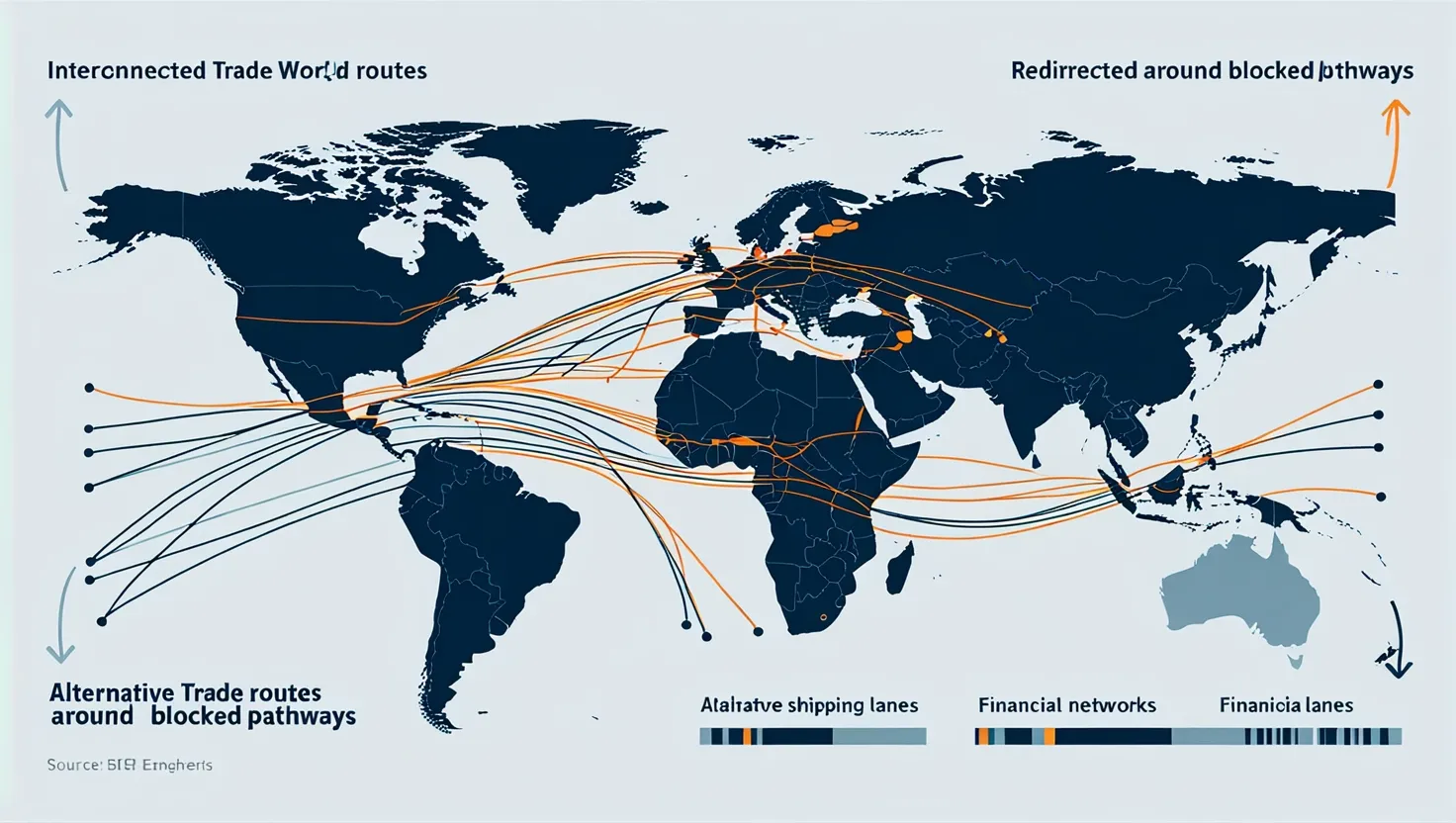

The effects of currency wars and geopolitical tensions are not limited to the US market. Asian stock indices, particularly those in China, South Korea, and Taiwan, are highly sensitive to currency fluctuations. A weakening yuan can lead to significant downside pressure on these markets, as seen in the recent movements of the MSCI Asia Pacific ex Japan exchange-traded fund.

Investor Behavior

Investors often react impulsively to the news of currency wars or geopolitical conflicts. There's a tendency to move towards safer assets like gold, bonds, or currencies perceived as safe havens. However, history suggests that these reactions are often short-lived. For instance, after Russia invaded Ukraine in February 2022, the S&P 500 fell sharply but rebounded to pre-invasion levels within a month. This pattern of initial sell-off followed by a quick recovery is a common theme in many geopolitical crises.

Economic Uncertainty

One of the key factors that influence market reactions is the level of economic uncertainty. Wars and currency wars introduce a high degree of unpredictability, which markets generally dislike. This uncertainty can lead to sharp sell-offs, but it also means that markets can recover quickly once the situation stabilizes or the scope of the conflict becomes clearer.

Government Spending and Defense

Government spending, particularly on defense, can also play a significant role in how markets react. During wartime, defense spending can stimulate certain sectors of the economy, such as defense contractors and infrastructure. This can lead to positive market performance in some cases, even amidst broader economic uncertainty.

Long-Term Effects

While the immediate effects of currency wars and geopolitical conflicts on stock markets can be dramatic, the long-term impact is often less severe. Historical data shows that stock markets have a remarkable ability to recover from major shocks. For example, during World War II, the Dow Jones Industrial Average rose by 50% from 1939 to 1945, despite the war's devastating impact on the global economy.

Personal Touches and Lessons

As an investor, it's crucial to keep a level head during times of geopolitical turmoil. It's easy to get caught up in the headlines and make impulsive decisions, but history teaches us that markets tend to recover quickly. I recall the period after the Russian invasion of Ukraine, where the initial panic gave way to a swift recovery. This experience taught me the importance of sticking to my investment process and not letting short-term volatility dictate long-term decisions.

Conclusion

In the complex world of finance, the interplay between currency wars and stock markets is a delicate balance of power and uncertainty. While the immediate impacts can be significant, it's the long-term resilience of markets that should give investors hope. By understanding the historical context, sector-specific impacts, and the role of government spending, investors can navigate these turbulent times with greater confidence. As we move forward in an increasingly interconnected world, staying informed and adaptable will be key to weathering the storms of currency wars and geopolitical conflicts.