The Indian banking sector has long been the backbone of the country's economic framework, fueling growth across industries. However, it wasn't without its Achilles' heel, a mounting pile of non-performing assets (NPAs) and a cumbersome process for handling insolvencies and bankruptcies. The introduction of the Insolvency and Bankruptcy Code (IBC) in 2016 marked a pivotal shift, bringing with it a promise to cleanse the banking system of its stressed assets and streamline the process of resolving insolvencies. The IBC was designed to consolidate all existing frameworks into one cohesive law aimed at speeding up and simplifying the recovery process. By doing so, it not only aimed to help banks recover bad loans more efficiently but also played a crucial role in improving the ease of doing business in India, reshaping the landscape for creditors, investors, and business entities alike.

The need for a robust mechanism like the IBC became increasingly apparent in the wake of high-profile financial failures, with Kingfisher Airlines serving as a particularly stark example. Once a giant in the Indian aviation sector, Kingfisher's downfall began with its inability to pay back loans amounting to thousands of crores, culminating in its bankruptcy. This case highlighted the systemic issues in the banking sector—primarily, the inefficiency of the then-existing legal framework to handle such defaults effectively and timely.

Kingfisher was not an isolated case. Around the same period, several other major defaults shook the Indian economy, involving significant sums of money and prominent companies. These incidents exposed the vulnerabilities of the Indian banking system, where defaults on such a massive scale led to severe liquidity crunches, affecting the overall financial stability of the country. The ripple effects were felt across the market, leading to job losses, dips in shareholder value, and a diminishing trust in the banking system.

These scenarios underscored an urgent need for reform. The IBC was envisioned as a reformative tool to address these challenges head-on, ensuring that financial failures could be managed in a way that minimized losses and preserved economic value. By introducing a structured and time-bound insolvency resolution process, the IBC has since been instrumental in reshaping how bankruptcy and insolvency are handled in India, marking a new era for Indian banking and business operations.

Understanding IBC

The Insolvency and Bankruptcy Code (IBC) was enacted in 2016 as a comprehensive economic reform designed to consolidate all existing insolvency-related laws into one single law to address insolvency and bankruptcy in India. The primary purpose of the IBC is to provide a legal framework that can swiftly and effectively handle the resolution of insolvencies, which had previously been a prolonged process fraught with complexities. By simplifying and expediting the insolvency process, the IBC aims to improve the ease of doing business, enhance creditor recoveries, and boost investor confidence in the Indian market.

The IBC has had a significant impact on the Indian economy, most notably by saving approximately 3.16 lakh crores for the banking sector since its implementation. This figure represents the amount recovered from defaulted loans that were previously considered likely losses due to the inefficiency of the old systems. The ability to recover such substantial amounts has directly contributed to stabilizing the banking sector by improving their balance sheets and reducing the volume of non-performing assets (NPAs).

Moreover, the IBC has played a crucial role in job preservation across various sectors. By facilitating quicker resolutions to insolvency cases, the IBC has helped many companies continue operations rather than shutting down. Continuity of business operations not only saves jobs but also sustains market competition and service delivery, contributing to overall economic stability.

Another significant impact of the IBC is on the broader economy. The code has instilled a structured and disciplined framework for financial distress resolution, which has enhanced the predictability of outcomes in these cases. This predictability, coupled with the expedited process, has improved India's ranking in the World Bank's Ease of Doing Business index, particularly in the parameter of resolving insolvency. The reformed insolvency process has also attracted foreign investment, as global investors often seek markets with robust legal frameworks for insolvency resolution.

The cumulative effect of improved recoveries, job preservation, and enhanced investor confidence has bolstered the Indian economy, making it more resilient and dynamic. The IBC's framework ensures that financial failures and insolvencies can be managed efficiently, thereby mitigating their potential negative impacts on the economy. This proactive approach to handling insolvency has not only saved a significant amount of money but has also protected the economy from potential shocks and instabilities that large-scale defaults and insolvencies could bring.

Why IBC?

Kingfisher Airlines

Kingfisher Airlines serves as a prominent example of how significant defaults can severely impact the banking sector. The airline accumulated a massive debt, which it failed to repay, leading to its bankruptcy. This bankruptcy highlighted critical flaws in India's previous insolvency systems, which were sluggish and ineffective, allowing such defaults to severely damage the financial ecosystem. The case underlined the urgent need for a mechanism that could handle such collapses more efficiently, eventually leading to the formulation and implementation of the IBC. By the time IBC was established, Kingfisher's bankruptcy had already become a cautionary tale of insufficient regulatory measures and their consequences on the economy.

Nirav Modi Scandal

The Nirav Modi scandal involved a massive bank fraud where huge sums were siphoned off through fraudulent transactions with one of India's largest banks. This case exposed the gaps in risk management and corporate governance within banks and highlighted how deeply systemic issues could run without adequate checks. While the IBC primarily deals with insolvency and bankruptcy, its framework strengthens the overall financial and credit structure by ensuring quicker resolution processes and better recovery methods. In scenarios like the Nirav Modi fraud, where massive defaults follow fraudulent activities, IBC can expedite the process of recovering dues and stabilize the financial market more promptly than previous systems.

Go First

The case of Go First is particularly illustrative of the IBC's potential to not only resolve insolvencies but also aid in business continuity. Faced with financial difficulties, Go First filed for bankruptcy. Under the IBC framework, rather than leading to the airline's liquidation, the process allowed for a reorganization of its debts and operations to keep the business running. This aspect of IBC not only helps in saving jobs but also ensures that the business can attempt to regain stability and profitability through structured and controlled measures. The ability to keep the airline operational, despite its financial troubles, demonstrates IBC's flexibility and effectiveness in handling complex insolvency scenarios while minimizing economic disruption.

Mechanism of IBC

We will keep this for an another day. We wil explore the IBC and its inner workings in an another episode.

Current Challenges and Future Outlook

Challenges

Increasing Duration of Insolvency Processes: One of the primary challenges faced by the IBC framework is the increasing duration of the insolvency resolution process. Initially, the IBC mandated a maximum timeframe of 330 days for completing the resolution process, including any legal challenges.

Decline in Recovery Rates: Initially, the IBC improved recovery rates significantly, but recent trends have shown a decline, with recovery rates falling to an average of 32%. This decline is largely due to the overcrowded legal system and the lack of experienced judges to handle complex bankruptcy cases.

Future Outlook

The future of IBC looks promising despite the current challenges, as the government and judiciary are aware of these issues and are making efforts to address them. Continuous refinement of the IBC, based on empirical data and stakeholder feedback, will be crucial. Furthermore, the global economic environment and India’s position as an attractive investment destination will also influence how insolvency resolutions evolve. With targeted reforms and a focus on enhancing judicial and infrastructural capabilities, the IBC can continue to be a cornerstone of India’s economic framework, ensuring that it remains effective in managing insolvencies and contributing to the overall economic health of the country.

Summary

The Insolvency and Bankruptcy Code, implemented in 2016, was designed to streamline the process of resolving insolvencies in India, enhancing the ease of doing business and aiding in the efficient recovery of bad loans. The IBC consolidates previous insolvency laws into a single framework, offering a structured, time-bound process for resolving financial failures.

The IBC has significantly impacted the Indian economy, saving approximately ₹3.16 lakh crores in banking and preventing massive job losses. High-profile cases like Kingfisher Airlines and the Nirav Modi scandal underscored the need for such a framework. The Go First case exemplified how businesses could remain operational during insolvency proceedings, preserving jobs and economic value.

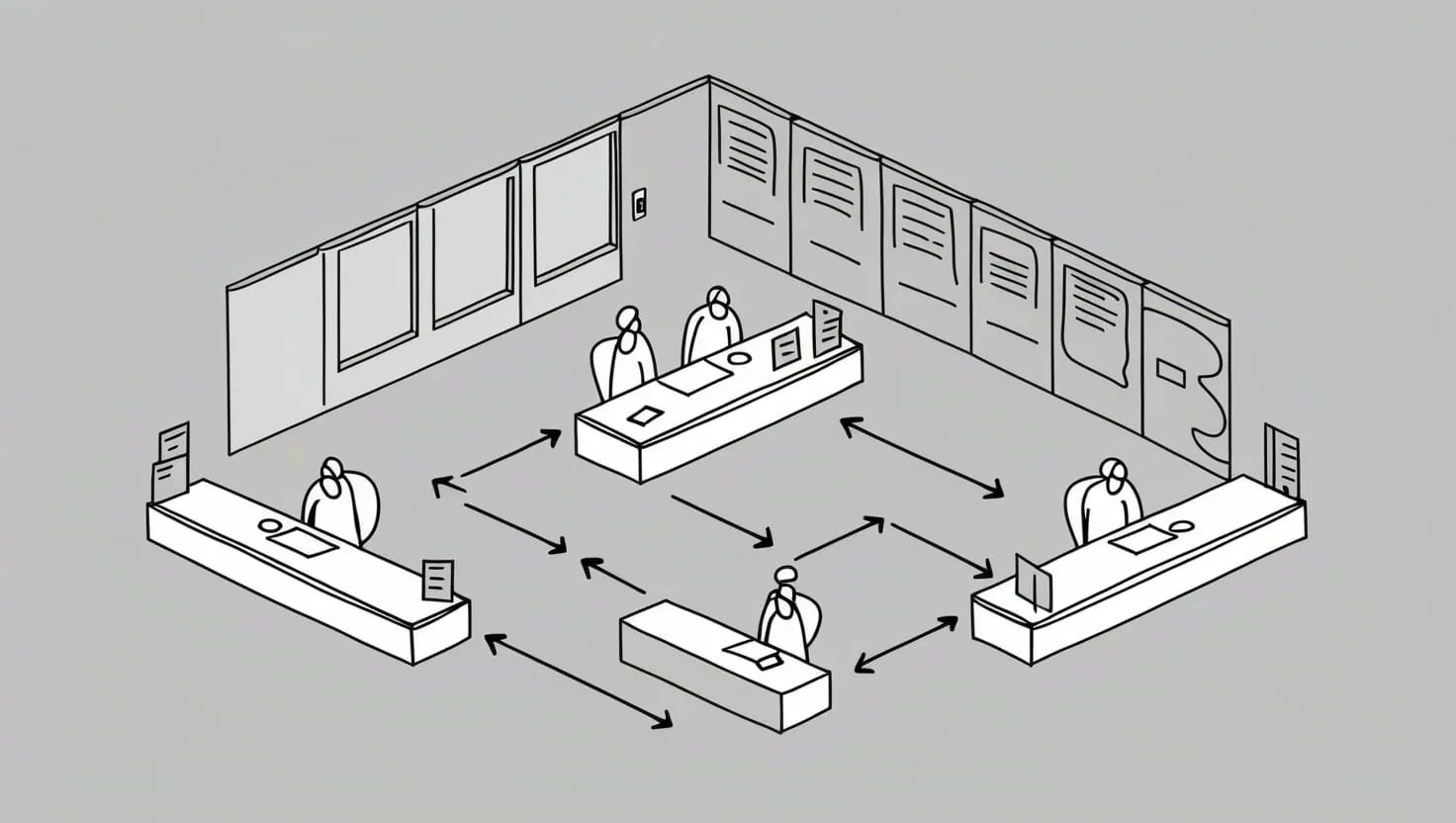

The IBC process begins with an initiation phase, usually triggered by creditors or the debtor itself, leading to a moratorium and the appointment of an Insolvency Professional (IP) who takes over the company's management. This is followed by the formation of a Committee of Creditors (CoC), the drafting and approval of a resolution plan, and, if necessary, liquidation.

Key roles include the Insolvency Professional, who manages the debtor during the process, and the Committee of Creditors, which makes crucial decisions on the resolution plans and future of the debtor. The existing management of the debtor is usually suspended to prevent interference and protect assets.

The IBC faces challenges such as prolonged resolution times, which average about 653 days, and a decline in recovery rates, now averaging 32%. Opportunities for improvement include enhancing judicial efficiency, streamlining procedures, integrating technology, promoting out-of-court settlements, and developing a market for distressed assets.

Despite challenges, the IBC's future is promising with ongoing adjustments and reforms aimed at addressing judicial bottlenecks and procedural inefficiencies. Continued enhancements will help maintain the effectiveness of the IBC in managing insolvencies and supporting India's economic health.