The insurance landscape in India is undergoing a seismic shift, propelled by a series of groundbreaking regulatory changes. These reforms are set to reshape the industry, promising to boost insurance penetration, enhance consumer protection, and foster market competition. Let’s explore these transformative measures and their far-reaching implications.

Imagine a construction site bustling with activity, workers toiling under the scorching sun to build a massive infrastructure project. Now, picture a scenario where the contractor suddenly abandons the project, leaving it in limbo. This is where surety bonds step in as a game-changer. These financial instruments, recently introduced by the Insurance Regulatory and Development Authority of India (IRDAI), serve as a safety net for infrastructure projects. They guarantee that the contractor will fulfill their obligations, providing a much-needed boost of confidence to project owners and investors.

But what makes surety bonds so revolutionary? Unlike traditional bank guarantees, surety bonds don’t tie up the contractor’s working capital. This frees up crucial resources, allowing contractors to take on more projects and potentially accelerating infrastructure development across the country. It’s a win-win situation that could inject new life into India’s ambitious infrastructure goals.

“The introduction of surety bonds is like giving wings to our infrastructure dreams,” remarked a seasoned industry expert. “It’s a bold move that could unlock billions in investments and create millions of jobs.”

However, the implementation of surety bonds isn’t without challenges. Insurance companies will need to develop robust underwriting capabilities to assess the risks associated with complex infrastructure projects. This calls for a significant upskilling of the workforce and investment in advanced risk assessment tools.

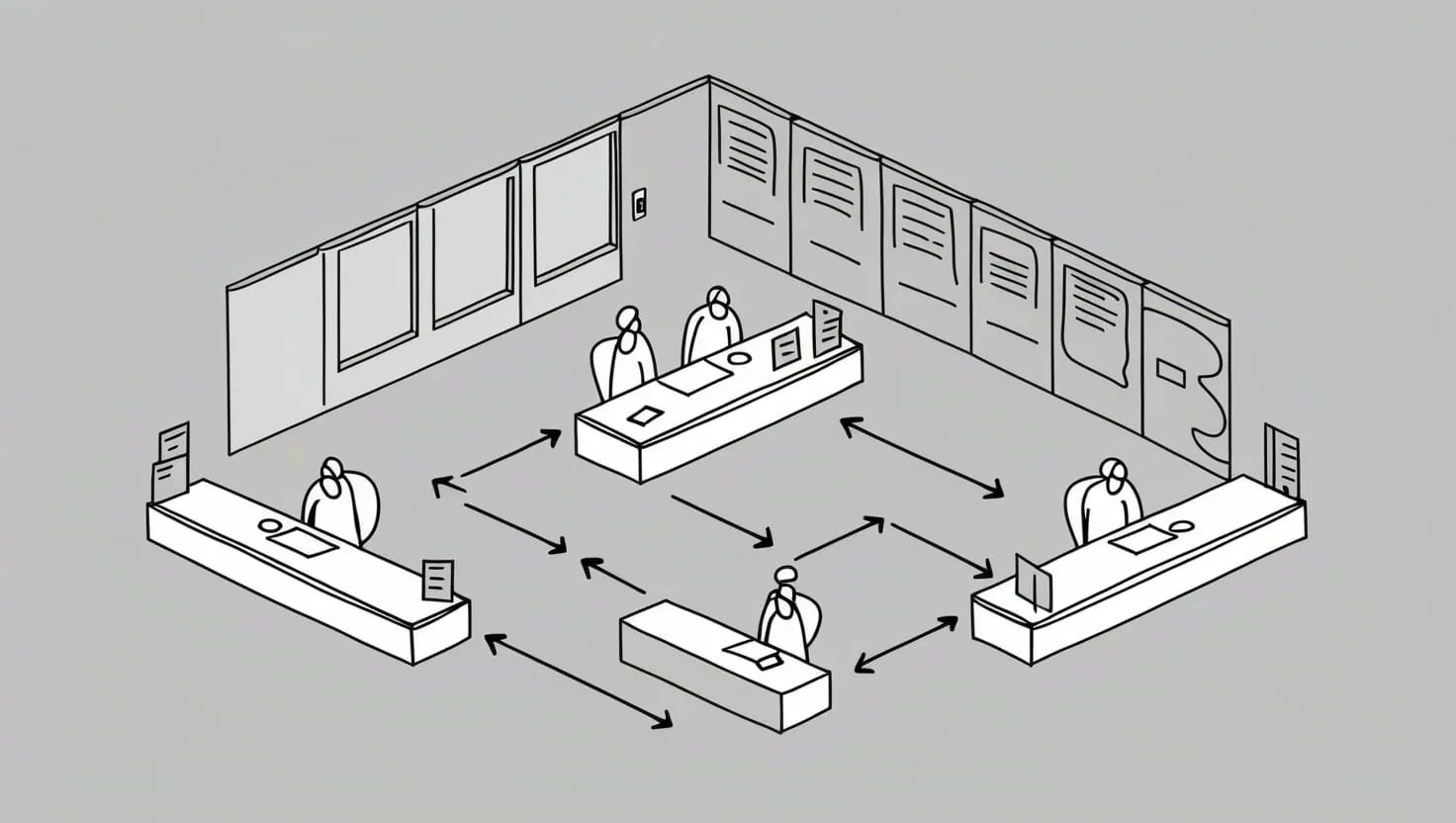

Moving on to another groundbreaking change, the IRDAI has introduced a composite license regime, allowing insurers to offer multiple insurance services under one roof. This move breaks down the traditional barriers between life, general, and health insurance, paving the way for more holistic and integrated insurance solutions.

Picture walking into an insurance office and being able to purchase life, health, and property insurance all in one go. Sounds convenient, doesn’t it? This is precisely what the composite license regime aims to achieve. It’s a customer-centric approach that could simplify the insurance-buying process and potentially lead to more comprehensive coverage for policyholders.

But what does this mean for the industry? For starters, it could spark a wave of consolidation as companies seek to expand their service offerings. We might see life insurers acquiring general insurance firms or vice versa, reshaping the competitive landscape. It also opens up opportunities for product innovation, with insurers potentially developing hybrid products that combine elements of different insurance types.

However, this change also raises important questions. How will insurers manage the different risk profiles associated with various insurance types? Will this lead to better risk management practices or create new vulnerabilities? These are challenges that the industry will need to grapple with as it adapts to this new reality.

“The composite license regime is like opening Pandora’s box,” mused a veteran insurance analyst. “It has the potential to revolutionize the industry, but it also brings a host of new challenges and opportunities.”

Shifting gears, let’s delve into the realm of investments. The IRDAI has introduced principal-based investment norms for insurance companies, moving away from the prescriptive approach of the past. This change gives insurers more flexibility in managing their investment portfolios, potentially leading to better returns and stronger financial positions.

Under the new norms, insurance companies have greater freedom to invest in a wider range of assets, including alternative investment funds and real estate investment trusts. This could lead to more diversified portfolios and potentially higher returns, which could translate into better value for policyholders.

But with greater freedom comes greater responsibility. How will insurers balance the need for higher returns with the imperative of maintaining financial stability? Will this lead to more sophisticated risk management practices or expose the industry to new risks?

These are questions that regulators and industry players will need to grapple with as they navigate this new investment landscape. It’s a delicate balancing act that could shape the financial health of the insurance sector for years to come.

Another significant change comes in the form of revised expense management regulations. The IRDAI has relaxed the caps on management expenses for insurers, giving them more flexibility in how they allocate their resources. This could potentially lead to increased investments in technology, distribution networks, and customer service.

But what does this mean for policyholders? On one hand, it could lead to improved services and more innovative products. On the other hand, there are concerns that it might result in higher premiums if insurers pass on increased costs to customers. The key will be in how insurers leverage this flexibility to create value for both their shareholders and policyholders.

“Expense management is the unsung hero of insurance operations,” noted a seasoned insurance executive. “These changes could be the catalyst for a new era of efficiency and innovation in the industry.”

Last but not least, we come to the technological revolution sweeping through the insurance sector. The IRDAI has been actively promoting the use of technology in claim settlements and underwriting, aiming to make these processes faster, more accurate, and more transparent.

Imagine filing an insurance claim and receiving the settlement within minutes, all through a mobile app. Or picture an underwriting process that uses artificial intelligence to assess risks more accurately, leading to fairer premiums. These are not distant dreams but imminent realities in India’s insurance sector.

The use of technology in insurance operations promises to revolutionize the customer experience, making insurance more accessible and user-friendly. It could also lead to more personalized insurance products, with premiums tailored to individual risk profiles.

However, this technological transformation also raises important questions about data privacy and security. How will insurers protect the vast amounts of personal data they collect? How will they ensure that AI-driven underwriting doesn’t lead to unfair discrimination?

As we navigate these changes, it’s clear that the Indian insurance sector is on the cusp of a major transformation. These regulatory reforms have the potential to make insurance more accessible, affordable, and relevant to the needs of India’s diverse population.

But success is not guaranteed. It will depend on how effectively these changes are implemented, how quickly the industry adapts, and how well the interests of all stakeholders are balanced.

As we look to the future, one question looms large: Will these changes truly democratize insurance in India, making it a universal financial safety net? Or will they create new challenges and inequalities?

The answer lies in the collective efforts of regulators, insurers, and policyholders. It’s a journey that promises to be as challenging as it is exciting, filled with opportunities to redefine what insurance means in the world’s largest democracy.

In the words of a visionary insurance leader, “We stand at the threshold of a new era in Indian insurance. The choices we make today will shape the financial security of millions for generations to come.”

As we conclude this exploration of India’s evolving insurance landscape, I invite you to ponder: How do you envision the future of insurance in India? What changes would you like to see to make insurance more relevant and accessible in your life?

The stage is set for a revolution in Indian insurance. The question is, are we ready to seize this moment and create an insurance ecosystem that truly serves the needs of a billion-plus people? Only time will tell, but one thing is certain – the journey promises to be nothing short of extraordinary.