Managing your finances through life’s transitions is a complex and often overwhelming task, but it’s a crucial part of ensuring your financial stability and peace of mind. Whether you’re facing a divorce, the loss of a spouse, a career change, or preparing for retirement, these transitions can be both emotionally and financially challenging.

When you’re in the midst of a major life change, it’s easy to feel like everything is out of control. However, taking a step back to review and adjust your financial plan can make a significant difference. This is where working with an experienced financial professional can be invaluable. They can provide objective advice and help you navigate the complex financial landscape, coordinating with your attorneys, accountants, and other professionals to ensure you’re making informed decisions.

Creating a detailed financial plan is essential during these times. This plan helps you assess your current situation, set realistic goals, and outline the steps you need to take to achieve them. For instance, if you’re going through a divorce, you’ll need to consider the financial implications of maintaining two separate households, which could double your mortgage or rent expenses. If a stay-at-home parent is returning to work, you’ll need to factor in childcare costs. Re-evaluating your budget and trimming non-essential expenses can help you get a clearer picture of where your money is going.

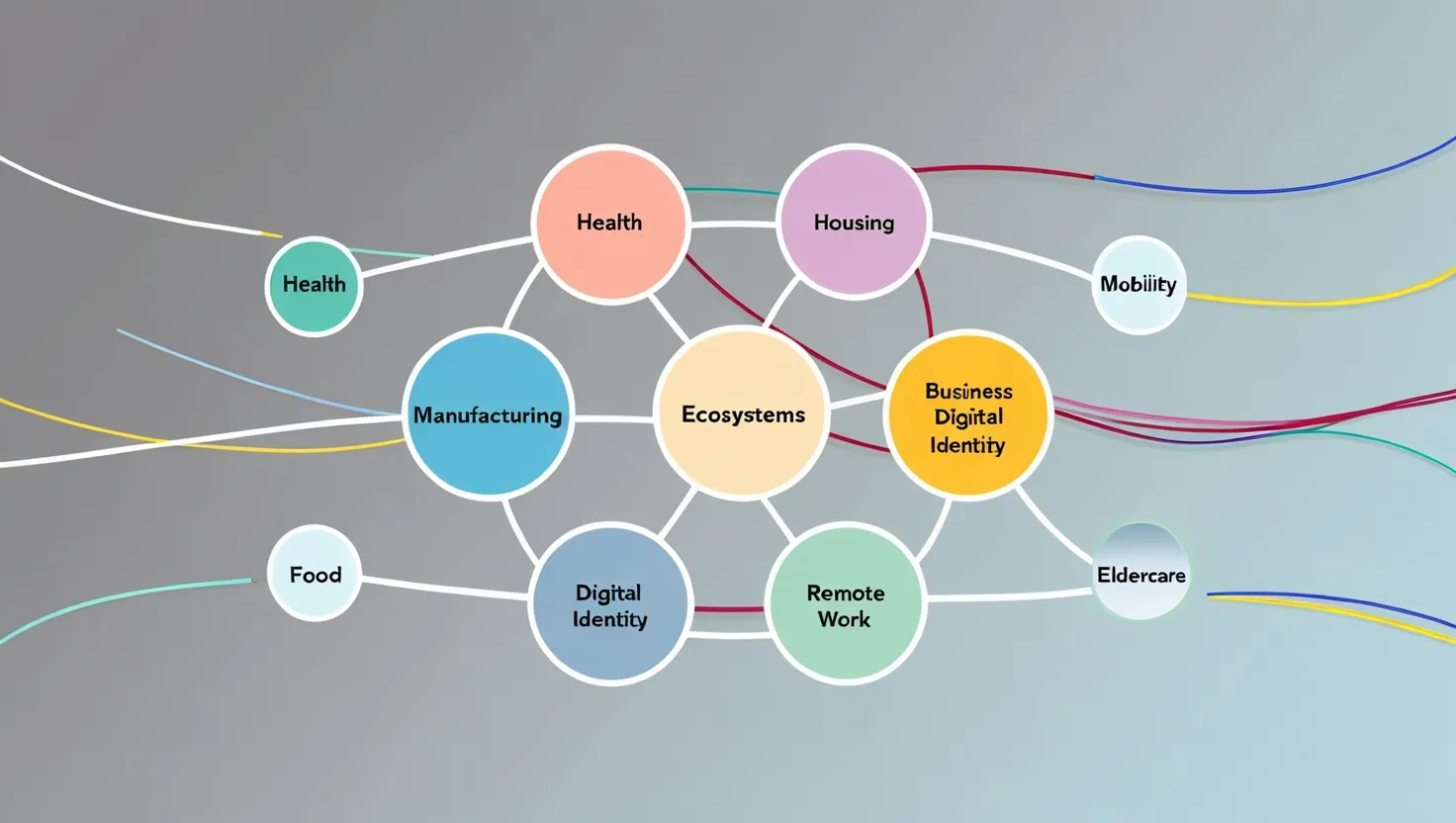

Maximizing your assets is another critical aspect of managing financial transitions. Events like divorce or the death of a spouse can have significant financial ramifications, such as insurance payouts, alimony payments, or strategic investments. Understanding your cash flow and where your income will come from in this new reality is key to smoothing out the transition.

Insurance coverage is another area that often needs attention during life transitions. If your insurance policies were in your ex-spouse’s name or tied to your previous job, you’ll need to ensure you have proper coverage. This includes health insurance, which you might need to secure through COBRA or the health care exchange. Having some liquidity is also important; you don’t want all your funds tied up in investments or retirement plans that are difficult to access without penalties.

It’s important to recognize that there’s no “perfect time” for making major transitions. Sometimes, you have to make decisions based on mental, physical, and emotional needs rather than purely financial ones. For example, if you’re desperate to leave your current job for health reasons, you might not have the ideal amount of savings or a new job lined up. This is okay, and it’s crucial to prioritize your well-being while still making financially sound decisions.

One strategy that can be particularly helpful during financial transitions is the “Six Month No Decision Zone.” This involves giving yourself permission to withhold long-term decisions for a period of time, usually six months, to allow yourself to adjust to the new circumstances without making rash decisions. During this time, you can still start planning and addressing immediate needs, such as cash flow strategies and securing health insurance.

Career transitions, whether voluntary or involuntary, also require careful financial planning. When changing jobs, you need to consider immediate needs like health care coverage and short-term cash needs. You might need to develop a budget if you haven’t had one before, focusing on the big-ticket items like housing and transportation costs. Managing debt carefully during this time is also important; options like a Securities Based Line of Credit can be more favorable than other forms of financing.

Tax planning is another area that deserves attention during career transitions. Ensuring adequate withholding on severance pay and managing stock options or employee stock purchase plans can help you avoid unexpected tax burdens. For instance, if you’re in a higher marginal tax bracket in the year you leave your job, you’ll want to plan your income taxes carefully to minimize your tax liability.

The transition from employment to retirement is another significant life change that requires careful financial planning. This period can be marked by a change in daily routine, social interactions, and financial stability. While some people look forward to retirement as a time of relaxation, others may worry about losing their sense of purpose and identity. Understanding how to navigate this transition is crucial for a fulfilling retirement.

Financial independence is a key aspect of adulthood, and it involves more than just securing a job. It means managing personal finances, making decisions about savings and investments, and ensuring you can sustain yourself financially. This is particularly important during transitions, as it helps you maintain stability and make informed financial decisions.

Life transitions also offer an opportunity for self-reflection and personal growth. As you embark on a new chapter, consider what you’ve learned from your past experiences and how they’ve shaped your values and aspirations. This reflection can help you align your new path with your true purpose and ensure that your financial decisions support your long-term goals.

Evaluating the risks and rewards of any transition is essential. Whether you’re changing careers or preparing for retirement, there will be some level of financial uncertainty. Creating a contingency plan, setting realistic expectations, and analyzing your financial situation can help mitigate these risks.

The cultural and generational influences on financial approaches to life transitions are also worth considering. Financial norms and expectations are evolving rapidly, and understanding these changes can provide rich insights into how different people manage their finances during various life stages. For example, younger generations may have different attitudes towards debt, savings, and investments compared to older generations.

Ultimately, managing finances during life transitions is about adaptability and continuous learning. It’s an ongoing process that requires regular reassessment and adjustment. By staying informed, seeking professional advice when needed, and being proactive about your financial planning, you can navigate these transitions with greater ease and confidence.

This approach to financial management strikes a balance between providing practical advice and offering a holistic view of how finances intertwine with life’s journey. It’s a narrative that can engage readers on both an intellectual and emotional level, making it a compelling subject for anyone interested in personal finance, leadership, productivity, and time management.

Whether you’re just starting your career, planning a family, or approaching retirement, the insights gained from understanding the financial choreography of life transitions can be invaluable. It’s about learning to adapt, to plan, and to make informed decisions that support your financial health and overall well-being. By embracing this mindset, you can turn what might seem like overwhelming challenges into opportunities for growth and financial stability.