The Psychology of Money

Welcome to our Summary Series, where we offer concise overviews of books with a focus on personal finance for our subscribers. This series is designed to give a snapshot of the book's content and should not be considered a replacement for the enriching experience of reading the book in its entirety. We highly recommend reading the full text to grasp the author's complete ideas and concepts, using this summary merely as a supplementary reference.

Continuing from Part 1, 2 & 3, you can find the discussions through the link below.

Summary Series: Deciphering the Psychology Behind Money - 1

Summary Series: Deciphering the Psychology Behind Money - 2

Summary Series: Deciphering the Psychology Behind Money - 3

Room for Error

The Margin of Safety

"Room for Error" discusses the importance of incorporating a margin of safety in financial planning. This concept is about having a buffer in your financial strategies to protect against unexpected events and errors in judgment.

The section explains that no matter how confident you are in your financial decisions, there's always a chance of something going wrong. This could be due to changes in the market, unforeseen personal circumstances, or just simple mistakes. The margin of safety is essentially a cushion that helps you absorb these shocks without major damage to your overall financial health.

Housel emphasizes that this margin isn't just a financial tactic but also a mindset. It involves being cautious and recognizing the limits of your knowledge and control. By planning for potential errors and downturns, you're less likely to be caught off guard and forced into difficult situations.

The narrative also discusses the balance between being overly cautious and taking necessary risks. While it's important to have a safety net, being too risk-averse can also hinder financial growth. The key is to find a balance that allows for growth while still protecting against significant losses.

In essence, "Room for Error" advocates for a prudent approach to financial planning, where you prepare for the best but also plan for the worst. This balance helps in maintaining financial stability and peace of mind in an unpredictable world.

You'll Change

Adapting Financial Plans

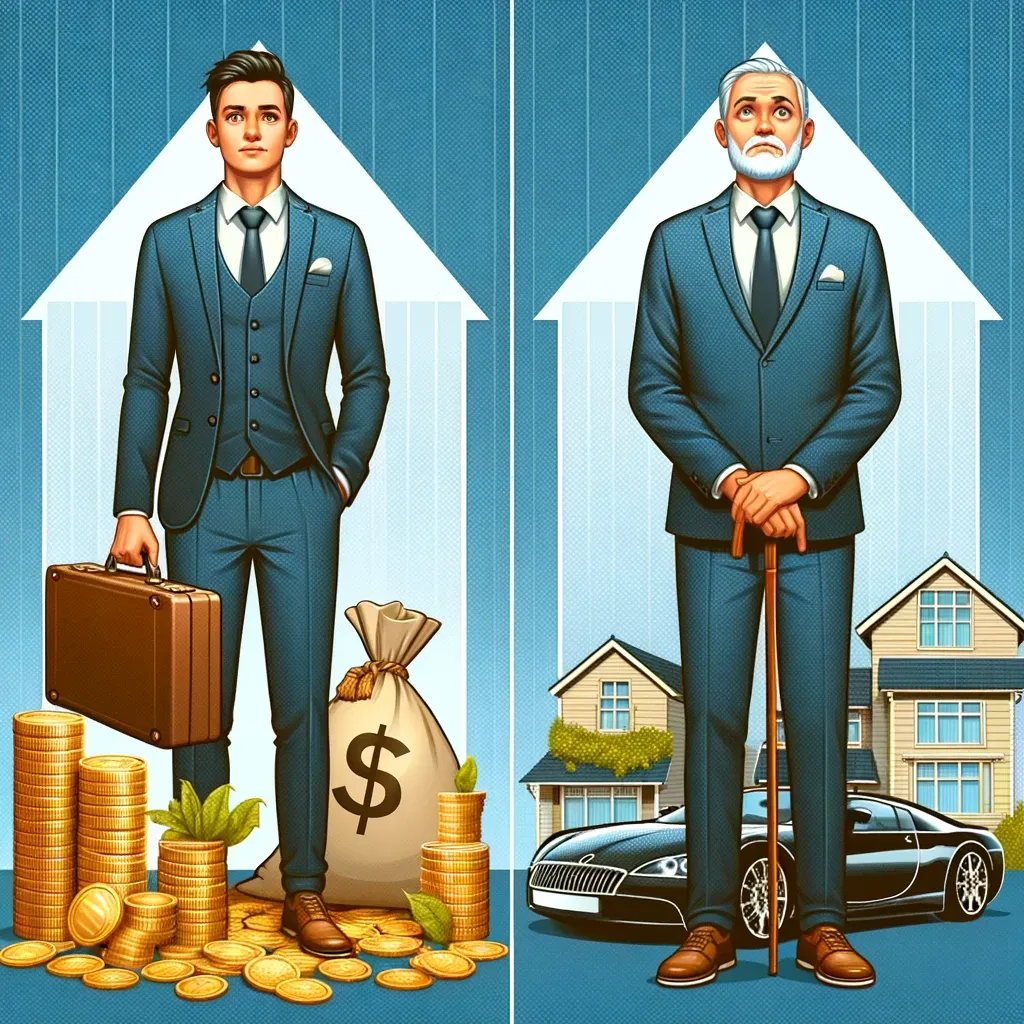

In "You'll Change," the focus is on the inevitability of personal and financial change over time. The section highlights how individual goals, circumstances, and risk tolerance can evolve, necessitating adjustments in financial strategies.

The book underscores that the financial plan that suits you today might not be appropriate in the future. As people go through different life stages, their priorities and financial needs often shift. For example, the financial approach suitable for a single person in their 20s may not be fitting when they are older, possibly with a family and different financial responsibilities.

Housel encourages readers to anticipate and plan for these changes. He suggests regularly revisiting and revising financial plans to ensure they align with current needs and goals. This process involves reassessing risk tolerance, investment choices, and savings goals at different life stages.

The narrative also addresses the psychological aspect of adapting to change. It points out that being flexible and open to modifying financial plans is crucial for long-term financial well-being. Adapting to change also means being willing to learn from experiences and adjust one's approach accordingly.

Overall, "You'll Change" is a reminder of the dynamic nature of personal finance. It advocates for a proactive approach to financial planning, one that evolves and adapts to the changing contours of one’s life.

Nothing's Free

The Cost of Risk Taking

"Nothing's Free" delves into the inherent costs and trade-offs involved in taking financial risks. This section discusses how every financial decision, particularly those involving potential high returns, comes with its own set of risks and costs.

The book highlights that in the pursuit of higher returns, investors often have to accept higher levels of risk. These risks can include market volatility, potential loss of capital, and the emotional stress associated with uncertain investments. Housel emphasizes that understanding and accepting these trade-offs is crucial for making informed financial decisions.

The narrative also explores the concept that avoiding risk entirely also comes with a cost, such as the potential loss of purchasing power due to inflation or missing out on growth opportunities. Therefore, the author suggests finding a balance between taking on enough risk to achieve financial goals while not exposing oneself to undue stress and potential loss.

Housel stresses the importance of risk assessment and understanding one’s own risk tolerance. He advises that investors should not only look at the potential rewards of an investment but also carefully consider the risks and whether they are acceptable and manageable within the context of their overall financial plan.

In summary, "Nothing's Free" serves as a reminder that there are no guaranteed returns without risk in the world of finance. It encourages a thoughtful and balanced approach to risk-taking, one that aligns with individual financial goals, risk tolerance, and long-term strategies.

You & Me

Individual Financial Paths

In "You & Me," the book delves into the uniqueness of each individual's financial journey. This section emphasizes that personal finance is deeply personal, and what works for one person may not be suitable for another.

The narrative explores how financial strategies and decisions are influenced by a variety of factors, including personal values, income levels, family responsibilities, and long-term goals. Housel points out that because everyone's life situation is different, a one-size-fits-all approach to finance is ineffective.

This part of the book highlights the importance of tailoring financial plans to individual needs and circumstances. It encourages readers to consider their unique financial positions, including their risk tolerance, investment preferences, and future aspirations, when making financial decisions.

The author also discusses the dangers of comparing one's financial progress to others. He cautions against measuring success by others’ standards or milestones, as this can lead to misguided financial choices and unnecessary stress.

Ultimately, "You & Me" is a call for self-awareness and individualization in personal finance. It advocates for a customized approach to money management, one that respects the diversity of financial situations and goals. By recognizing and embracing the uniqueness of each financial journey, individuals can create more effective and satisfying financial plans.

Summary:

Room for Error - The Margin of Safety:

This section emphasizes the importance of including a margin of safety in financial plans. It's about having a buffer to protect against unexpected events and errors, balancing risk-taking with prudent financial management.

You'll Change - Adapting Financial Plans:

The book highlights that personal and financial goals evolve over time. It encourages regularly revising financial plans to align with changing life stages, priorities, and risk tolerance.

Nothing's Free - The Cost of Risk Taking:

This part delves into the costs and risks associated with financial decisions. It discusses the need to balance the pursuit of high returns with an understanding of the accompanying risks, emphasizing informed and balanced risk-taking.

You & Me - Individual Financial Paths:

The focus here is on the individuality of financial journeys. It underscores the importance of customizing financial strategies to personal circumstances and warns against comparing financial progress with others.