The FTSE 100, often referred to as the "Footsie" (Financial Times-Stock Exchange), is a stock market index that represents the performance of the 100 largest companies listed on the London Stock Exchange (LSE) by market capitalization. It's a widely recognized barometer of the UK stock market's health and an important index in the global financial landscape.

The FTSE 100 is composed of the top 100 companies listed on the LSE. These companies are selected based on their market capitalization, which is the total market value of a company's outstanding shares. The index is regularly reviewed to ensure it accurately reflects the most valuable companies in the UK market.

The index encompasses a diverse range of sectors, including finance, energy, consumer goods, health care, technology, and more. This diversity makes it a comprehensive indicator of the overall health of the UK economy.

Some of the major names in the FTSE 100 Index are Unilever, HSBC Holdings, BP, AstraZeneca, GlaxoSmithKline, British American Tobacco, Royal Dutch Shell, Vodafone Group, Diageo, Rio Tinto.

Investment Appeal of the FTSE 100 Constituents:

The attractiveness of the FTSE 100, especially in the current economic climate, can be attributed to a combination of macroeconomic conditions and specific financial metrics. Here's a breakdown:

Low Price-to-Earnings (PE) Ratios:

The FTSE 100 is currently exhibiting lower PE ratios compared to other major global indices.

A lower PE ratio can indicate that stocks are undervalued, presenting a potential opportunity for value investors.

Stable or Growing Earnings Per Share (EPS):

Despite economic uncertainties, many companies in the FTSE 100 have maintained stable or growing EPS.

This suggests resilience and potential for growth, making these stocks attractive for long-term investment.

Dividend Yields:

The FTSE 100 is known for its strong dividend yields, which are attractive in times of market volatility.

This provides an income stream for investors, adding to the index’s overall appeal.

Diverse Sector Representation:

The FTSE 100's diverse sector representation helps in risk mitigation, as not all sectors are equally affected by economic downturns.

Macro-Economic Conditions in the UK:

High Inflation: The UK is experiencing high inflation, leading to cautious spending and investment. However, this has also resulted in lower stock valuations, making some stocks potentially undervalued.

Interest Rate Fluctuations: The Bank of England's responses to inflation, primarily through interest rate adjustments, create a volatile environment, but also opportunities for investors.

Brexit Aftermath: Ongoing adjustments post-Brexit continue to influence the market, sometimes creating unique investment opportunities.

World Market

UK's Recession Fears

Nithin Bharadwaj • Dec 26, 2023

What Went Wrong? Brexit and Its Aftermath (2016 - Present): Uncertainty and Trade Disruptions: The 2016 referendum where the UK voted to leave the European Union led to significant economic uncertainty. This uncertainty impacted investment and trade as businesses grappled with the unknown future of the UK's relationship with its largest trading partner.

Read full story →Relative Underperformance:

Compared to other global indices like the S&P 500, Nikkei, Nifty or NASDAQ, the FTSE 100 has underperformed in recent years. This underperformance, however, might indicate that the market is undervalued, offering a good entry point for investors.

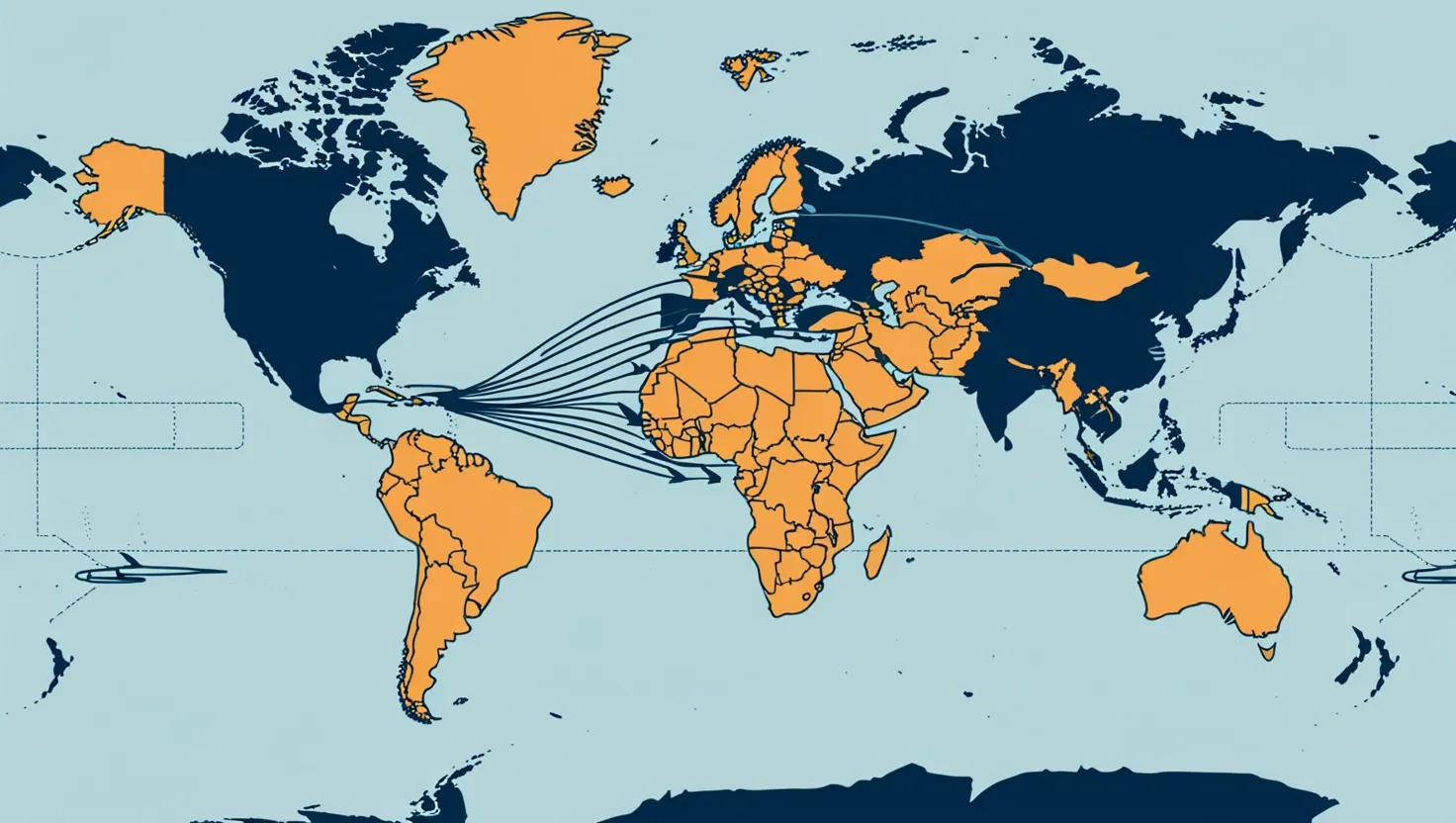

Global Exposure:

Many companies in the FTSE 100 have a significant global presence, offering exposure to international markets and potential for growth outside the UK.

Currency Fluctuations:

The value of the British Pound affects the FTSE 100. A weaker pound can benefit exporters and multinational companies in the index, potentially boosting their stock prices.

Government and Regulatory Policies:

Government policies in response to economic challenges, including fiscal stimulus or regulatory changes, can impact market sentiment and create investment opportunities.

Recovery Potential Post-Pandemic:

As the global economy recovers from the pandemic, War and inflation, sectors within the FTSE 100 that were heavily impacted could see a rebound, offering growth potential.

Comparative Global Analysis:

When conducting a Comparative Global Analysis between the FTSE 100 and other major global indices such as the S&P 500, NIFTY 50, and Nikkei 225, several key aspects come into play but we highlight just the mathematical ratios and leave the rest to the readers.

* If the data used is incorrect, please report

Author’s Take:

In our analysis, it becomes evident that the UK stock market, particularly the FTSE 100, presents a significant investment opportunity. This is especially notable when juxtaposed against other global indices and markets. Our findings indicate that several prominent UK companies, boasting robust revenue streams, minimal to zero debt, and promising future prospects, are currently trading at remarkably low Price-to-Earnings (PE) ratios, some as low as 4.0 and even beneath. These companies appear to be undervalued by as much as 70% in certain cases, according to our assessments.

It is important to note that we refrain from highlighting specific companies for this investment proposition. Instead, we encourage our readers to exercise their discretion and judgment in selecting which UK stocks or indices to invest in.

We advise potential investors to approach these opportunities with patience and a long-term perspective. The timeline for realizing growth in such investments is challenging to predict due to numerous macroeconomic factors at play. Historical precedents, such as the prolonged stagnation of Japan's stock market, which did not see recovery for over 30 years, stand as a testament to the potential volatility and unpredictability in financial markets.

Thus, we strongly recommend that investors proceed with caution and conduct thorough research before embarking on their investment journey. Ensuring a well-diversified portfolio is crucial to mitigate risks associated with such uncertain scenarios. This prudence and strategic planning are essential for navigating the complex and often unpredictable landscape of stock market investments