In today’s fast-paced financial landscape, the concept of “The Mindful Money Manager” is gaining significant traction, and for good reason. This approach to financial management is not just about numbers and budgets; it’s about integrating emotional intelligence, self-awareness, and a holistic view of wealth into your financial decisions.

When you think about managing your finances, you might immediately jump to spreadsheets, investment portfolios, and budgeting apps. However, the mindful money manager takes a step back and looks at the bigger picture. This involves understanding how your emotions and mindset influence your financial choices. In an increasingly complex financial world, managing stress and emotions is crucial. It’s no secret that financial decisions are often driven by emotions rather than logic, and this is where mindfulness comes into play.

Imagine having a tool that not only helps you track your monetary net worth but also quantifies your intangible investments. This is what the concept of a “Financial Selfie” offers. It’s a unique approach that catalogs your investments in areas such as gratitude, experience, mentorship, physical health, insights, community, knowledge, and skills. Each activity is assigned a value, reflecting its impact on your overall well-being and financial health. This method nurtures self-esteem and confidence while providing a clear narrative of your personal growth and financial empowerment.

The foundation of mindful money management is rooted in a positive and flexible mindset. Successful individuals in the financial realm often share a common trait: they have a powerful, positive mindset that allows them to navigate challenges with ease. This mindset is not just about being optimistic; it’s about being resilient and adaptable. It’s about recognizing that financial freedom is not a smooth sail but a journey with its ups and downs. By doubting your doubts and focusing on self-worth, gratitude, love, and service, you can build a strong foundation for your financial success.

One of the most significant benefits of this approach is its versatility. Whether you’re a professional in the financial industry or an individual looking to manage your personal finances better, the principles of mindful money management can be adapted to fit your needs. For professionals, this could mean innovating client relationships by offering more holistic and sustainable financial advice. It could involve moving away from the traditional high-pressure approaches that often lead to burnout and towards a more balanced, mindful strategy.

The challenge to “hustle culture” in finance is particularly timely. Many people feel overwhelmed by the constant pressure to perform and the endless pursuit of wealth. A mindful approach offers a refreshing alternative, one that emphasizes balance and sustainability over relentless hustle. This doesn’t mean you’ll be less successful; it means you’ll be more fulfilled and less stressed along the way.

Incorporating mindfulness into your financial routine can also enhance your productivity and time management skills. When you’re clear about your financial goals and the emotional drivers behind them, you make more intentional decisions. You prioritize what truly matters, whether that’s saving for a big purchase, investing in your education, or simply enjoying the present moment without financial anxiety.

Leadership in the financial sector can also benefit greatly from this approach. Leaders who practice mindfulness are better equipped to handle stress, make clearer decisions, and foster healthier team dynamics. By promoting a culture of mindfulness within their organizations, leaders can create a more supportive and productive work environment. This, in turn, can lead to better client outcomes and a more sustainable business model.

The practical value of mindful money management extends beyond just financial health; it impacts every dimension of your life. By recognizing the interconnectedness of your financial, emotional, and physical well-being, you can make choices that enrich your life in multiple ways. For instance, investing in your physical health can have long-term financial benefits, such as reduced healthcare costs and increased productivity.

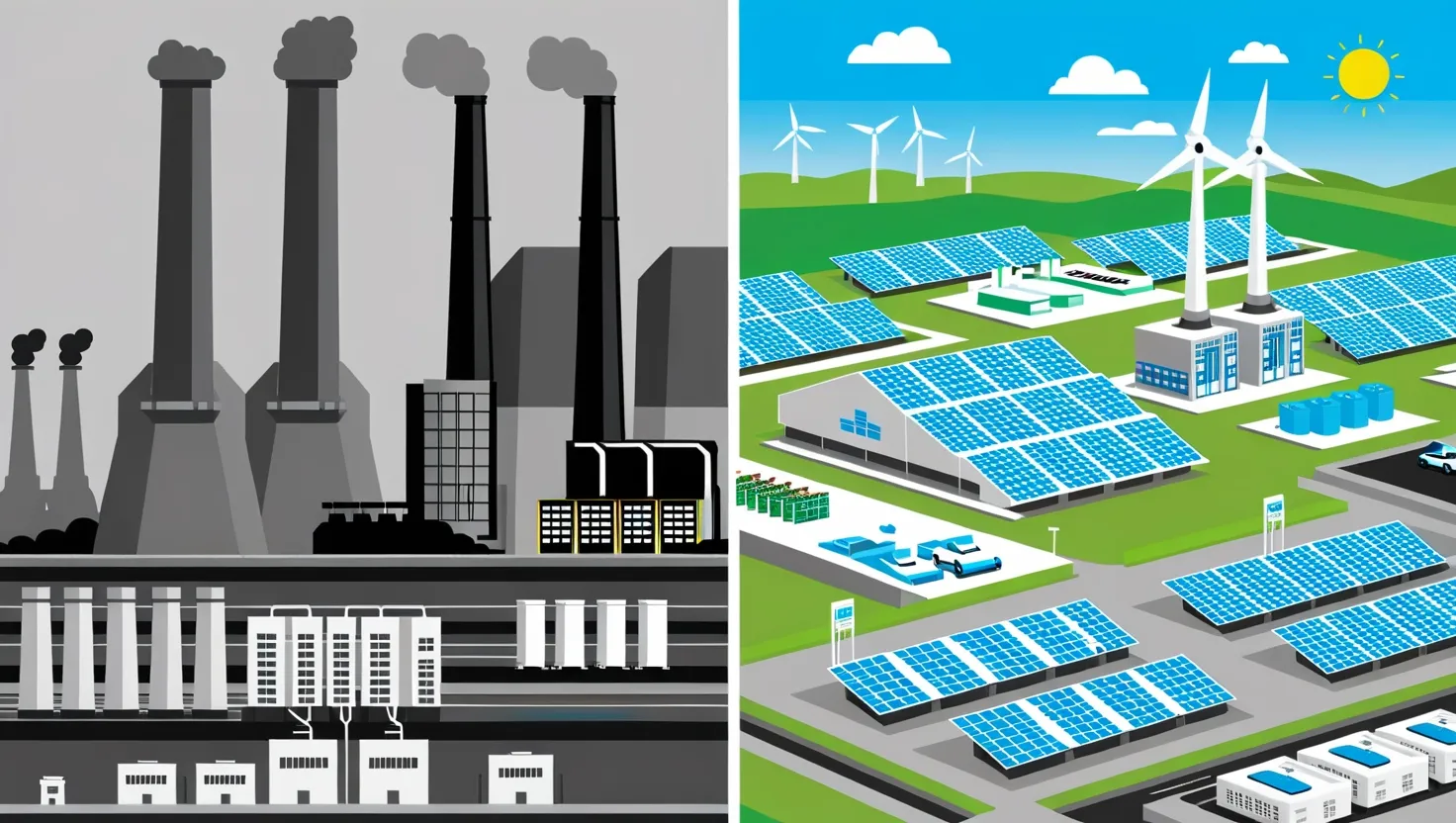

In an era where ethical and conscious investing are gaining traction, mindful money management aligns perfectly with these trends. It’s about making investments that not only grow your wealth but also contribute positively to society and the environment. This approach ensures that your financial decisions are not just profitable but also sustainable and responsible.

As you embark on this journey of mindful money management, remember that it’s a process. It’s about gradual changes and continuous learning. Start by taking small steps: practice mindfulness in your daily life, reflect on your financial goals, and begin to integrate emotional intelligence into your decision-making process.

The journey to financial freedom is not a solo endeavor; it’s one that benefits from community and support. Surround yourself with people who share your values and goals. Seek out resources and tools that help you stay on track, whether that’s through books, podcasts, or workshops.

In conclusion, the concept of “The Mindful Money Manager” is more than just a financial strategy; it’s a way of life. It’s about creating a balance between your financial health and your overall well-being. By embracing this approach, you’re not just managing your money; you’re enriching your life in every dimension. So, take the first step today, and watch how this mindful approach transforms your relationship with money and your journey towards financial freedom.