Market Bubbles: A Rollercoaster Ride Through Financial History

Hey there, finance enthusiasts! Ever felt like you're riding a financial rollercoaster? Well, that's exactly what market bubbles are all about. These wild economic phenomena have been popping up (and bursting) throughout history, leaving investors either grinning from ear to ear or crying into their empty wallets.

So, what's the deal with these bubbles anyway? Imagine you're at a party, and everyone's going crazy over a new dance move. Suddenly, it's all anyone can talk about, and people are even paying ridiculous amounts for dance lessons. That's kinda what a market bubble is like, but with money and investments instead of dance moves.

These bubbles aren't just your average market hiccups. They're more like those massive balloons you see at parades – they keep getting bigger and bigger until... pop! And when they burst, it's not just confetti that falls – it's people's life savings, dreams, and financial stability.

Now, you might be wondering, "How do these crazy bubbles even form?" Well, it's a perfect storm of factors. Picture this: the government's handing out money like it's candy on Halloween, interest rates are so low you'd think they're playing limbo, and everyone and their grandma is suddenly an investment guru. Mix that all together, and voila! You've got yourself a bubble cocktail.

But here's the kicker – it's not just about economics. Our brains play a huge role too. We humans are a funny bunch. We see our neighbors getting rich quick, and suddenly we're overcome with FOMO (that's Fear Of Missing Out, for you cool cats who aren't up on the lingo). We start throwing money at things we don't even understand, just because everyone else is doing it. It's like that time in high school when everyone started wearing those awful neon pants – we just couldn't help ourselves!

Remember the dot-com bubble? That was a wild ride. People were throwing money at any company with a ".com" in its name, even if their business plan was as solid as a chocolate teapot. Or how about the housing bubble? Folks were buying houses like they were going out of style, convinced that property values would keep soaring forever. Spoiler alert: they didn't.

So, how can you spot a bubble before it pops in your face? Well, it's not easy, but there are some signs. If you're hearing your Uber driver giving stock tips, or your hairdresser is suddenly a crypto millionaire, it might be time to raise an eyebrow. When everyone's talking about how the "old rules don't apply anymore," and how "this time it's different," that's usually a red flag bigger than a matador's cape.

But here's the real kicker – when these bubbles burst, it's not just a bit of air escaping. It's more like a nuclear explosion in slow motion. Remember 2008? Yeah, that wasn't fun for anyone (except maybe the guys who shorted the market and made a killing). Jobs disappeared, homes were lost, and the global economy took a nosedive that would make Olympic divers jealous.

So, what's an investor to do in this bubble-filled world? Well, one approach that's stood the test of time is value investing. It's like being the sensible shopper who waits for the sales instead of buying the latest gadget at full price just because it's trendy. Value investors look for companies that are like hidden gems – underappreciated but with solid foundations. It's not as exciting as riding the bubble wave, but it's a lot less likely to leave you broke and crying into your ramen noodles.

Let's take a stroll down memory lane and look at some of the most infamous bubbles in history. The Roaring Twenties? More like the Bursting Thirties, am I right? The stock market crash of 1929 led to the Great Depression, which was about as fun as it sounds. Fast forward to the late 90s, and we've got the dot-com bubble. Companies like Amazon were riding high, only to come crashing down harder than a skydiver without a parachute. Amazon's stock rose 21 times from 1998 to 1999, then plummeted 92% from 2000 to 2002. Talk about a wild ride!

Now, I know what you're thinking. "How can I avoid getting caught up in these bubble shenanigans?" Well, my friend, here's some advice that's worth its weight in gold (which, by the way, is also subject to bubbles):

First, keep your feet on the ground. If something sounds too good to be true, it probably is. Remember, there's no such thing as a free lunch, unless you're at your grandma's house.

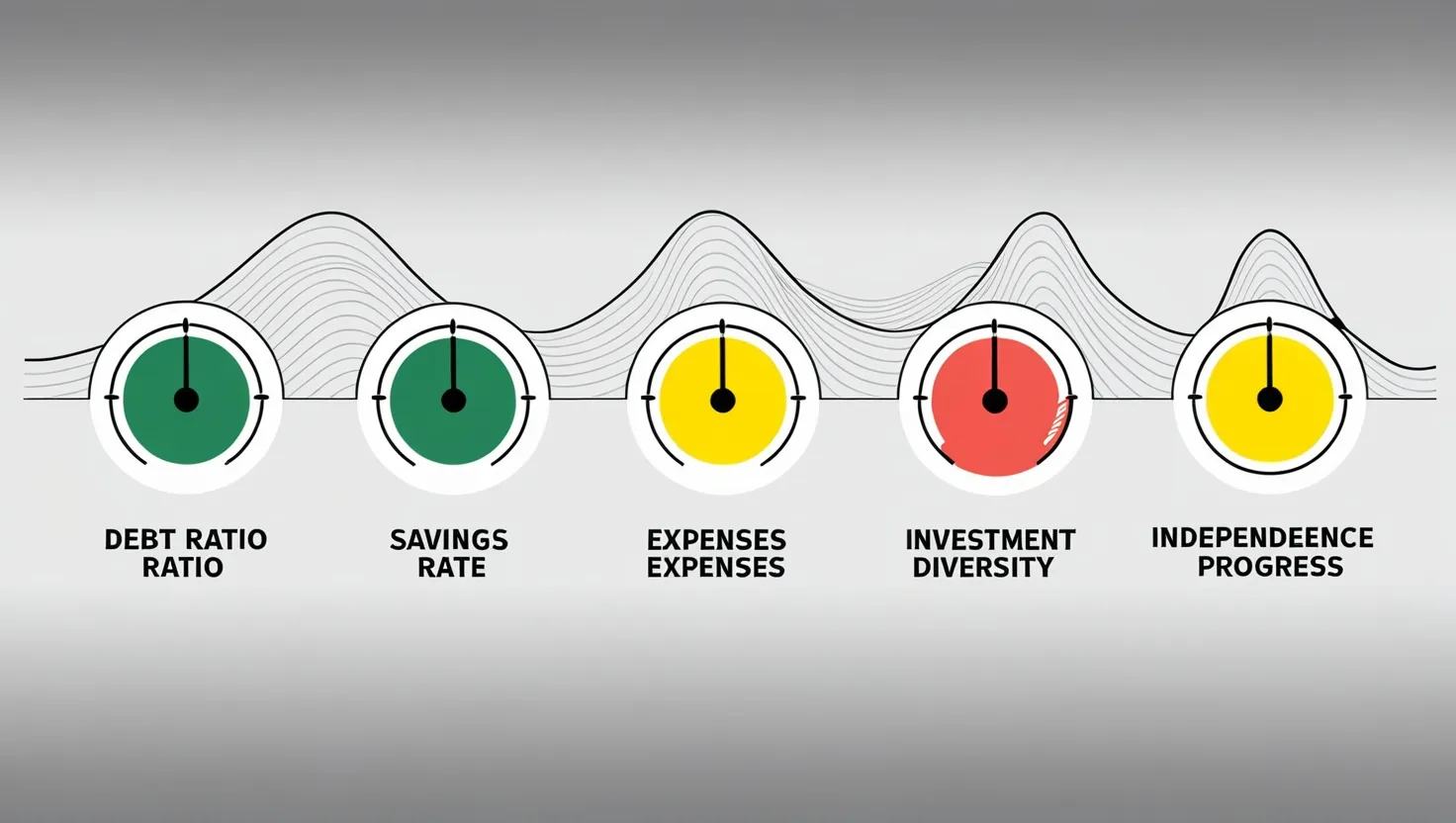

Second, focus on the fundamentals. Don't just look at the price tag – look at what you're actually buying. Is it a solid company with good revenue and a clear business plan, or is it just a bunch of hot air wrapped in a fancy name?

Third, don't put all your eggs in one basket. Spread your investments around like you're feeding a flock of very picky chickens. That way, if one investment goes south, you're not left with egg on your face (pun absolutely intended).

Lastly, patience is a virtue. Investing isn't a sprint; it's a marathon. Don't make decisions based on what the market did in the last five minutes. Take a deep breath, think long-term, and maybe go for a nice walk instead of obsessively checking your portfolio every two seconds.

Now, here's where things get a bit scary. Some economists are predicting a "bubble of bubbles" that could make the 2008 crisis look like a picnic in the park. We're talking about the S&P 500 potentially losing 86% of its value, and the Nasdaq Composite dropping by 92%. Yikes!

One economist, Harry Dent, is even calling it the "crash of a lifetime," predicting it'll hit in 2025. He says this "everything bubble" has been inflating for way longer than your average bubble, and when it pops, it's gonna be messier than a food fight at a pie factory.

So, what's a savvy investor to do? Well, Dent suggests moving your money out of stocks and into safer options like bonds. He also points out that the good ol' USA, being the biggest economy on the block, will weather the storm better than most.

But here's the thing – no one can predict the future with 100% accuracy. If they could, they'd be sipping margaritas on their own private island instead of giving interviews. The best we can do is stay informed, stay cautious, and maybe keep a little cash under the mattress (just kidding – please don't do that).

In the end, market bubbles are like those inflatable clowns that pop back up when you punch them – they keep coming back, no matter how many times we think we've learned our lesson. But armed with knowledge, a level head, and a healthy dose of skepticism, we can navigate these turbulent financial waters.

Remember, in the world of finance, pride really does come before a fall. So stay humble, stay smart, and maybe think twice before investing your life savings in the next big thing, even if your neighbor swears it's a "sure thing."

So there you have it, folks – a whirlwind tour of market bubbles, from their bubbly beginnings to their not-so-pleasant pops. Keep your wits about you, your investments diversified, and your sense of humor intact. After all, in the crazy world of finance, sometimes laughter is the best investment of all!