What Went Wrong?

Brexit and Its Aftermath (2016 - Present):

Uncertainty and Trade Disruptions: The 2016 referendum where the UK voted to leave the European Union led to significant economic uncertainty. This uncertainty impacted investment and trade as businesses grappled with the unknown future of the UK's relationship with its largest trading partner.

Labour Market and Supply Chain Issues: Post-Brexit, changes in immigration policy resulted in labor shortages, particularly in sectors like agriculture, healthcare, and hospitality. The withdrawal also affected supply chains, with increased border checks and paperwork, leading to delays and higher costs.

COVID-19 Pandemic (2020 - Present):

Economic Shutdowns: The pandemic forced widespread lockdowns, severely impacting industries such as retail, hospitality, and tourism. This led to a significant contraction in GDP.

Government Spending: In response, the UK government implemented substantial fiscal support measures, including furlough schemes and business loans, which increased public debt.

Monetary Policy and Inflation:

Low Interest Rates: The Bank of England maintained historically low interest rates to stimulate the economy, which, while initially helpful, has contributed to rising inflation, especially as the economy started recovering from the pandemic.

Inflationary Pressures: Currently, the UK is experiencing high inflation rates, driven partly by global energy price increases and supply chain disruptions. This reduces consumer purchasing power and can stifle economic growth.

Global Economic Factors:

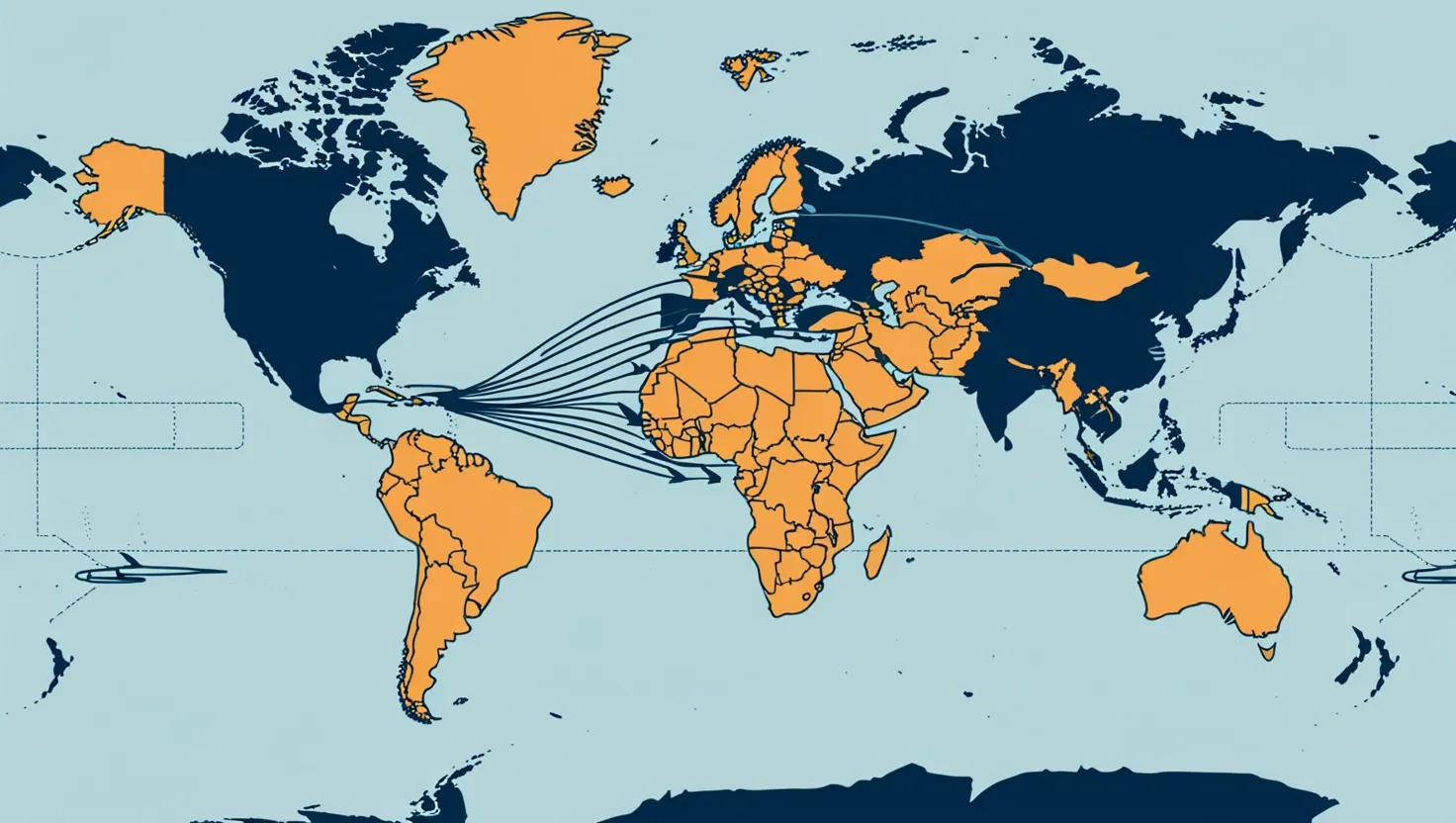

Trade Wars and International Relations: Ongoing international trade tensions, particularly between the US and China, have had ripple effects on global markets, including the UK.

Geopolitical Events: Events like the Russia-Ukraine conflict have further disrupted global supply chains, particularly in energy and food markets, exacerbating inflationary pressures in the UK.

Structural Issues in the Economy:

Productivity Challenges: The UK has faced long-term productivity issues, which have hampered economic growth.

Regional Disparities: Economic growth has been uneven across different regions of the UK, with London and the South East often outperforming other regions.

Housing Market Pressures:

Rising House Prices: The UK's housing market has seen a continuous rise in prices, outpacing wage growth, which contributes to broader economic inequality and impacts consumer spending.

Key Parameters to keep track of:

Gross Domestic Product (GDP):

The GDP is a primary indicator of economic health. Post-Brexit and COVID-19, the UK's GDP has shown signs of recovery but also faces ongoing challenges due to global economic uncertainties and domestic issues.

Inflation:

The rate of inflation is a critical concern, as it impacts the cost of living and purchasing power of consumers. The UK has been experiencing higher inflation rates, driven partly by rising energy prices and supply chain disruptions.

Unemployment Rates:

Unemployment figures provide insight into the job market and overall economic activity. While the UK's job market has shown resilience, certain sectors continue to struggle, partly due to labor shortages following Brexit.

Public Debt:

The level of government debt is significant, especially considering the substantial fiscal measures taken during the pandemic. This debt level poses long-term challenges for public finance and economic policy.

Interest Rates and Monetary Policy:

The Bank of England's monetary policy, especially interest rates, is a key factor in managing economic growth and inflation. Decisions on interest rates affect borrowing, spending, and saving across the economy.

Consumer Confidence and Spending:

Consumer confidence and spending patterns are indicators of economic optimism and the health of the retail sector. Fluctuations in these areas can significantly impact economic growth.

Housing Market:

The housing market in the UK has implications for both economic stability and social policy, given the rising house prices and the challenge of affordability.

Trade and Investment:

Post-Brexit trade agreements and investment flows are vital in determining the UK's economic positioning in the global market.

Sector-Specific Performance:

The performance of key sectors like finance, technology, manufacturing, and services provides insights into the strengths and vulnerabilities of the UK economy.

Global Economic Context:

The UK's economy does not operate in isolation. Global economic trends, including supply chain issues, geopolitical tensions, and international market dynamics, have direct and indirect impacts.

Inflation - The primary Cause:

- Reduced Purchasing Power: Inflation erodes the purchasing power of consumers. As prices rise, people can afford less, leading to reduced consumer spending, a key driver of economic growth.

- Cost-Push Inflation: When the cost of production (like raw materials or wages) increases, companies might increase prices to maintain profit margins. This can lead to a decrease in demand for these more expensive products, slowing down economic activity.

- Interest Rate Increases: In response to high inflation, central banks often raise interest rates to cool down the economy. While this can temper inflation, higher interest rates also make borrowing more expensive, potentially leading to reduced investment and consumer spending, which are crucial for economic growth.

- Uncertainty and Lowered Confidence: Persistent inflation creates uncertainty in the economy. Businesses may hesitate to invest or expand, and consumers may cut back on spending due to fears of a worsening economic situation. This decline in confidence can be a self-fulfilling prophecy, pushing the economy towards recession.

What caused this Inflation:

- Supply Chain Disruptions: Global events like the COVID-19 pandemic caused significant disruptions in supply chains, leading to shortages of goods and subsequently higher prices.

- Energy Prices: Increases in global energy prices, exacerbated by geopolitical tensions and supply issues, have a ripple effect, increasing the cost of production and transportation, thus driving up prices across the board.

- Monetary Policy During Pandemic: In response to the pandemic, many governments, including the UK, injected significant amounts of money into the economy to support businesses and individuals. This increase in money supply can contribute to inflation.

- Demand-Pull Inflation: As economies reopened post-pandemic lockdowns, there was a surge in consumer demand. However, supply couldn’t immediately keep up, leading to higher prices.

- Wage-Price Spiral: In some sectors, a shortage of labor post-Brexit led to wage increases. Higher wages can lead to higher prices as businesses pass on the costs to consumers, creating a cycle of wage and price increases.

- Brexit: The UK's departure from the EU caused trade barriers and labor shortages, affecting the cost and availability of goods and services, contributing to inflation.

Current UK FTSE Index:

Expanding on the idea that the UK stock market presents opportunities for value investors to acquire shares in solid companies at a discount. It's important to note that the following analyses are based on general market knowledge as of early 2023 and should not be considered as financial advice.

Investor Central is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Start writing today. Use the button below to create your Substack and connect your publication with Investor Central