When it comes to personal finance, few books have had as profound an impact as “Your Money or Your Life” by Vicki Robin and Joe Dominguez. This seminal work doesn’t just offer tips on saving and investing; it challenges readers to rethink their entire relationship with money and time. Here are four key lessons from the book that can significantly alter your financial trajectory and, more importantly, your life.

The True Cost of Your Time

One of the most eye-opening concepts in “Your Money or Your Life” is the idea of calculating your real hourly wage. Most of us think of our salary as the amount we see on our paychecks, but this figure doesn’t account for the myriad expenses associated with working. From commuting costs to work-related clothing and lunches out, these expenditures can significantly reduce your actual earnings.

“Time is a limited resource, and once it’s gone, it’s gone forever,” a principle that resonates deeply when you consider the hours spent on tasks that aren’t necessarily fulfilling. By factoring in these work-related expenses, you get a clearer picture of what your time is truly worth. This realization can be a powerful motivator to reassess your career choices and lifestyle.

The Power of Tracking Every Cent

Tracking every cent you spend might sound tedious, but it’s a practice that can reveal a lot about your spending habits and values. In the book, Robin and Dominguez advocate for maintaining a detailed spending log to identify patterns and align your spending with what truly matters to you.

As the famous investor Warren Buffett once said, “Do what you would do if you were going to be there forever.” This mindset applies not just to investments but to every dollar you spend. By monitoring your spending, you can see where your money is going and make conscious decisions about whether those expenditures align with your long-term goals and values.

Evaluating Expenses: The Life Satisfaction Test

Every purchase, no matter how small, should be evaluated against a simple yet profound question: Does this expense contribute to my life satisfaction? This is a test that many of our daily purchases fail. Think about the last time you bought something on impulse – did it bring you lasting joy, or was it just a fleeting pleasure?

Robin and Dominguez suggest that each expense should be scrutinized to ensure it aligns with your personal values. This approach helps in distinguishing between necessary expenses and those that are merely driven by consumerism. As Henry David Thoreau wisely put it, “The cost of a thing is the amount of what I will call life which is required to be exchanged for it, immediately or in the long run.”

Pursuing Financial Independence

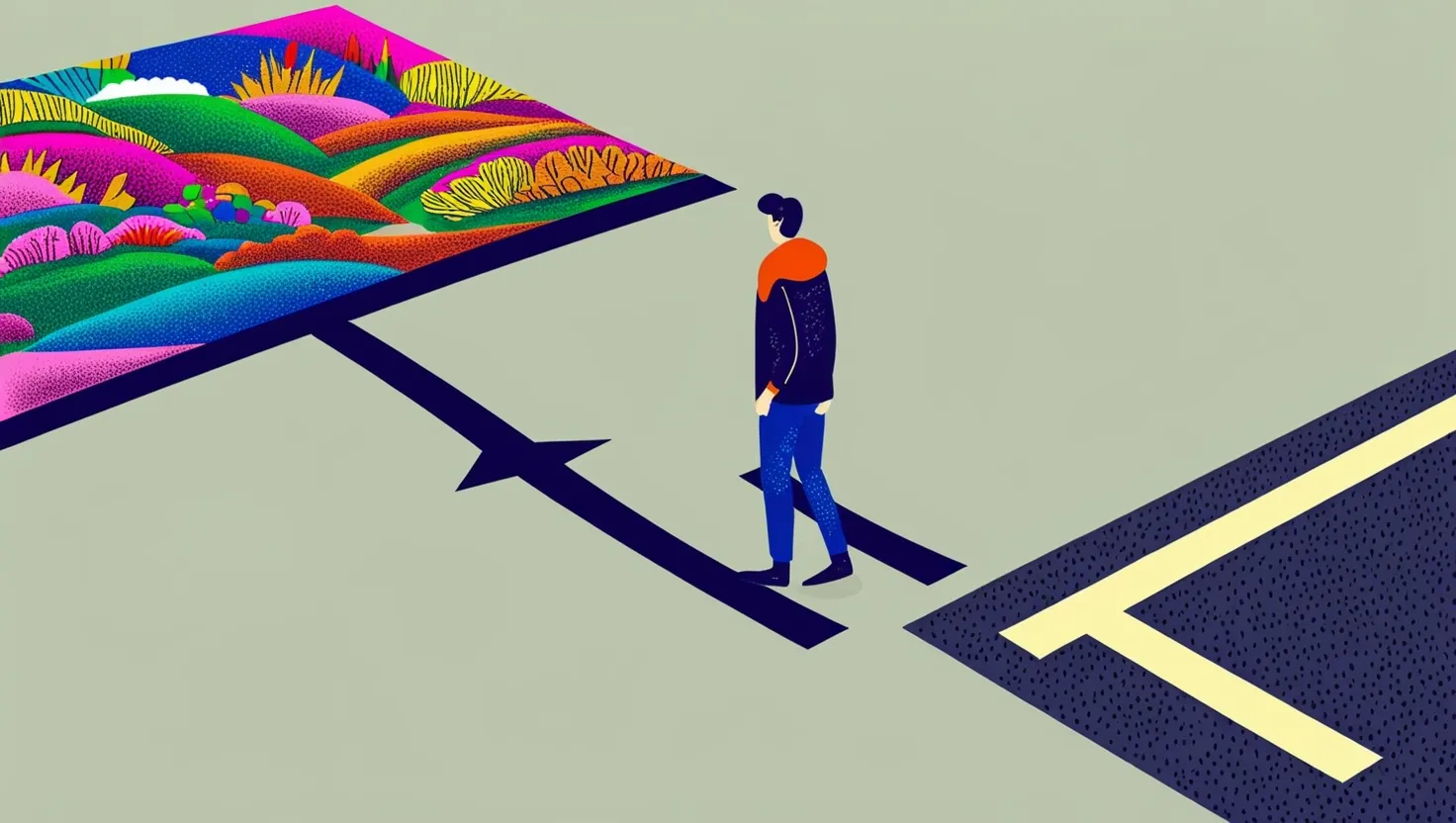

The ultimate goal of “Your Money or Your Life” is to achieve financial independence, where your passive income covers your living expenses. This concept is often misunderstood as a call to retire early, but it’s more about gaining the freedom to pursue what truly matters to you.

Imagine having the financial security to quit a job that doesn’t fulfill you or to pursue a passion project without worrying about the paycheck. This is what financial independence offers – the ability to live life on your own terms. As Vicki Robin and Joe Dominguez did, reducing their annual expenses to just $6,000 and spending their time volunteering, you too can create a life that is rich in purpose and fulfillment.

Applying These Lessons

So, how do you apply these lessons in your own life? Start by calculating your actual hourly rate, taking into account all the expenses associated with your job. This will give you a clearer understanding of the true value of your time.

Next, maintain a detailed spending log. This might seem like a chore, but it’s a powerful tool for identifying where your money is going and whether those expenditures align with your values.

Regularly assess each purchase against the life satisfaction test. Ask yourself if the item you’re about to buy will truly add value to your life or if it’s just another impulse buy.

Finally, develop a plan to generate passive income. This could involve investing in stocks, real estate, or other assets that can provide a steady stream of income without requiring your direct involvement.

Transforming Your Relationship with Money

By implementing these strategies, you can transform your relationship with money and increase your financial awareness. It’s not just about saving more or spending less; it’s about aligning your financial decisions with your true priorities.

As you embark on this journey, remember that it’s a process. It takes time, discipline, and a clear understanding of what you want out of life. But the rewards are well worth the effort – a life that is more fulfilling, more aligned with your values, and more free from the burdens of unnecessary expenses.

So, take a step back and ask yourself: What is your money really buying you? Is it buying you freedom, happiness, or just a collection of possessions? The answers to these questions can lead you to a more meaningful and financially independent life. As the saying goes, “Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.”