How Emerging Markets Are Quietly Reshaping Global Business Strategy in 2024

Master global business expansion in emerging markets. Learn infrastructure shifts, digital leapfrogging, local partnerships & consumer trends driving success. Transform your strategy today.

Strategic Currency Risk Management: 7 Advanced Tactics Beyond Basic Hedging for Global Businesses

Discover advanced currency risk management strategies beyond basic hedging. Learn cost alignment, multi-currency accounts & dynamic pricing to protect global business profits. Expert tactics inside.

5 Circular Economy Models Transforming Business: From Product-as-a-Service to Industrial Symbiosis Networks

Discover 5 circular economy business models transforming industries through product-as-a-service, waste recovery, and asset sharing. Learn how companies reduce costs while boosting sustainability.

How Smart Companies Navigate Geopolitical Disruption: Supply Chain Strategies for Global Uncertainty

Learn how geopolitical risks impact supply chains & explore strategic solutions: regionalization, currency hedging, political risk insurance & scenario planning for business resilience in uncertain times.

Global Workforce Transformation: How Japan, Germany, and India Are Solving 2025's Talent Crisis

Learn 5 proven workforce strategies from Japan, Germany & India for 2025. Discover automation, flexible work models, rapid reskilling & global talent sourcing. Get actionable insights now.

**2024 Consumer Behavior Trends: How Memory-Driven Shopping and Subscription Fatigue Are Reshaping Retail**

Discover 2024's consumer trends: experience-focused shopping, subscription fatigue, value-driven purchases, and local loyalty. Learn how businesses adapt to changing behaviors and build lasting customer relationships.

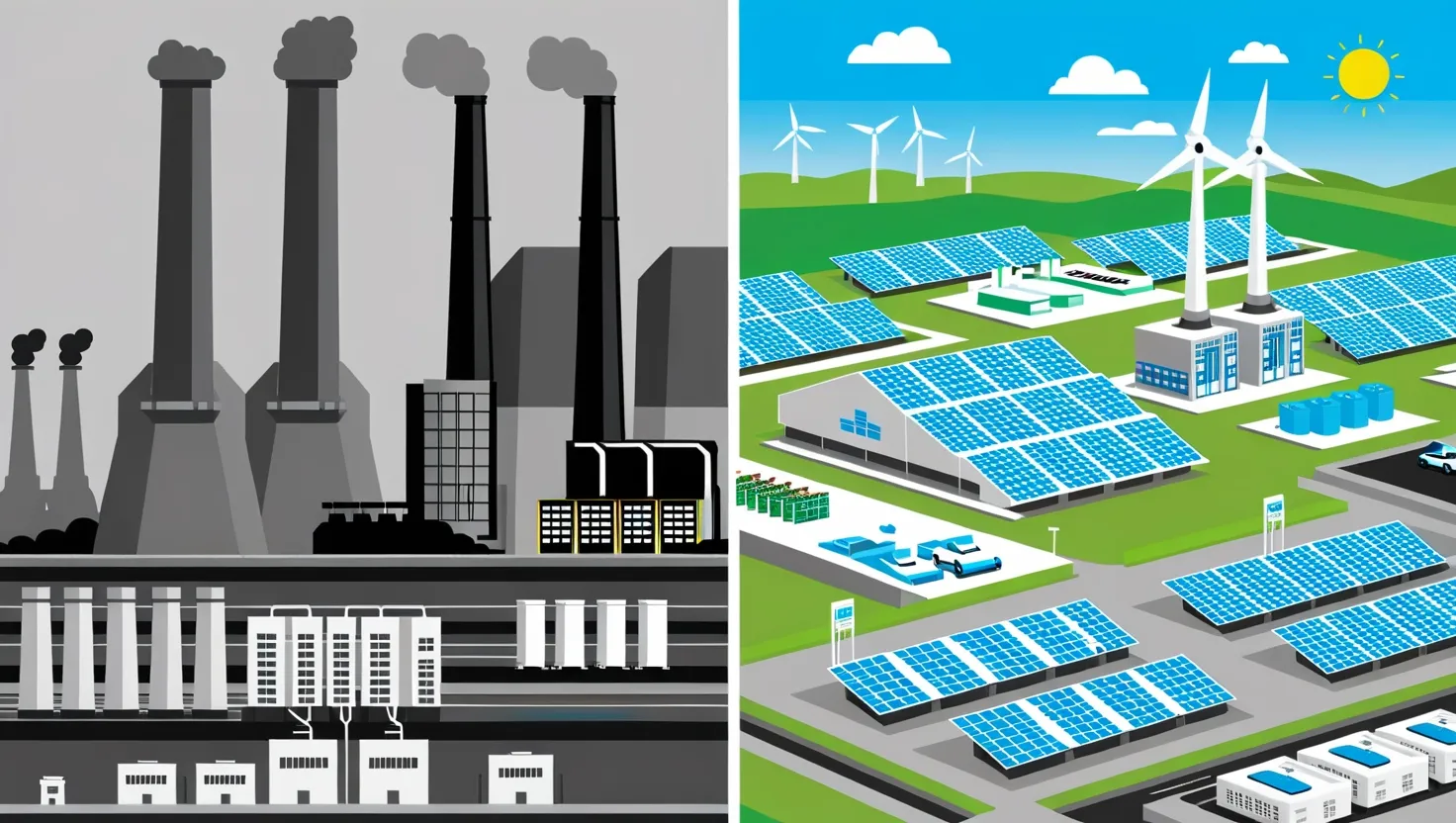

How Renewable Energy is Transforming 5 Major Industries Beyond Solar Panels

Discover how renewable energy is transforming 5 major industries beyond solar panels. From oil giants to banks, see strategic shifts reshaping business models and competitive advantages.

Small Business Cybersecurity: Essential Multi-Layer Defense Strategies That Actually Work in 2025

Discover proven cybersecurity strategies for small businesses in 2024. Learn multi-factor authentication, phishing prevention, automated threat detection & incident response planning to protect against cyberattacks.

**How Companies Are Adapting Business Models for Climate Change Challenges and Market Disruption**

Discover 4 proven climate adaptation strategies helping businesses thrive: facility resilience, supply chain protection, insurance overhauls & revenue pivots. Real case studies included.

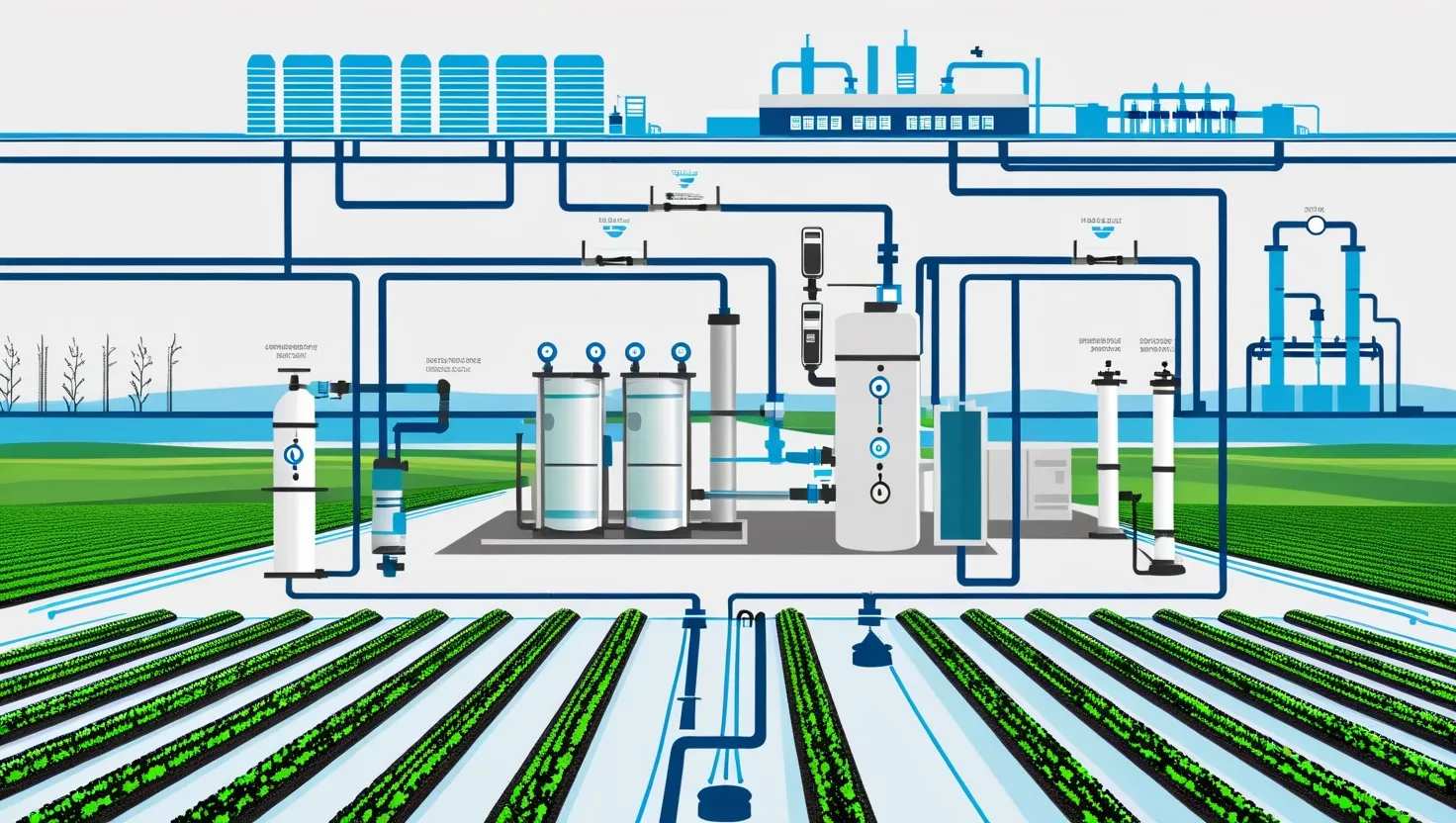

**How 4 Water Management Strategies Are Reshaping Corporate Operations and Supply Chains**

Discover how water scarcity is reshaping business operations with 4 innovative strategies: smart leak detection, process redesign, wastewater recycling, and precision irrigation. Learn actionable solutions that reduce costs, mitigate risks, and future-proof your supply chain. Transform water challenges into competitive advantages today.

5 AI Applications Transforming Financial Services: From Loan Approvals to Fraud Detection

Discover how AI transforms financial services through automated underwriting, fraud detection, wealth management, compliance, and cash flow forecasting. See real results today.

Small Business Inflation Survival: 7 Proven Strategies to Protect Your Margins and Customers

Small businesses can survive inflation with smart pricing, cost management, and strategic tech investments. Learn proven tactics to protect margins, retain customers, and build resilience. Start adapting your strategy today.

**4 Brick-and-Mortar Strategies Driving Retail's Comeback Against E-Commerce Dominance**

Discover how Nike, Warby Parker & Sephora are revolutionizing retail with experiential stores, hybrid tech & personalized experiences. Learn 4 strategies driving brick-and-mortar success.