7 Essential ESG Metrics: Measuring Impact and Financial Performance for Sustainable Investing

Discover 7 essential metrics that evaluate ESG investment impact and financial viability. Learn how carbon intensity, board diversity, supply chain ethics, and more can help build a sustainable portfolio that aligns with your values while delivering returns. #ESGInvesting

Alternative Investment Trends 2025: Farmland, Digital Art, and Private Credit Opportunities

Discover key alternative investment trends shaping 2025: farmland platforms, tokenized art, renewable infrastructure debt & private credit. Learn how these emerging options can diversify your investment portfolio. #Investing

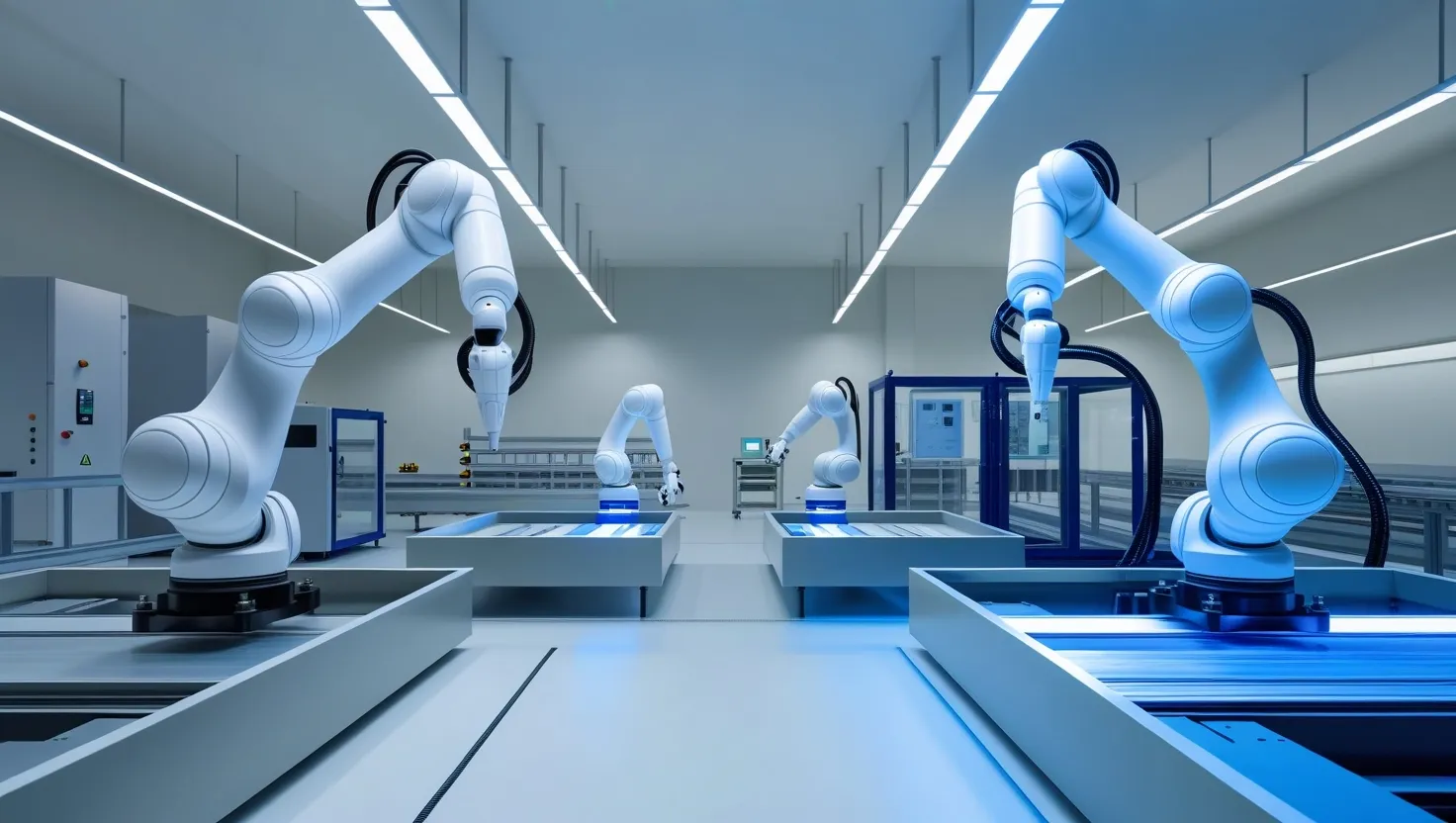

6 Manufacturing Trends Transforming Industry in 2024: AI, Robotics, and Sustainability

Discover 6 transformative manufacturing trends shaping 2024. From advanced robotics to sustainable practices, explore how new technologies and strategies are revolutionizing global production. Learn what's next for manufacturing.

5 Infrastructure Investment Trends Driving Global Economic Growth in 2024

Discover 5 transformative infrastructure trends shaping global economic growth, from smart cities to green energy. Learn how nations leverage public-private partnerships for sustainable development. #Infrastructure #Economics

5 Game-Changing Supply Chain Intelligence Tools Transforming Modern Business Operations

Discover 5 innovative supply chain intelligence tools transforming business operations. Learn how real-time tracking, AI, and blockchain enhance efficiency and reduce costs. Get insights from industry leaders.

6 Essential Innovation Metrics Every Company Must Track in 2024

Learn how top companies measure innovation success in 2024. Discover 6 essential metrics, from patent-to-revenue ratio to ROI, that drive growth. Get practical insights to evaluate your innovation strategy.

2025 Payment Trends: 4 Market Signals Reshaping Digital Commerce and Consumer Spending

Discover how digital wallets, BNPL, contactless & cross-border payments are reshaping finance in 2025. Learn key trends driving consumer behavior & what they mean for businesses. Read now.

7 Proven Strategies for Small Business Financial Resilience

Discover 7 proven strategies for building financial resilience in your small business. Learn how to diversify revenue, manage cash flow, and thrive in any economic climate. Start fortifying your business today!

5 Disruptive Business Models Reshaping Industries in 2023

Discover 5 innovative business models reshaping industries. From PaaS in manufacturing to MaaS in transportation, explore how technology is driving disruptive change. Learn about challenges and opportunities ahead.

7 Key Macroeconomic Factors Reshaping Global Trade in 2024

Discover the key macroeconomic factors reshaping global trade in 2024. Learn how geopolitics, climate change, and technology are impacting businesses worldwide. Adapt and thrive in the new trade landscape.

4 Unconventional Business Strategies Reshaping Corporate Success

Discover 4 unconventional business strategies driving innovation: radical transparency, 4-day workweek, reverse mentoring, and zero-budget marketing. Learn how to transform your company's approach.

5 Critical Cybersecurity Metrics Every Business Must Track in 2023

Discover 5 critical cybersecurity metrics to protect your business. Learn how to measure and improve detection speed, patch management, employee awareness, encryption, and vendor risk. Enhance your security now.

6 Emerging Green Economy Niches: Opportunities in Sustainable Innovation

Discover 6 lucrative green economy niches revolutionizing sustainability. Explore vertical farming, eco-packaging, carbon capture, and more. Learn how these markets are shaping the future of business and the environment.