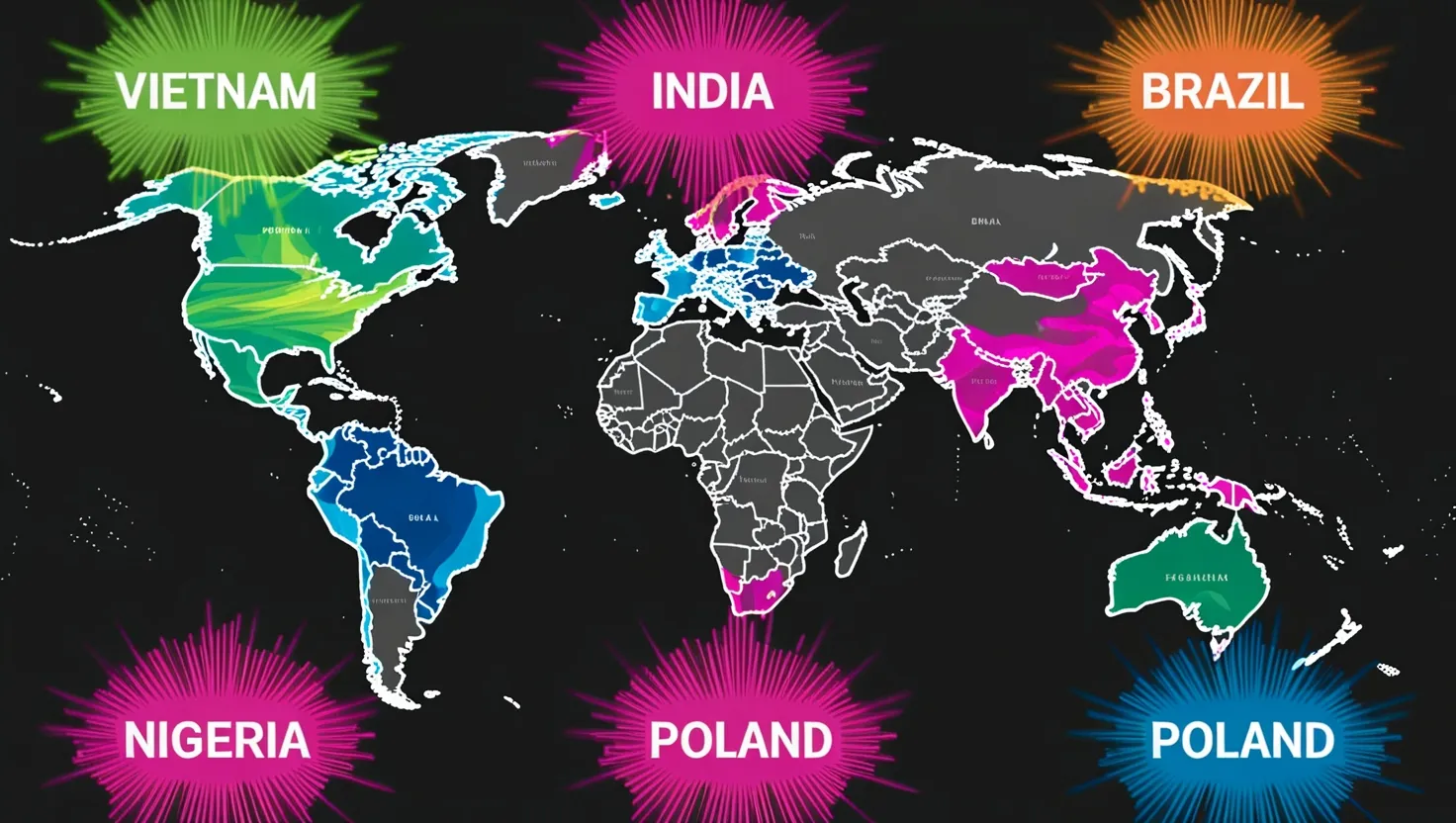

5 Emerging Markets Reshaping Global Trade: From Vietnam's Manufacturing to Nigeria's Fintech

Discover how emerging markets are reshaping global trade. Explore Vietnam's manufacturing boom, India's tech prowess, Brazil's sustainable agriculture, Nigeria's fintech revolution, and Poland's supply chain impact. Learn more.

Mindful Money: Stress-Free Financial Management for a Balanced Life

Discover mindful money management: Reduce financial stress, align spending with values, and make smarter decisions. Learn how to balance wealth and well-being for a fulfilling life.

Master Your Money Mindset: Secrets to Balancing Wealth and Well-being

Discover mindful money management: Balance emotions, values, and financial decisions for holistic wealth. Learn to align spending with goals and build lasting financial well-being.

The Mindful Money Manager: Balance Your Wallet and Well-being for True Wealth

Discover the power of mindful money management. Balance finances with emotional intelligence for a richer life. Learn to make smarter, more fulfilling financial decisions today.

Feng Shui Your Digital Space: Boost Productivity and Financial Success at Home

Boost productivity and financial clarity with Feng Shui in your digital workspace. Learn how to organize, balance, and optimize your virtual environment for success.

Mindful Money: Transform Your Finances and Reduce Stress with Simple Awareness Techniques

Discover mindful money management: Blend mindfulness with finance for better decisions, reduced stress, and a balanced financial life. Transform your money relationship.

Mastering Money Through Life Changes: Expert Tips for Financial Success

Navigate life's financial transitions: Expert advice on managing money during major life changes. Plan, adapt, and thrive with smart strategies for long-term stability.

Boost Your Finances: How Money Circles Can Transform Your Financial Future

When it comes to managing our finances, the traditional approach often suggests that it's a solitary journey. However, what if I told you that involving your community and collaborating with others could revolutionize your financial well-being? Let's explore the innovative concept of 'Mindful Money Circles' and how peer support can transform your financial journey.

Transform Your Finances: The Mindful Spending Matrix Revealed

In the bustling world of personal finance, one often finds themselves at a crossroads, torn between the urge to save and the temptation to spend. For Ananya, a young professional, this dilemma was a constant source of stress. However, her financial landscape began to change when she stumbled upon the concept of a 'Mindful Spending Matrix.' This innovative tool helped her align her spending habits with her personal values, leading to a more fulfilling and stress-free financial journey.

Unlock Financial Success: How Group Money Management Boosts Wealth and Well-being

In the realm of personal finance, the traditional narrative often portrays money management as a solitary endeavor, a private affair that each individual must navigate alone. However, what if this approach could be transformed? What if forming a community around financial goals could not only make the journey more enjoyable but also more effective?

Boost Your Brain Power: Unlock Financial Success with Simple Mental Hacks

Imagine you are Anika, a busy professional juggling a demanding job, family responsibilities, and a myriad of other tasks that fill your day. Amidst this chaos, managing your finances can often take a back seat, not because you don't care, but because your brain's limited cognitive bandwidth is already stretched thin.

CFO's Secret Weapon: How Company Culture Shapes Financial Success

Imagine being Priya, a newly appointed CFO tasked with the daunting challenge of transforming a struggling company's financial health. As she delves deeper into the financial records and meets with various departments, she begins to realize that the root of the company's financial issues lies not in the numbers themselves, but in the ingrained cultural beliefs about money and success that permeate every level of the organization.

Unlock Your Financial Future: Write Your Money Story and Change Your Life

When it comes to managing our finances, we often focus on the numbers, the budgets, and the investment strategies. However, there is a more personal and profound way to approach financial health: through the power of storytelling. Writing your own financial memoir can be a transformative process that helps you understand your relationship with money on a deeper level.