How Global Financial Trends Impact Your Daily Expenses and Long-Term Planning in India

Discover 5 global financial trends impacting your daily expenses and investments in India. Learn to track central bank rates, currency swings, commodity prices, and trade policies to make smarter money decisions. Start saving today.

**How 5 Game-Changing Policies Are Transforming Indian Agriculture for 600 Million Farmers**

Discover how 5 transformative policies are revolutionizing Indian agriculture through direct income support, smart insurance, soil testing, digital markets & water tech. Learn more!

5 Telecom Policy Changes Transforming Your Mobile Experience in 2024

Discover how 5 recent telecom policy changes are transforming your mobile experience with clearer bills, faster number porting, and network compensation rights. Take control today.

5 Major Education Reforms Transforming Indian Schools: What Students and Parents Need to Know

Discover how India's 5 major education reforms are transforming learning with flexible curriculum, skill-based education, digital infrastructure, and new assessment methods. Learn how students can thrive in this evolving system.

How New Electricity Policy Changes Can Cut Your Bills by 40% Starting Today

Learn how recent electricity policy reforms like Time-of-Day tariffs, smart meters, and solar subsidies can reduce your bills by 10-40%. Discover practical steps to cut costs today.

How Foreign Policy Shifts Are Quietly Transforming Daily Life for Millions of Indians

Discover how India's evolving foreign policy creates new opportunities for travel, business, education & careers. Learn practical ways to leverage diplomatic shifts for personal and professional growth in 2024.

5 Government Programs Revolutionizing Rural India: Digital Banking, Housing, and Market Access Transformations

Discover how 5 key government programs are transforming rural India through digital connectivity, financial inclusion, housing schemes, and livelihood missions. Learn how these initiatives are empowering millions of rural Indians with new opportunities, better infrastructure, and improved living standards. Explore the real impact on farmers, women, and families across India's villages.

India's Skill Development Revolution: 5 Game-Changing Initiatives Transforming Careers and Employment

Discover how India's top 5 skill development initiatives are transforming careers through digital training, apprenticeships, and certification programs. Learn which skills employers need most and how to access free government-funded courses. Start your career transformation today.

**5 Game-Changing Health Policies Transforming Healthcare Access for Indian Families in 2024**

Discover 5 key health policy changes transforming healthcare access for Indian families. Learn about improved insurance coverage, telemedicine benefits, device price caps, generic medicine savings & quality standards. Take action today!

5 New Financial Protection Rules Every Indian Consumer Must Know in 2024

Discover 5 new financial protection rules in India that safeguard against loan harassment, insurance fraud, and digital payment scams. Learn how ethical recovery practices, simplified policies, fraud liability protection, cooling-off periods, and centralized complaint systems empower consumers with greater control and faster justice.

How Fiscal Policy Changes Directly Impact Your Monthly Budget and Household Savings

Discover how fiscal policy changes directly impact your household budget - from income tax slabs to fuel prices and subsidies. Learn practical strategies to adapt your spending and maximize savings when government policies shift. Start optimizing your finances today.

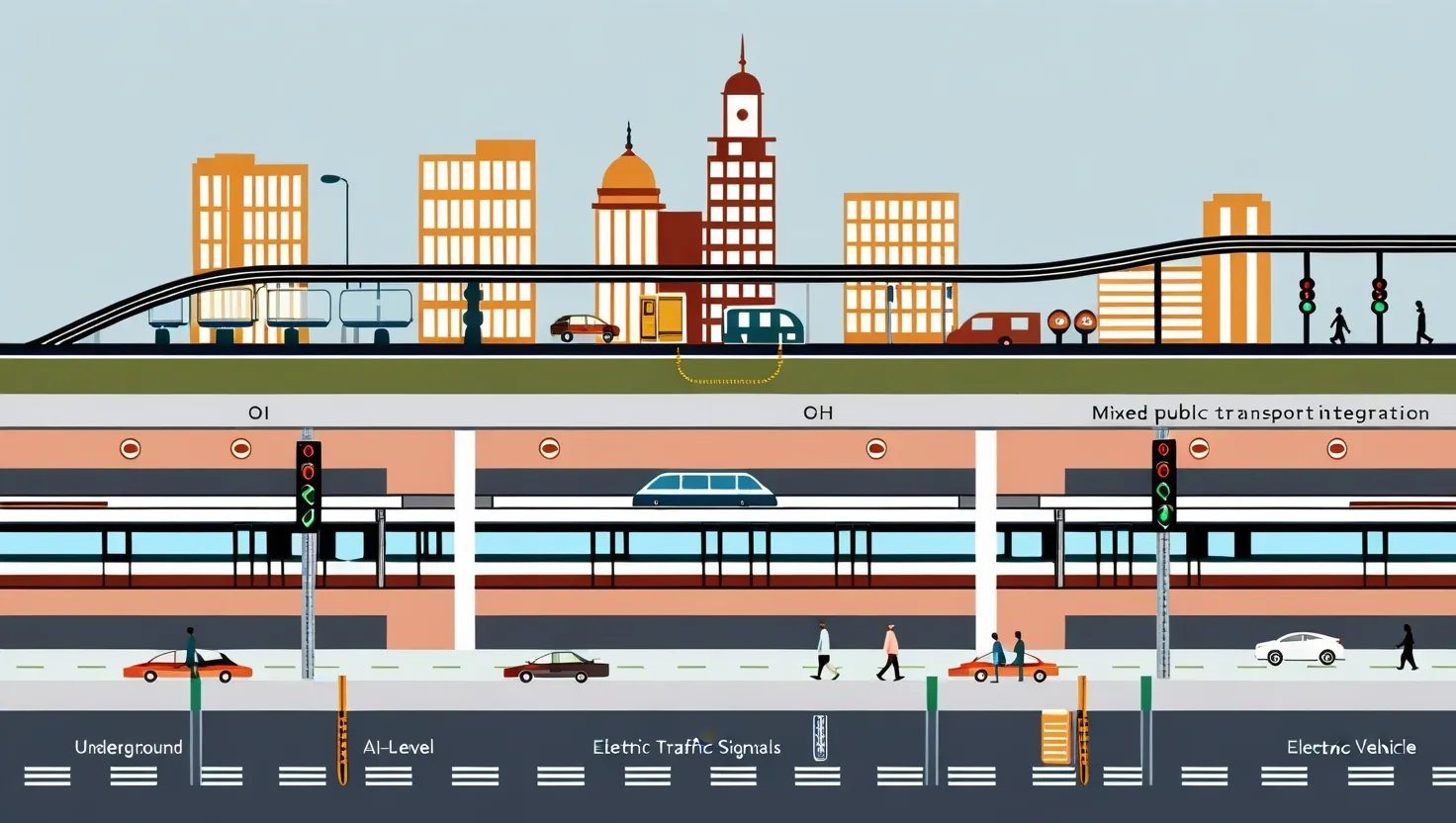

How 5 Infrastructure Projects Are Quietly Transforming India's City Commutes in 2024

Discover how 5 infrastructure projects are transforming India's urban commutes beyond metro cities. Get practical tips for smarter travel with AI traffic, EV corridors & unified transit apps.

How India's New Banking Rules Are Saving Customers Thousands in Hidden Fees

Discover how India's new banking rules are protecting customers with 30-day fee warnings, transparent loan agreements, and streamlined complaints. Learn to safeguard your finances today.