Why You Should Never Buy a Stock Without Checking This First!

Researching stocks involves understanding the business, analyzing financials, identifying competitive advantages, assessing leadership, evaluating industry trends, and determining fair valuation. Diversification and aligning investments with personal goals are crucial for smart investing.

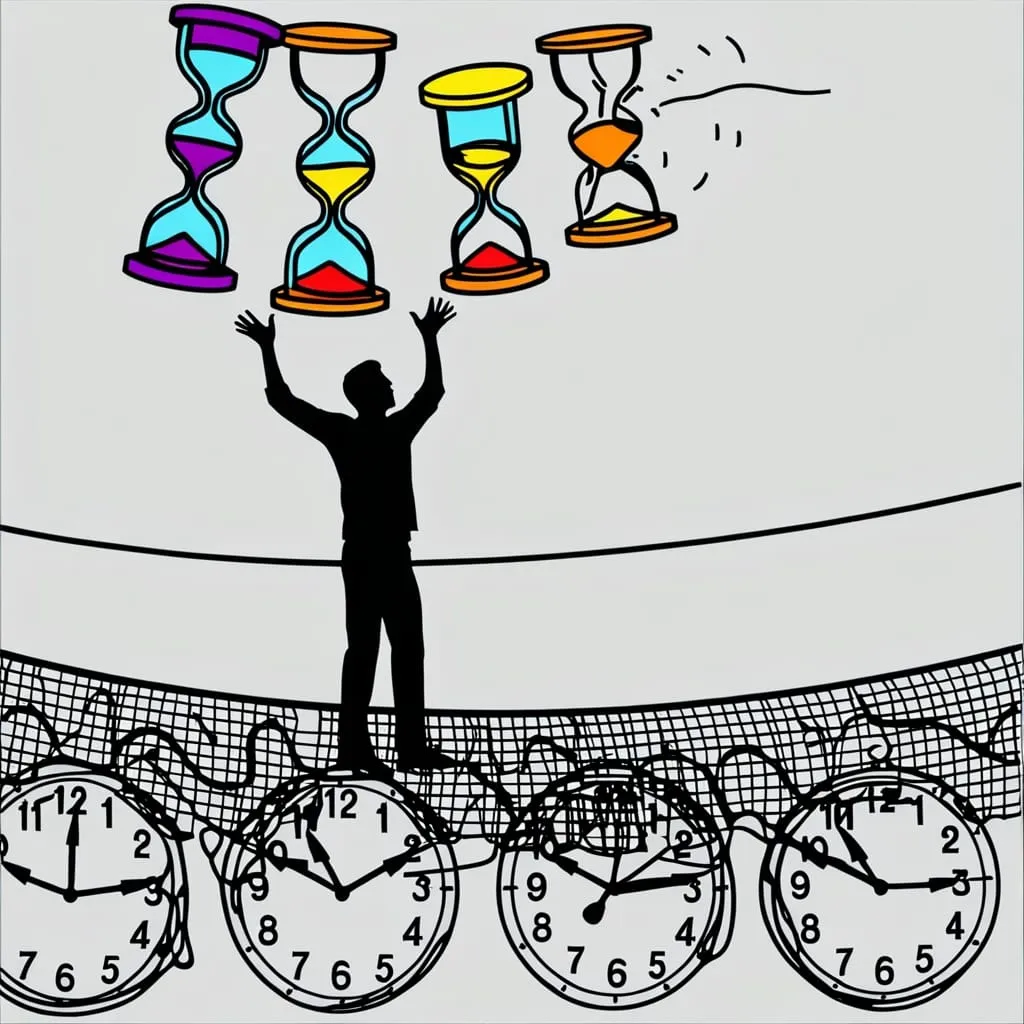

The ‘Free Day’ Strategy: How Taking a Day Off Can Double Your Output

Strategic breaks boost productivity. Free days recharge the brain, spark creativity, and enhance focus. Smart scheduling of rest periods leads to better time management and prevents burnout. Quality work trumps quantity.

The ‘Pre-Mortem’ Technique: Plan Your Time with Zero Regrets

Pre-mortem thinking imagines project failure before starting, identifying potential issues. This proactive approach improves planning, boosts confidence, and increases success chances by addressing risks early.

Why ‘Buffer Blocks’ Could Be the Missing Piece in Your Schedule

Buffer blocks are strategic time pockets in schedules, providing flexibility for unexpected tasks. They reduce stress, manage expectations, and boost productivity. Implementing buffer time enhances work-life balance and improves overall time management skills.

Cryptocurrency and Blockchain

Impact and Applications of Digital Currencies and Distributed Ledger Technology

Choosing the right Life Cover

Exploring the Advantages of Separating Insurance and Investment for Long-term Wealth

The Secret Technique CEOs Use to Work Just 4 Hours a Day!

CEOs maximize productivity by prioritizing high-impact tasks, protecting focused work time, delegating effectively, and maintaining work-life balance. Strategic planning and regular rest are crucial for sustained success and impact.

All Weather Portfolio for long term wealth creation - Ray Dalio's Strategy

Ray Dalio's Strategy for Every Economic Season

Risks of Trading, F&O and Other Speculative Investments

Understanding and Avoiding Financial Pitfalls

Why You Should Start Your Day with the Hardest Task First!

Tackling the hardest task first boosts productivity, reduces stress, and builds momentum. This approach maximizes mental sharpness, enhances focus, and creates a sense of accomplishment. It transforms work habits, improving overall efficiency and work-life balance.

Index Funds: A Smart Investor's Guide to Market Success

Navigating the World of Indexes, Their Benefits, and the Simple Art of Outperforming Active Investments

Golden Security: Safeguarding Your Future with Gold

Exploring Gold as an Emergency Fund and Long-Term Investment