7 Powerful Sustainable Investing Strategies for Long-Term Growth and Impact

Discover 7 sustainable investing strategies to grow your portfolio while making a positive impact. Learn how to align your investments with your values and contribute to a better future. #SustainableInvesting

8 Unconventional Economic Indicators: Surprising Insights for Investors

Discover 8 unconventional economic indicators that offer unique insights into market trends. Learn how lipstick sales, skyscrapers, and more can inform your investment decisions. Gain a fresh perspective on economics.

6 Essential Ratio Analysis Techniques for Value Investing Success

Discover 6 essential financial ratio analysis techniques for value investing. Learn how to evaluate stocks, assess company health, and make informed investment decisions. Unlock hidden value now.

5 Hidden Psychological Biases Shaping Your Financial Decisions: Insights for Smarter Investing

Discover how psychological biases impact your financial decisions. Learn to recognize and overcome 5 common biases for smarter money management. Improve your financial well-being today.

Maximize Your Returns: 7 Tax-Efficient Investment Strategies for Smart Investors

Maximize your investment returns through tax-efficient strategies. Learn asset location, tax-loss harvesting, and more to keep more money in your pocket. Boost your wealth today!

7 Critical Lessons from Market Crashes: Protect Your Portfolio Now

Learn from history's market crashes. Discover key lessons on diversification, leverage risks, and market psychology. Protect your investments with expert insights and actionable strategies. Click to safeguard your financial future.

5 Fintech Trends Reshaping Personal Finance in 2025: AI, Blockchain, and Beyond

Discover 2025's top fintech trends reshaping personal finance. AI advisors, blockchain, open banking, and more. Learn how to optimize your financial management for the future.

8 Essential Metrics for Evaluating Dividend Stocks: Maximize Your Investment Returns

Discover 8 key metrics for evaluating dividend stocks. Learn to balance yield with growth potential and build a robust portfolio. Expert insights for informed investing decisions.

6 Lucrative Side Hustles for Finance Professionals: Boost Your Income and Impact

Discover 6 innovative side hustles for finance pros. Leverage your skills, boost income, and make an impact. From financial coaching to fintech apps, explore new opportunities today.

Dollar-Cost Averaging: The Smart Investor's Guide to Steady Wealth Building

Discover the power of dollar-cost averaging for steady wealth building. Learn how this investment strategy can help you navigate market volatility and achieve long-term financial success. Start investing smarter today!

5 Unconventional Inflation Hedges: Protect Your Wealth Beyond Stocks

Discover unique inflation hedges beyond stocks and bonds. Learn how fine wine, farmland, collectibles, carbon credits, and royalties can protect your wealth. Diversify wisely.

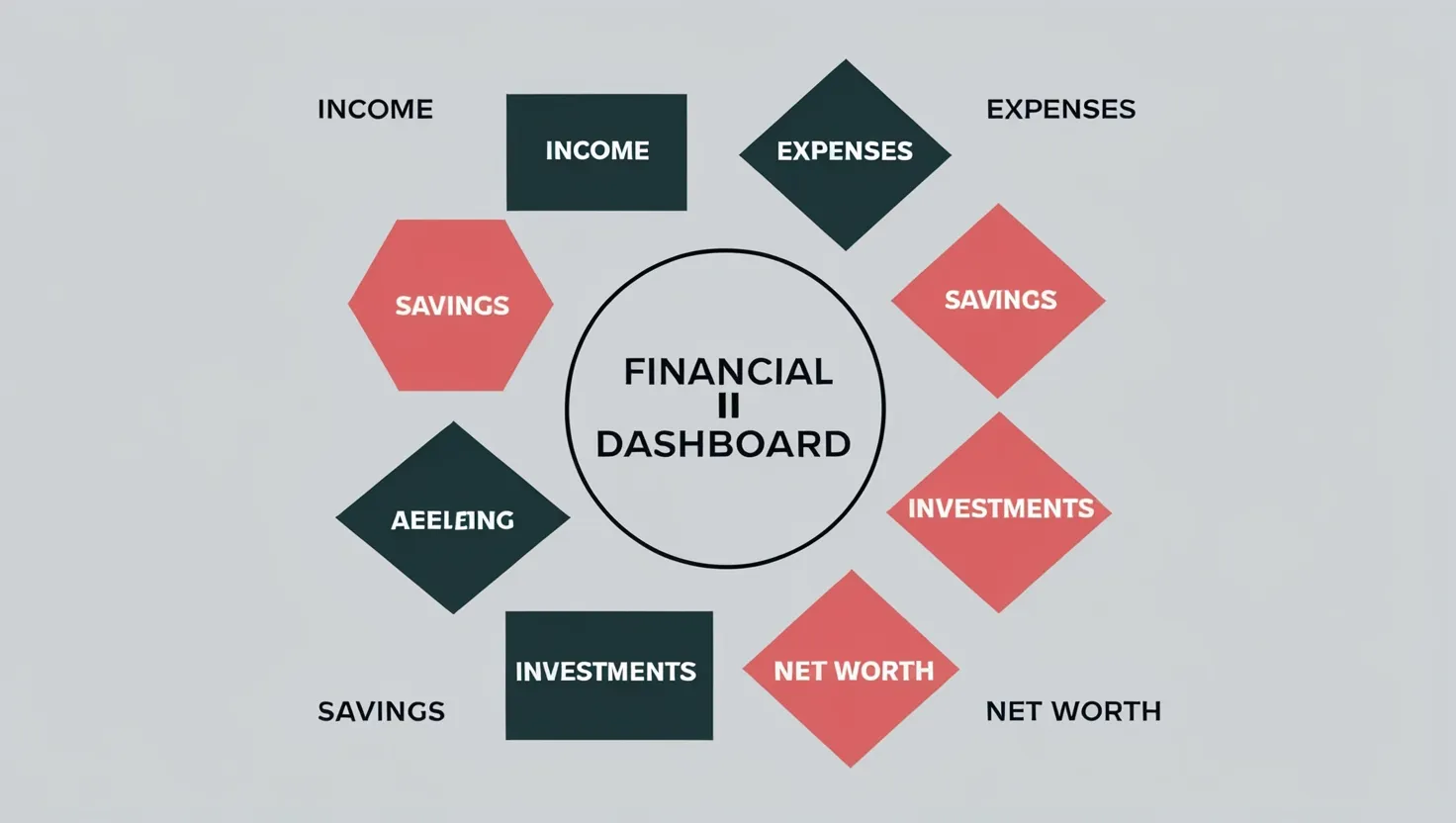

Master Your Finances: Build a Personal Financial Dashboard in 6 Steps

Discover how to create a personal financial dashboard. Learn to track income, expenses, savings, and investments. Gain control of your finances with this step-by-step guide. Start building your financial future today.

7 Behavioral Finance Traps and How to Avoid Them: A Guide for Smart Investors

Discover 7 behavioral finance traps and learn how to avoid them. Make smarter investment decisions by understanding cognitive biases and emotional influences. Improve your financial strategy today.